May 30, 2024

The Achilles Heel of Real Estate

After nearly 12 years of outsized price appreciation in real estate across the globe, we have all been trained to believe that real estate prices are impenetrable, rock solid, and only going higher. The standard argument of not having enough housing stock still justifies our collective opinions. But like our good friend Achilles, vulnerability is often found in unanticipated places. Rapidly rising homeowners’ insurance costs have the potential to be very disruptive to real estate prices and the long-term demand side of the equation.

Why are Homeowners’ Insurance Premiums Rocketing Higher?

Insurance premiums are very much a local rate thing. Many states west of the Mississippi and north of the Mason Dixon line, have enjoyed relatively low homeowners’ insurance premiums for decades. Changes in local rates have moved higher slowly and generally less than inflation for years, roughly 2.4% annually as a rate of change. But starting in late 2023 and now accelerating in 2024, we are seeing insurance premiums increase by 7-9% in most states and some as much as 50-60%. What’s going on?

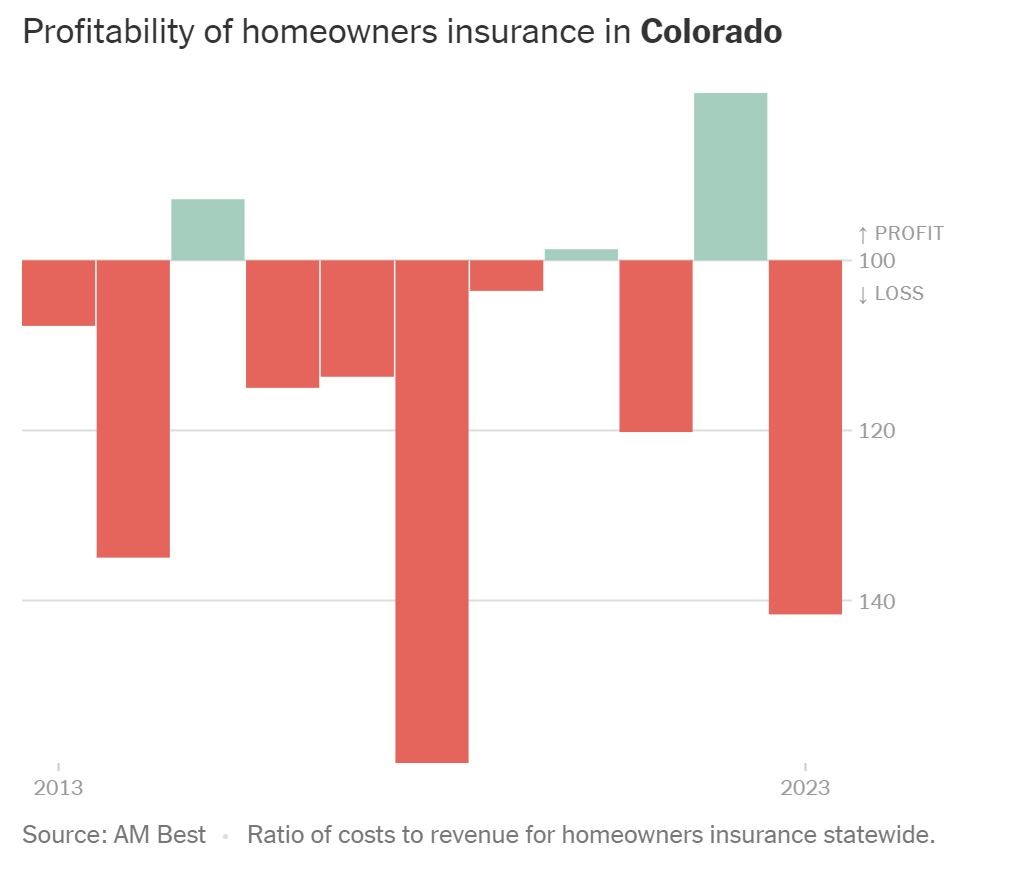

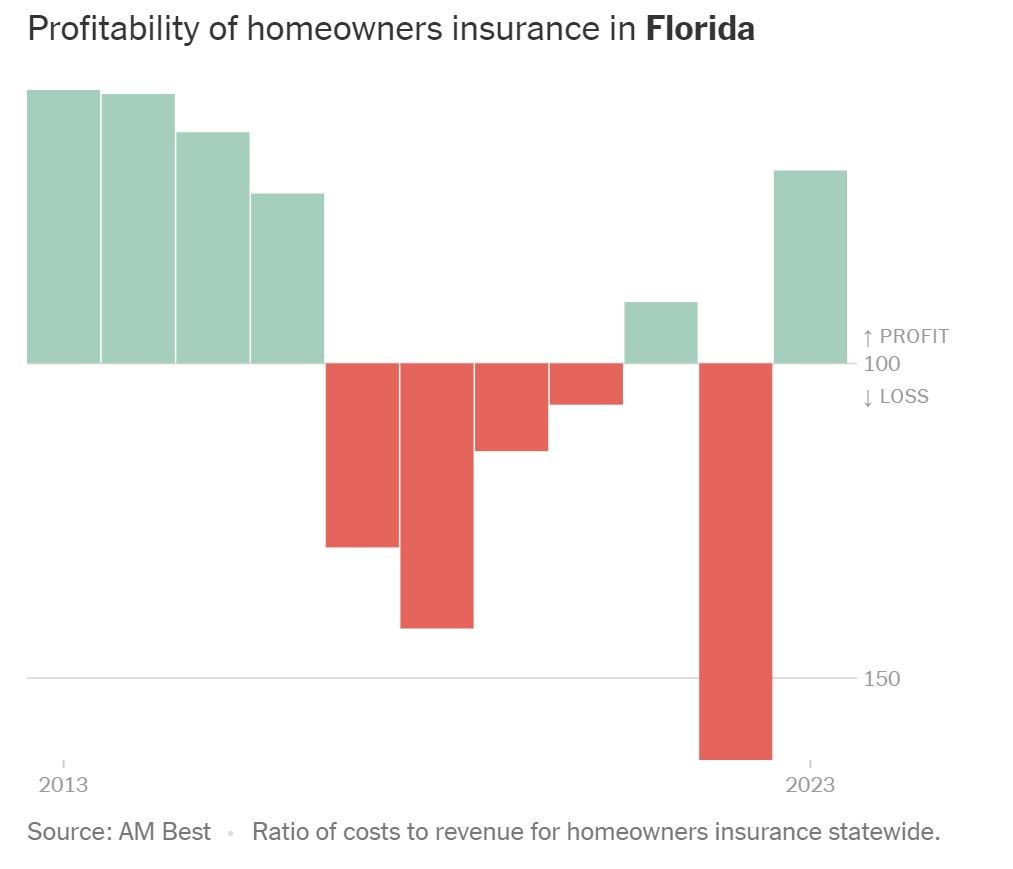

Well, there are several factors in play. The first and most obvious reason is that homeowners’ insurance is becoming selectively unprofitable for insurance companies. On May 13th, the NYTimes ran an eye-opening article illustrating that point. Here’s the article if you have a NYTimes subscription.

https://www.nytimes.com/interactive/2024/05/13/climate/home-insurance-profit-us-states-weather.html

The article focused on the rising and consistent costs associated with Climate related disasters in states like Florida (Hurricanes, floods), California (Floods, mudslides, etc.), Louisiana (Floods) and Colorado (Wildfire and Hail) as obvious reasons for increasing insurance premiums.

