We all make mistakes. It’s not realistic to say that we can be error-free or avoid being wrong. The trick is to recognize when we are making a mistake and correct it quickly to limit any damage in the future. Seasoned investors understand this well and it takes the form of cutting your losses short (and letting your winners ride). This update will offer some insight into how your investment portfolio should be allocated now across the various asset classes. But there are other mistakes I see happening now outside of your investment portfolio.

Mistake #1 – Holding and Hoping with Too Much Stock in Your Portfolio

We can’t know the future and we don’t have any control over the direction of the markets looking forward. We can only control how we respond to current evidence as it unfolds and adjust our investment allocations incrementally and thoughtfully. Regular readers know that we have been incrementally and thoughtfully reducing our maximum allocation to stocks since December of 2017. We went from a maximum allocation of 70{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} stocks in January of 2018, to 50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} in October of 2018, and then again reduced to 40{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} in May of 2019. At the same time, we have incrementally and thoughtfully, added to our alternative and income (bond) allocations, now sitting at 10{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} and 50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} respectively. Income for us is a blend of corporate credit, emerging market debt, preferred securities, floating rate funds and short-term Treasury bonds. The evidence supporting these changes in our allocations away from stocks has been overwhelming both on the economic and market fronts. I’ve been over many of the indicators we watch suggesting we are now closer than ever to a formal recession in the US and perhaps even globally. We made note in February of 2018 that there were two variables still holding strong that have not buckled yet.

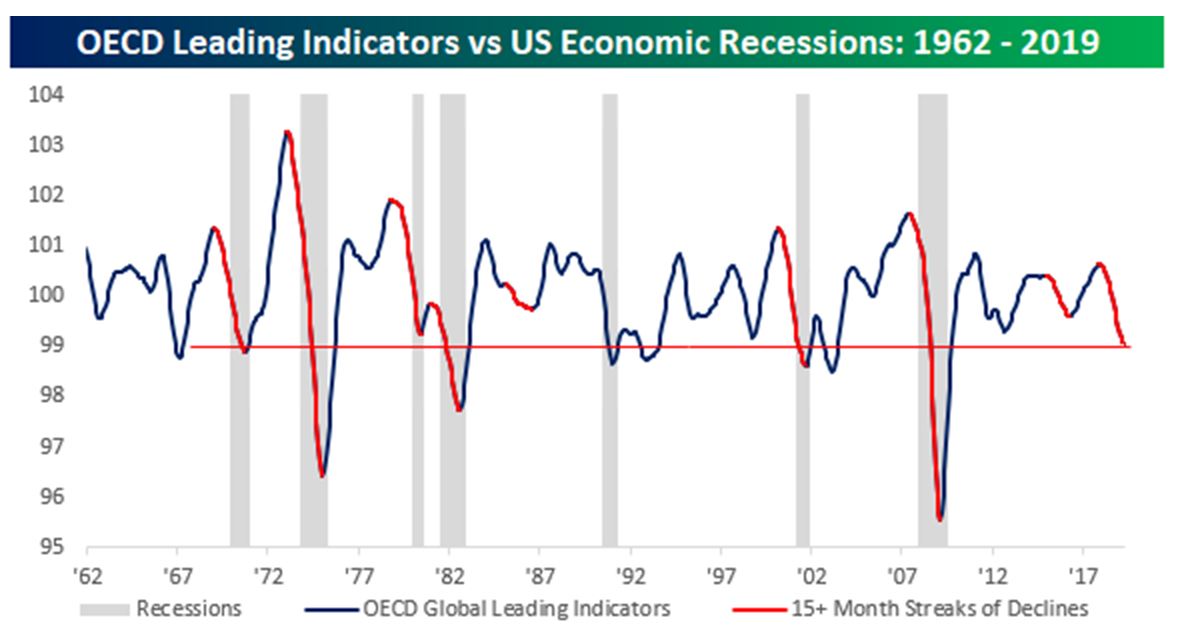

The first was the OECD Leading Indicators index which was persistently strong and rising. This is a global index mind you, but the US is still the big driver of change here. No recession has ever unfolded with this index trending higher. Well, now we can add a falling Leading Indicators index to the pile of evidence. The shaded areas of this chart provided by Bespoke Institutional are formal recessions. Since the early 60’s this index has fallen dramatically (+15 months) as it is now, 8 times. 7 of them lead to global recession within months. The odds player won’t argue with this one.

