January 4, 2023

As is tradition, today’s update will look ahead to significant opportunities and new risks in the financial markets for 2023. Happy New Year to all and thank you again for another year with our firm. We genuinely appreciate your continued trust and confidence.

Opportunities – Dare to Imagine

Fear has become the dominant sentiment regarding public securities, markets and the economy. It has become so pronounced that analysts’ estimates for future earnings are being adjusted down for companies that are already off their highs by 60-80%. I cannot find a headline that doesn’t speak to recession in 2023 these days and indeed the evidence in support on that outcome is considerable. It’s truly amazing to me how much recency bias develops when markets move in one direction for even a period of several months. Today, there are widespread assumptions that technology stocks will continue to fall, that energy stocks will continue to rise to infinity, that the US dollar will march upward as the Federal Reserve will continue to raise interest rates. Oh my, where do I begin? The only crisis I see today is a failure of imagination. Imagine if these dominant trends will either not continue, not happen or even reverse direction 180 degrees in 2023. Imagine that! The market has a way of punishing the greatest majority of investors possible so we might stay open to some dramatic reversals in 2023. In fact, given the extreme consensus view of a pending mild recession, we should all remain alert to two alternative outcomes. The first is that the widely anticipated mild recession is not mild at all but rather severe as suggested by the current bond market yield curve. The second is that we have no recession at all. Personally, I can make a compelling case for either. Regardless, 2023 will offer investors significant opportunities especially for those willing and able to buy low and/or sell high and more importantly think unconventionally about how their money is allocated inside the new investing landscape. My blanket advice to all investors for 2023; free your mind of assumptions about what will happen and imagine consensus opinion failing to produce expected outcomes.

The New Investment Landscape

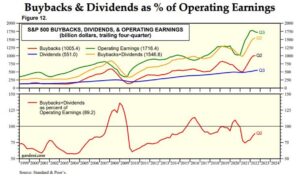

Let’s set the stage a bit. What exactly is the new landscape. As I’ve said many times in the last two years, we have crossed into an environment where debt, inflation and tightening monetary policy by way of central banks, have and will continue to be, obstacles for many public companies and asset classes. This didn’t just suddenly happen. We find ourselves in this environment having travelled here for over 20 years of easy money, artificially low interest rates, financially engineered earnings and debt-based form of capitalism. In short, money (capital) has been too plentiful and too cheap for more than two decades. Consequently, public companies have done what we would expect them to do. They have borrowed money to buy back their own shares and issue dividends in lieu of focusing on growing earnings and revenues (aka financial engineering). They have committed no crimes but they have artificially pumped earnings higher on a magnificent scale. This is probably the best chart I could find from Standard & Poors illustrating the point. Aggregate Buybacks and Dividends (yellow line), have been hovering between 75% and 140% of annual operating earnings (Green line) for most of the 2000’s! In basic terms, the vast majority of operating earnings have come on the back of accounting strategies and share count manipulation. And as you can imagine, when borrowing costs rise, share buybacks using borrowed money, ends quickly.

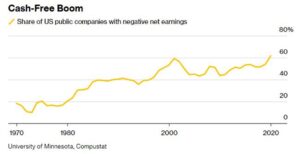

Cheap and plentiful money ALWAYS leads to inflation as we see today, just as we saw in the 70’s and early 80’s. Eventually, we reap what we sow. The new environment will force companies to actually show real profits, actually have solid balance sheets, and actually pay attention to their expenses and debt levels. Likewise, companies with negative earnings can only survive in the old environment of nearly free capital and unlimited investors’ appetites. It’s a little disturbing to see an all-time new high in the share of US public companies with negative net earnings. Over the next decade, this line should work its way back toward the zero line as companies (re)focus on generating real positive net earnings.

The new investor environment is therefore more selective and less rewarding for those who don’t understand how the tide has turned. For those who get it, there are still plenty of new opportunities by simply reinvesting in companies that have the right stuff. We have already made these changes across all managed investment strategies, starting in 2021.

Opportunities

#1 Adopt a Macro Strategy

What the heck does that mean? In short, a “macro” approach to investments bases its holding on big picture type issues like the direction of interest rates, debt levels, central bank policies, currencies, politics and overall economic health on a global scale. It also has the capacity to own many more types of assets outside of US bonds and stocks including things like commodities, Gold and Silver, alternatives and other non-correlated securities, real estate and even long/short hedging securities if possible. Generally speaking, these are active strategies run by managers who have a lot of experience and understand the drivers of returns. “All Season Financial” was founded as a macro strategy investment firm all the way back to the 70’s; The last time we had real inflation.

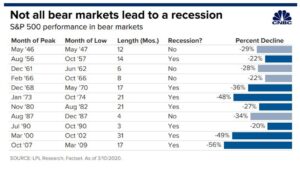

Looking backwards to 2022, we know with 100% clarity that nearly every investment style outside of macro strategies suffered one of the worst single years in modern history. Energy and commodities, hedges and the US dollar, were the only investment “things” that finished positive on the year. 2023 is likely to see a broadening number of winning sectors and asset classes as we climb down the inflation ladder. However, investors still shouldn’t expect an easy environment by any means. Transition years like 2023 are always frustrating because investors find themselves watching the very thing they just sold, take off the upside. We should also be aware that significant bear market BOTTOMs occur smack in the middle of labelled and acknowledged economic recessions. Today, we have not acknowledged that we are in recession and are therefore not in the middle of anything. At its worst, the broad US stock market was down -25% in mid-October. Is that enough of a decline to say that the market has “priced” in a recession? Probably not. Historic averages tell us the AVERAGE bear market decline with a recession is 34%. If there is no recession, then indeed the work of this bear might be done.