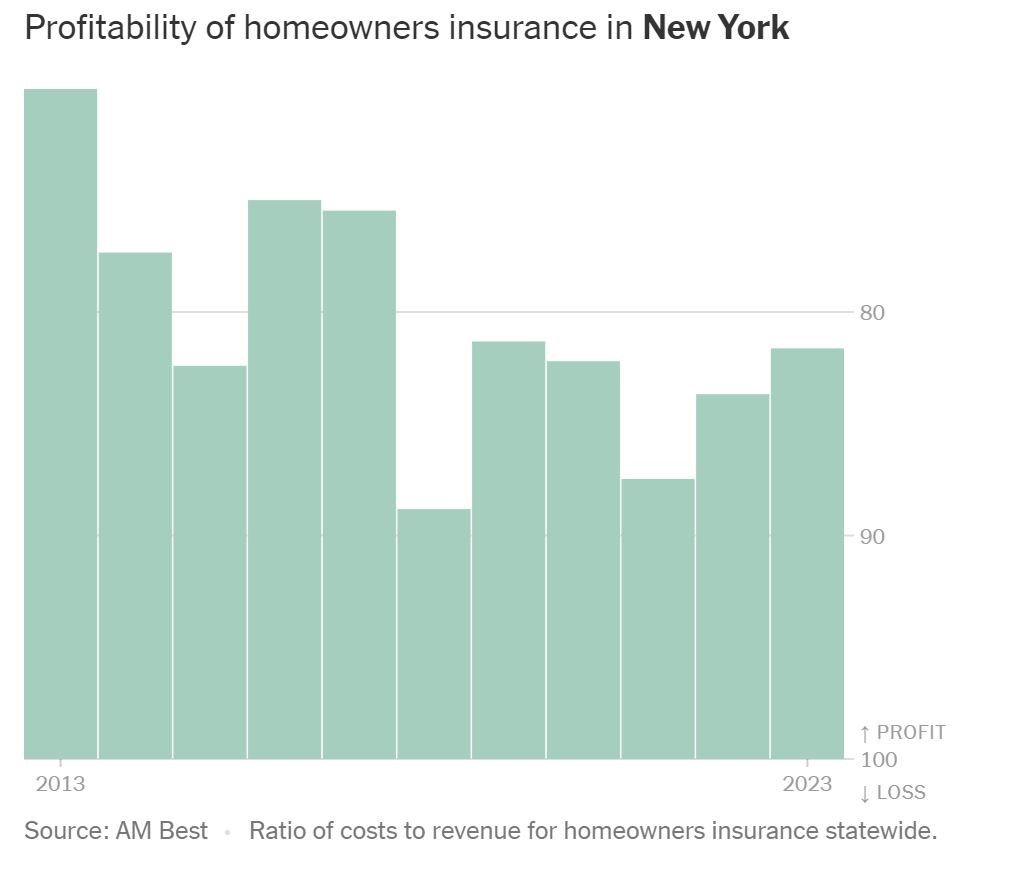

Other states like Maine, Connecticut, and New York are still very profitable for insurance companies.

But these states may be just enjoying temporary low insurance rates, considering the damages last Winter from rising sea levels, powerful storms, and properties literally falling into the ocean. I am in Maine and was surprised to see several iconic oceanside bait shacks, beachside stone staircases, and homes gone this year, washed away.

Costs associated with climate change are now landing on our shores, literally, and insurance companies are reflexively pricing those risks into their premiums. But there is more to the story!

After digging a bit deeper, it appears we have some bad actors and bad behavior in the play as well. There is quite a war happening between homeowners, their contractor soldiers, and insurance adjusters. On the homeowners’ side, a small claim, like water damage to a floor, turns into a rather large claim when contractors are brought in to estimate repair costs. Yes, yes, the vinyl floor needs to be fixed! But why not fix it with expensive hardwood floors and throw in new kitchen cabinets to the claim? Yes, this is fraud, and yes, this is happening on a grand scale. Insurance companies are fighting back by rejecting claims and taking the issues to court. Who is right or wrong is in the eye of the beholder, but it’s bad business all around. Florida, for instance, represents only 9% of total claims for nationwide insurers but nearly 80% of all claims that go to litigation. Now, if you are with an insurance company covering the state of Florida and you know that you are going to go to court to fight 80% of questionable property insurance claims, what would you do? You would leave the state and focus on becoming more competitive in states where there is lower climate-related risk, cost, and fraud. Goodbye Florida, goodbye California, and sadly Goodbye to our fine state of Colorado. *Colorado residents, be prepared to see your premiums increase by 50-100% in 2024. Many in our state make a claim for an entirely new roof when it seems opportunistic to do so after a notable hailstorm. It hails golf balls in the front range of Colorado every year! Anecdotally, our home in Steamboat Springs was dropped by All State Insurance after doing business with them for 25 years. Wildfire risk was the reason for this in a two-sentence letter. We quickly got coverage from Traveler’s Insurance, thankfully, but we have spent over $20,000 on fire mitigation around our house, and I’m still nervous. It’s going to get ugly.