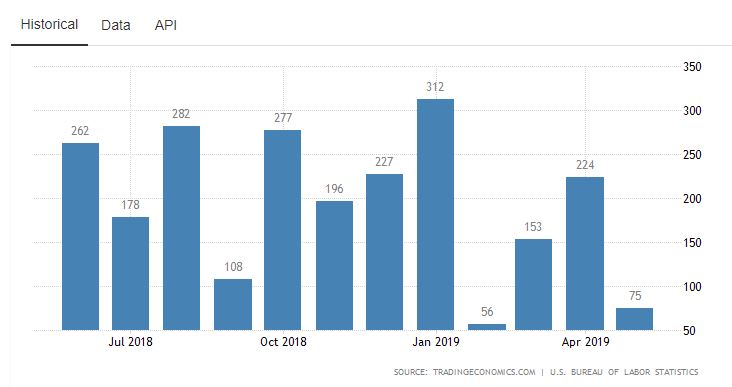

The second are the employment numbers. And this one is really the last and most important variable. The US employment picture is as strong as I’ve ever seen it and we’ll admit, it is very hard for recession to unfold without a rise in unemployment or a dramatic increase in jobless claims. That event has NOT happened yet. The Fed is also watching this closely which is why they will not drop rates in June. But the recent preliminary non-farm payroll numbers came in dreadfully short (75k) of expectations (190k). I wouldn’t say the employment picture is weak, but I would describe the last four months as nervous looking data. We will not be surprised to see a jump in unemployment by the end of summer if things continue as they are, and that will be the last variable to fall.

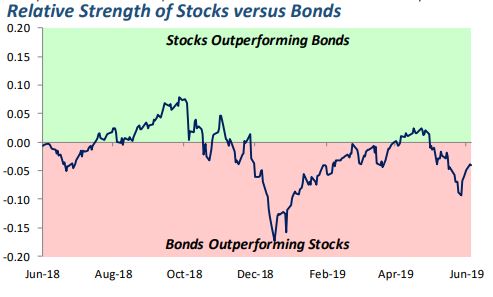

So, the mistake I see today is that many investor portfolios coming to us for consideration are still sitting with the same allocations to stocks, usually 60, 70 even 80{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}. That’s just too much. Bond allocations are generally too small, and we aren’t seeing any holdings that are non-correlated to the movements in the broad US stock market (alternatives). It is very possible for an investor to remain fully invested across a bunch of different asset classes, like stocks, bonds, real estate, hybrid income, even gold now. But in our view, for young or old, there is no reason to have more than about 40-50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of your total portfolio in stocks; probably less. Treasury bonds have been outperforming US stocks since February of 2018 by almost 3:1 and there is no reason to change an overweight position to bonds yet.

Mistake #2 – Reaching for Returns with Illiquid Investments

Its hard to find a Real Estate newsletter these days that isn’t talking about relative performance of real estate and stock prices. No doubt, real estate prices have gone up a lot in the last 3-4 years. In aggregate price trends for housing are healthy and stable. In select high priced markets like Manhattan and San Fran, prices are down 15-20{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} year over year. In other markets, they might be up as much. The average looks stable but here again, I would describe this data as nervous and inconsistent. Real estate people want you to buy real estate. Stock people want you to buy stocks. So, it’s really hard to find unconflicted advice out there right now. You’ve really got to do your own homework and make your own judgments. I wouldn’t buy either anywhere in here unless you can find some special situation. However, after having experienced several global recessions including generational wipe outs in real estate and stocks, I will argue that it is critically important to maintain liquidity when there are higher levels of uncertainty. Liquidity means you can get in or out of something with a push of a button. Real estate is not liquid. It takes a great deal of pain, time, money and a very high transaction cost (6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}) to buy or sell hard real estate. Moving money out of the financial markets in order to chase gains in real estate without any evidence to suggest that one will perform better than the other looking forward is really just an exercise in removing liquidity from your net worth. I wouldn’t do it. I’d rather make 4-5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} in tax free municipal bonds with very little downside risk than tie up my money in real estate with 4-8{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} carry costs (mortgage, taxes, insurance, upkeep, etc). The same argument can be made against investing in private equity or anything that demands a lock up period at this stage of the cycle.

