April 29, 2022

April is historically one of the strongest and most dependable months of the year for market returns. Obviously, we are making history in the year 2022. Behind the losses for the month, we also witnessed something that I find very gratifying. We are finally seeing the markets return to a more rational, logical condition in a world where gravity proves to be a real force. Please excuse the victory laps in my commentary below. Clearly now, the economic and market cycle is shifting forward toward recession or Stage 6 (of 6). Asset allocations need to be changed to stay with the trends and follow new leadership avoiding new risks and engaging with new opportunities. For risk managed money, this is a time for action, not complacency. Conversely, passive investors or allocations to constant exposure strategies, should do exactly nothing beyond rebalancing, as prescribed.

The All Season Economic and Market Cycle

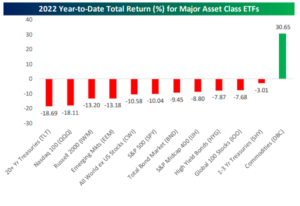

I describe this cycle as one for All Seasons because we need to remember that every “season” in the economy and the markets presents new risk AND new opportunities. It is true that there is always a bull market somewhere. Investors unfortunately tend to think that US stocks are the only investment out there. The season for global stocks and bonds is in Winter to stick with the analogy, while commodities have been in a well establish spring and summer mode. For my first victory lap, I will remind all of our readers that I said in our year end update, “2022 could be a year where commodities are the one and only place to be”. Clients know that we have held a double overweight position in commodities, gold, energy, and materials for almost 18 months. It has been a great ride, but all good things must come to an end. This chart provided by Bespoke Institutional – The Bespoke Report 4/22/2022.

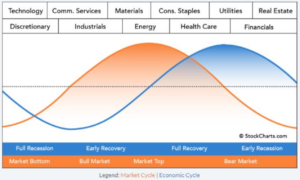

Let’s look again at the market and economic cycle pattern so I can show you where we are now and what SHOULD happen next in terms of asset classes and sector strength and weakness. Chart provided by Stock Charts and S&P guide to Sector Rotation.

As shown above, the market cycle shown in orange shows which sectors lead at different stages. Clearly based on sector performance in the last 5-6 months, we know that energy, materials, and consumer staples are the only sectors that are positive YTD. That fact alone tells us that we are near, at or even slightly past a stock “Market Top.” Meanwhile, the condition of the economy, shown in blue is also clearly moving from full recovery to early recession. Financial markets look ahead of economic conditions which is why the two bell curves are slightly offset with the markets effectively leading the economy by 6-9 months.

Now here is the critical takeaway.

When we see a top in the energy and materials sectors, then we know that the cycle for the stock market in general is also topping out. This event historically happens when the Federal Reserve is aggressively raising interest rates in an effort to curb inflation and the rise in commodities like energy (read gas prices). On Wednesday of next week, the Fed is going to raise rates again by .50% adding to their .25% increase last month. This is not a secret and stocks are now pricing in the reality that the economy is slipping toward recession. Yesterday, the US Gross Domestic Product (GDP) for the first quarter was reported as -1.4% down from +6% last year. Maybe slipping isn’t the right word here. Looking at the chart above, smart sector investors should now set stops on their energy and materials positions and stick with consumer staples, utilities, and healthcare. Financials are something to invest in closer to the bottom of a recession, so we will start looking there in 2023. Of course, we still want to stay far, far away from technology, consumer discretionary and communication services. As I write, Amazon is plumbing new lows, down 13% today alone. In fact, Apple is now the only stock among the fabled FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google) that is NOT down between 20-70% from the highs. Remember when they said that valuations do not matter anymore because interest rates are so low. I said that was dilutional. Gravity is real and valuations ultimately do matter. Now, we are finally seeing massive wealth destruction in technology companies that traded at nosebleed valuations as I suggested in 2021 (victory lap #2).

Now let’s talk about asset class (stocks, bonds, commodities, and cash) rotation in the context of cycles and seasons.

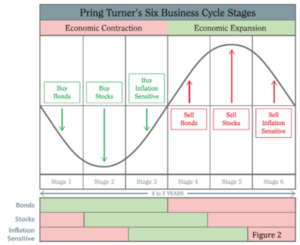

Enter the Pring Turner Six Business Cycle Stages!