The other obvious reason for increasing insurance costs is simply the rapid increase in the value of homes and labor inflation for home improvement contractors. Higher costs equal higher claims and, therefore, higher insurance premiums. For both of these, we can thank the Federal Reserve and $7 Trillion in stimulus spending in the last 4 years.

Insurance Rates Increasing the Total Cost of Ownership (TCO)

I have been harping about TCO for over a year now. TCO includes all the costs of carrying a home over time. These include the following:

Property Taxes

Homeowners’ Insurance

Maintenance and repairs

Mortgage (principal and interest)

Upgrades and Improvements

Utilities (Water, trash, sewer, gas, electric)

If you are willing, look through your own bills in these categories over the last several years. Headlines in the media will make you worry about sky-high mortgage rates today (7.5%) versus three years ago (3%). Guess which one of the TCO categories above is not a problem for 85% of current homeowners? Mortgage rates! This is the only category that is fixed and relatively low compared to all the other costs of ownership, which are going up 10,20, and 30% annually. Granted, high mortgage rates are an issue for future homeowners looking to buy, and yes, this will add to the TCO total for next-gen buyers who are simply refusing to pay up (More on this in a minute).

Capacity for Disruption

Homeowners’ insurance is pretty important, especially if you happen to live in a place that has more exposure to the backhand of mother nature. She’s not very happy with climate change, that is for sure. Even more, for those carrying a mortgage, homeowners’ insurance is mandatory. Let’s walk down the road of options, assuming homeowners’ insurance is going to march higher at the current rate of 6-8% annually.

Going without homeowners’ insurance doesn’t seem like a good choice, considering how much of our net worth as a country is now wrapped up in our homes with very healthy equity values.

Perhaps we can follow the path of Healthcare plans and move to a system of high-deductible homeowners’ insurance. $200,000 deductible, anyone?

I could see our lender of last resort (The US Government) stepping into the insurance business to cover homes that private insurance companies have dropped for any number of reasons. Of course, this option is fraught with a moral dilemma about socializing risk and the role of government. We’ve become masterful at this over the years, so I sort of expect this outcome, honestly.

Finally, there is the very disruptive outcome, which is almost unthinkable today. Homes that are uninsurable will be priced as such. If you cannot protect a very expensive hard asset, it will be worth far less to any owner. How much less? 50% less? 80% less? I couldn’t say, but it’s a big number.

Rent Versus Buy

I would like to reiterate my strong opinion that renting today is still a better option than owning real estate in many cases (most actually). This is not permanent advice, nor do I suggest this applies to all situations and locations. Looking back, owning real estate has been the clear choice. Looking forward, renting is the clear choice.

The NY Times ran another article last week about this very subject, profiling several young couples that are doing the math and smartly choosing the rent, perhaps forever. Again, sorry for the paywall, but you should honestly spend $60/ year for the NY Times. Junk news sites like X and Reddit will be free, and you will enjoy an all-you-can-eat buffet of misinformation. I’ll pay for edited, fact-checked news and try to keep my perspective, education, and sanity. Thank you very much.