Mistake #3 – Sitting on Piles of Cash

We are empathetic to the sense of worry out there and understand why you might want to just carry a big bank balance. After all, if uncertainty is on the rise and we don’t feel confident in making investments now, why not just wait in cash. Well, there are several reasons.

First, there are incredible investment options now for your cash that don’t have much downside risk and are still generating very healthy returns. These are income investments and we have been pounding the table on this for months. Since late November of last year, our own Freeway High Income strategy which owns a huge diversified mix of income bearing securities and heavy in tax free municipal bonds, is trading at all-time highs week after week after week generating total returns of 7{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} annualized net of any fees. I don’t have any idea how long this will last, but it would seem the Fed has our back with pending rate cuts and we’ll probably be hitting solid numbers into the second year of any recession. If somehow, we avoid a recession and global economies pick up steam, our income model returns will taper back to their 2-3{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} numbers. I’m happy with either scenario for cash considering the best you can get in the bank is still pretty poor, like 0.50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}.

Second, inflation is grossly understated in the US. I’ve harped on this point for a long time. Gas prices, food prices, healthcare costs, costs to build and maintain a home, rents, labor costs, and now trade wars are making things much more expensive for everyday households. You know it, I know it. They say there is no inflation. Laughable. There is a ton of inflation everywhere. Cash sitting in the bank is not keeping up with your real cost of living. You will need to make about 5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} to break even with rising living costs. Do what you can do, right?

Mistake #4 – Not Saving Enough – Spending Too Much

This is sort of a timeless mistake but it seems to become a bigger problem at the end of every business cycle. I see a lot of reckless spending now and I do mean reckless. When times are tough and employment or income feels tenuous, we naturally don’t reach for that discretionary thing. We save our money. But after years of gainful employment, healthy incomes and a rising stock market, we have a tendency to spend like it will never end and save very little. We are watching the savings rate in the US approach zero again and the use of credit rise strongly, especially in things like car loans and credit cards. I am also seeing a lot of our clients accelerate their withdrawal rates well beyond our prescribed 4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}/ year. I’m going to waggle my finger now. This is the time and place to cut back on spending (Goodbye Chai!) and add to our savings for that rainy day. This is not the time to spend big and hit your investment accounts to pay for it. Life will not get less expensive during a recession, but you may not have the stock market returns or income to pay for it during a contraction in business activity. Review your current savings rate or spending rates now. Keep it real.

Mistake #5 – Avoid Job Hopping and Be A Valuable Employee

Jobs seem plentiful and they are. Many industries are really struggling to find quality employees. There are lots of folks who are looking for work or better paying work but really lack the qualifications or skills to land those high paying jobs, but that’s a different topic. As a new employee anywhere, you have to know that many companies operate on a last in, first out basis. And many companies are just trying to keep someone, anyone, in the office to maintain existing business. But there isn’t much job security out there really for anyone. Software is replacing actual employees at an alarming rate. Employees in practically every industry, are being forced to redefine their value proposition to their company or risk losing their job. The new guy (or girl) has to prove that they are not only valuable but worth the added expense. The employment situation in the US is tenuous. Companies are looking for ways to maintain their profits and the number one way to do that is to reduce their labor costs. It would be a mistake to try to jump to a different company hoping that the situation will change. The best thing you can do is ask how you can be a valuable, productive and an irreplaceable asset to your current company. Keep those benefits, keep that income, stay employed, and redefine your job if you must.

Those are the big 5 mistakes for where we are now in the business cycle. Remember, it’s not wrong to make mistakes, but it is a mistake to stay wrong. We’re here to help with any and all decision points.

Sincerely,

Your financial partner in all conditions!

Sam Jones

President, All Season Financial Advisors