In 1994, I read Martin Pring’s book, the All Season Investor. It was profound for me to the extent that I renamed our firm, All Season Financial Advisors a few years later. This construct is pretty basic and simplified but it does correlate with the sector cycle chart above nicely.

With perfect hindsight, we know that the economy was between Stage 3 and Stage 4, back in October of 2020. That was the time to “Buy inflation sensitive” stuff (like energy, commodities, materials, etc.). We did so aggressively for our client accounts. It was also a time to sell bonds aggressively as indicated above. Stocks could be held then as long as one was selective and leaning toward value, dividend payers and high cash flow companies. You’re all probably tired of hearing me harp about Value over Growth trades but it’s been a winner obviously (Victory lap #3).

Most of 2021 fell into a Stage 5 environment (Stocks Ok, Inflation Sensitives Strong, Bonds weak). And 2022 is quickly moving toward Stage 6. Let me spend a bit of ink on this stage.

Stage 6 is short, thankfully. Stage 6 is also the time when we see the most wealth destruction as stocks (all stocks including value) can enter the realm of real bear market losses. Stage 6 also sees a top in commodities and inflation hedges as the economy slips toward recession and inflation recedes. We’re still early here and inflation is not done, nor are we formally in recession yet. But that is the NEXT thing to happen from a cycle standpoint. Can we skip stage 6? Can the Fed orchestrate a soft landing and avoid a deep or lasting recession? We will see. So, dear investors, we are approaching a rather serious time and place where we need to begin making asset allocation changes to our portfolios. Please note, this advice is only appropriate for portfolios that are intentionally dynamic, risk managed and preferably tax deferred (to avoid unwanted taxes associated with trading). These changes are as follows:

- Start reducing your stock exposure all together if you have not already done so. During stage 6, all stocks washout, the good and the bad.

- Consider reducing, but not eliminating, inflation hedges, commodities, and hard assets.

- Use the proceeds from #1 and #2 to rebuild your bond position. These can be intermediate or long-term Treasury bonds, investment grade corporate bonds and municipal bonds (for taxable accounts).

Our flagship All Season strategy has the following asset allocation for reference as of today.

Global Stock Indexes – 60%

47% domestic stock ETFs, mostly dividend payers and value – reduced!

17% international stock ETFs, mostly emerging markets, Canada, and Mexico – New!

Alternatives/Inflation Hedges – 21%

9% Commodities – reduced!

8% Gold – hold

4% Real estate – reduced!

Bonds/ Income – 19%

5% Long Term Treasuries – New!

5% investment grade corporate bonds – New!

6% Specialty Income – New!

3% cash

Constant Exposure Approach during Stage 6

As you know, we have a growing number of client assets invested in our “Constant Exposure” strategies. These are formally our Wealth Beacon and Custom Direct Index strategies. The obvious concern for any who are invested in more passive models during a stage 6 environment is that your account balance will fall. That is 100% true. But the strategy of investing with constant exposure is not to attempt to sidestep risk and loss but rather to find great moments to add to these strategies. Stage 6 presents constant exposure investors with that opportunity. We are not there yet. Our goal with any passively invested money (529 plans, 401k plans, constant exposure models) is to buy low, that’s it. We do not attempt to sell high or do sector rotation or move a lot of money between asset classes as described above. We build our asset allocation models to include mostly stocks and bonds, we remain disciplined in keeping our portfolio balanced and we patiently work to find that time and place when we can add to our portfolios. This is the simplest, most effective, and most productive way to manage your money assuming you have the tolerance for this approach.

So, for all investors who have money committed to Constant Exposure, I will offer some simple advice. Pile up your cash, be patient and know that your day to deploy at deep discounts is coming. You will make greater after-tax returns than any other approach if you remain disciplined over time. What you cannot do is sell out at the lows in an emotional act of sudden risk aversion. Selling at the lows destroys the entire process of accumulating wealth, adds tax liability, and forces you to buy back often at much higher prices. There is merit in the constant exposure approach if done correctly with discipline. We are here to help guide you through this process and work through the emotions that come along with it.

Next update, we’ll be talking about real estate. There is much going on here and given the fact that so much wealth in our country is tied up in real estate, it will be worth your time.

Have a great week! Mud season up here in Steamboat Springs (not my favorite).

Cheers

Sam Jones