A final bottom in US stocks and the end to this bear market, still looms but could easily occur anytime in 2023. Buyer beware but buyer be ready!

…back to the point

For the first time in nearly 30 years investors are learning the hard way, what true diversification actually means and why it’s important. We are in a bear market for both bonds and stocks. Diversifying across only these two asset classes did nothing to prevent significant losses in 2022. Investors will need to embrace strategies that reach beyond these two icons if they hope to have a more positive outcome for the foreseeable future. The last cycle of serious inflation in the US lasted for 14 years (1968-1982). All Season Financial has a strong commitment to this space as 6 of our 10 in house strategies are driven by Macro factors with true, multi-asset diversification of securities.

#2 – Stick with Value

Hopefully, I made the point clear that the new environment is not fleeting. It is a long-term structural change in how companies will approach their own survival and growth prospects considering the new cost of capital. This is a good thing and a healthy change. We want companies to produce profits by adding value, innovating, investing in R and D and growing organically as opposed to engineering their earnings in an unsustainable form of capitalism. “Value”, even deep value companies are those that never left this space and thankfully, 38% of all public securities still offer tremendous value. Our industry has made it quite easy to invest in funds that focus exclusively on value, deep value, high dividends, etc. Value comes in many flavors as well. Regular readers know that some of the best values in the world are outside the US markets, especially China and Emerging markets.

*Note on China. I’ve heard many times in 2022, that China is uninvestable due to the heavy hand of the Chinese government. Like most free Americans, I have no love for their autocratic/ communist culture or the loss of civil liberties. However, do be aware that China has added 500 million people to their “middle class” in the last year while the US of A has lost almost as many to poverty. Likewise, the Hang Seng now trades at 1/3 the value of the S&P 500. Consensus opinion regarding Chinese investment opportunities could be very wrong.

These, together with most of Europe, appear to have put in long term bottoms in October after devastating bear market declines. Now, internationals are outperforming the US markets by a wide margin, and most have entered new bull markets. Again, if you’re stuck in a US centric bubble where stock and bond indexes are your only holdings, these new opportunities will pass you by.

#3 – Special Situations

There are a number of special situations out there in the opportunity camp, but I will highlight four of them. High Yield corporate bonds have historically never experience two consecutive years of losses. As I write, the High Yield bond index is closing 2022 down -11.24%. The risks of owning HY corporate bonds as we enter a recession do not escape us but again, let’s try to use our imagination. What if there is no recession and default rates don’t spike higher? What if inflation continues to fall and bond yields fall back to 3%? Wouldn’t an 8% yielding corporate bond suddenly look pretty attractive? High yield bonds could have a very good year despite conventional thinking.

Home Builders are also in a potential sweet spot. Demand for housing is still very high and supply is not coming from the existing homes as homeowners are essentially frozen in place carrying 2-3% mortgages. Where will supply come from? New homes! Homebuilder valuations are also very attractive. Consensus views might have you think that all forms of real estate are dead in 2023. Think again!

A third sector with great potential is financial services, especially banks, brokerage, capital markets and asset managers. Again, value is present here and the cycle should begin to favor financials as inflation cools. Imagine this; Bank profitability reached a 14 year high in 2022 with a return on equity of 12.5%. Bank stocks are trading at 50% of the valuation of the S&P 500.

Finally, one area of value that looks attractive on pure fundamentals are the gold and silver miners. Crescat Capital does some of the best research I’ve seen in this space (https://www.crescat.net/mining-industry-renaissance/). After 7 years of deleveraging their balance sheets, gold and silver miners are sitting on the highest levels of cash in history and are now paying some of the highest dividends in the market. Furthermore, gold and silver reserves are at historic lows while ore prices continue climbing steadily. The timing and set up to own gold and silver miners may be one of those rare premium value plays in 2023 for a small piece of your portfolio. Even Warren Buffet, notorious hater of Gold, would have to take a second look at the mining companies.

New Risks

When we think about potential recessions, investors tend to lean into “safe” things like consumer defensive stocks, utilities and healthcare. While these sectors have held up better than most in the last 12 months, they are simply no longer attractive from a valuation standpoint. Many like Walmart, McDonalds, Proctor and Gamble, Costco and Pepsi, now have P/E multiples higher than the technology sector which is still very expensive by any standard. The same goes for the biggest names in healthcare and utilities. It seems the market has already priced a future recession into the defensive side of the market which presents a new risk for 2023. If we do escape recession, these sectors could be some of the worst performers in 2023. Any holdings here should be on your “watch to sell” list.

2023 is going to test your resolve as an investor. Perhaps the greatest risk of all time for investors in the throws of a deep and lasting bear market is the risk of giving up. I choose my words carefully. Giving up is that moment when you can’t stand to lose another single dollar to a market that feels hopeless, literally without hope. Why would I stay invested or buy any security with price risk when I can “get” 4% year risk free in short term bonds or an 18-month CD? Why am I investing at all? I want out! That is giving up and it happens at or near the very lows of every bear market. We saw it happen in late May and late September of 2022. The markets finished 2022 slightly above those levels. We’ve all been there, when it’s dark and headlines offer no optimism. Emotionally, we need to protect our egos, so we find an excuse for selling everything. Managing your emotions and staying engaged with your investment discipline is the most challenging risk we all face. At the same time, it’s important to keep your money in the right place at the right time, manage your tax impact, manage your asset allocations, keep them in balance, find new opportunities and avoid obvious risks. Above all, stay in the game and remember that the greatest risk is to have your investment assets sit idle and unproductive after experiencing a loss, while your cost of living goes up over time. Stay strong and use 2023 as a year to find new opportunities for your investment dollars.

Best of luck to us all,

Sam Jones