https://www.nytimes.com/2024/05/19/business/renting-forever-investing.html

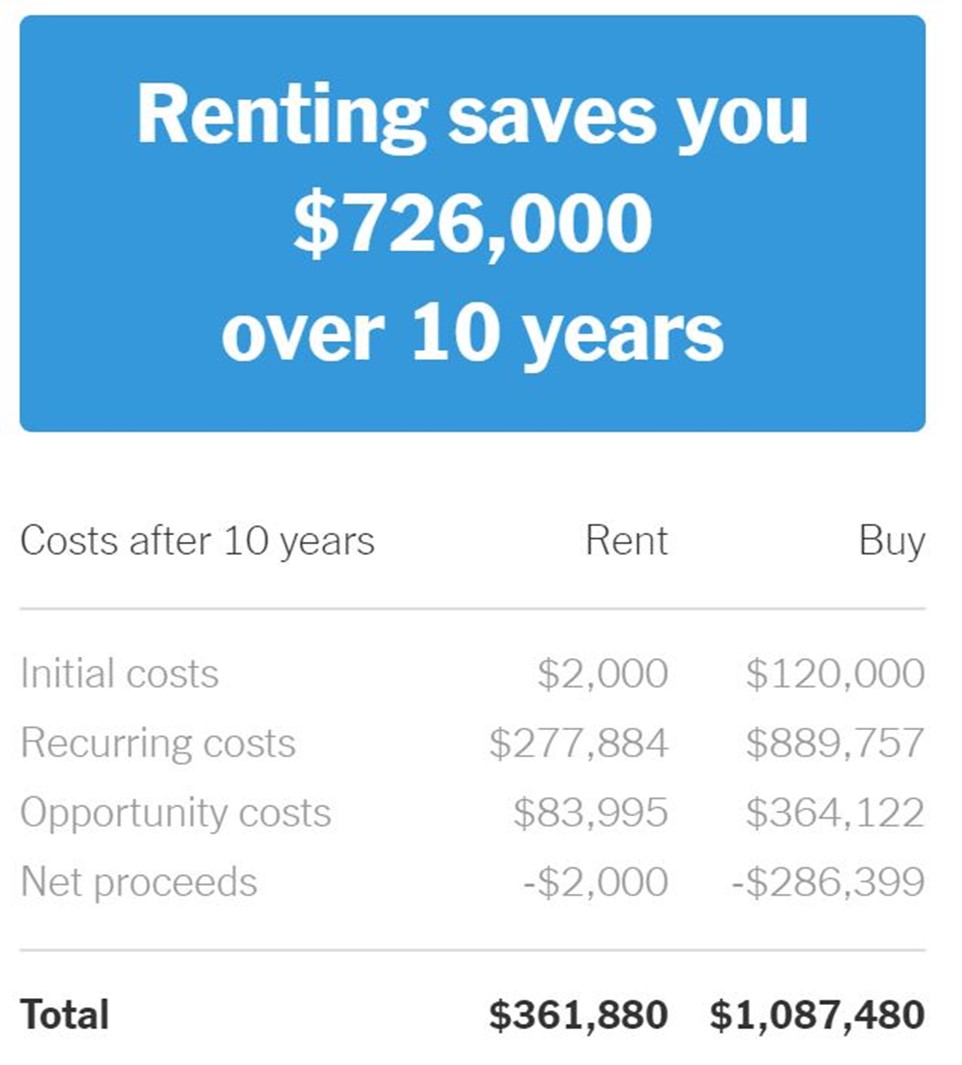

NY Times has also loaded an amazing rent versus buy calculator with 15-20 different adjustment tools. You can really dial in your situation, your location, opportunity costs, investment returns for your “house” money, insurance costs, taxes, and inflation. I spent a solid hour on the site this am. This was the output based on the variables I entered (Not yours!).

Once you have the site fleshed out with your estimates and details, you will see the breakeven between your potential buying limit and your maximum rent. This should be an app on the phone of every 30-year-old in our country.

https://www.nytimes.com/interactive/2024/upshot/buy-rent-calculator.html?

Amazing!

The point again is that owning a home is becoming crazy expensive to buy and carry. Renting is a viable option for many who might look to cash out or downsize. I would certainly check your math on the lure of the American Dream (home ownership) if you are just now trying to enter the game. Home prices will come down, as will the Total costs of ownership, but It’s going to take a lot of time and patience to unwind 30 years of accumulating cost.

Summary

Homeowners Insurance costs are going up and are likely to reflect the true costs of climate change, padded claims, bad behavior, labor inflation and elevated home values. These inputs into the profitability equation for insurers have been building for decades and are not easily undone. Insurance may very well become the Achilles Heel in the armor of the real estate industry. As always, we try to find insights into risks and opportunities for all things financial in an effort to help you make informed and judicious decisions. This is not the end of days but rather a planning opportunity. We’re here to help and hope to be your first call when you have questions.

Have a great week!

Sam Jones