Custom Indexing Strategies

The Future of Investment Management, Today!

What is Custom Indexing?

Unlike ETFs and mutual funds that offer one pre-packaged product for investors to purchase, the portfolio construction methodology behind Custom Indexing is personalized to an individual’s unique circumstances, risk tolerance, goals, and preferences. Custom Indexes are implemented through a separately managed account (SMA), where investors can directly own a mix of individual securities rather than indirectly owning positions through shares of funds and ETFs.

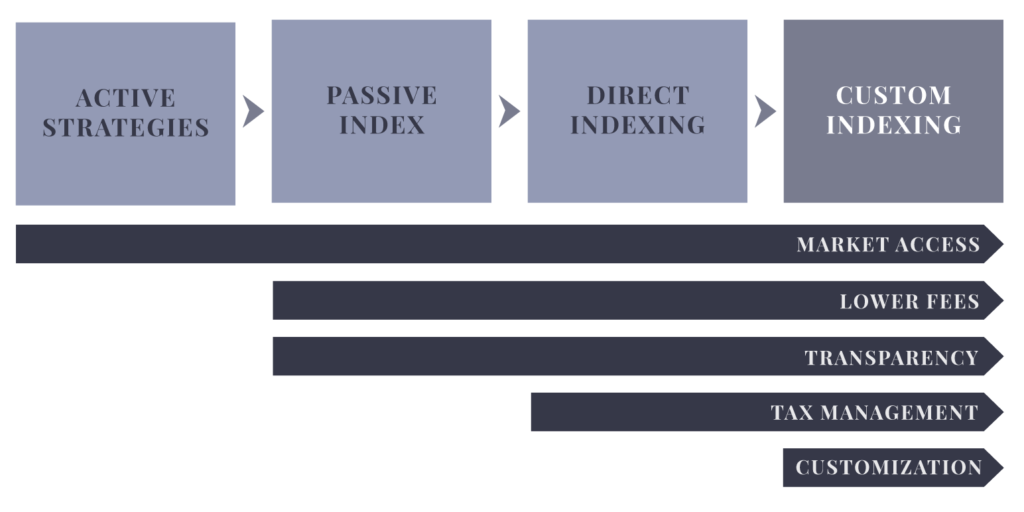

Custom Indexing is a technology, and technology often removes barriers to entry. Packaged funds (like mutual funds and ETFs) sit in between investors and the stocks they own. While mutual funds and ETFs were wonderful innovations, recent advances in portfolio management technology coupled with zero-commission trading have enabled investors to access sophisticated strategies consisting of direct share ownership.

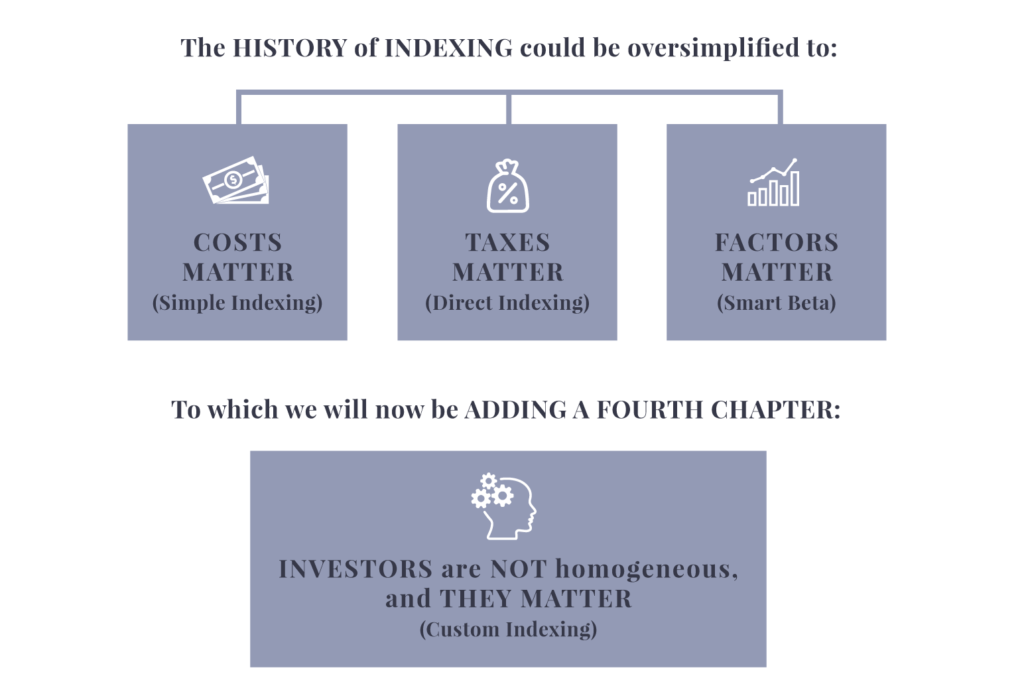

How We Got Here

Custom Indexes will be built using dynamic software, typically starting with broad market exposure (i.e. beta) and then accounting for each investor’s needs in areas like taxes and tax treatment, desired returns, income, risk exposures, ESG, and more.

Each simple step in the indexing progression builds on the last. Direct Indexing carried forward the low-cost benefits of simple indexing (via mutual funds and ETFs) and Custom Indexing will carry forward the benefits of low costs and tax-loss harvesting.

How Does Custom Indexing Help Me?

The Benefits of Unbundling & Owning Individual Securities

The direct share ownership of Custom Indexes allows for more precise execution of high-end financial planning and offers benefits not available to Mutual Funds and ETF investors, particularly in:

- Tax Loss Harvesting

- ESG & SRI

- Reducing Concentrated Stock Risk

- Allocation Flexibility

In Summary

ETFs and mutual funds suffer from a two core problems: lack of customization and an inability to actively take advantage of underlying losses to combat tax drag.

Enabled by advances in technology, commission-free trading, and more, Custom Indexing now allows investors to build portfolios that are personalized to their specific situations and preferences. In the future, investors will no longer buy into someone else’s investing formula: each investor will buy into their own.

Custom Indexing is the start of that future, and the time is now.

*Disclosures: The above information was compiled from O’Shaughnessy Asset Management. You may read more here: Custom Indexing: The Next Evolution of Index Investing and Custom Indexing: The Benefits of Unbundling. All Season Financial Advisors utilizes O’Shaughnessy Asset Management’s Canvas Platform to build and implement custom indexes on behalf of our clients. O’Shaughnessy Asset Management is a subsidiary of Franklin Templeton and acts as a third-party investment advisor on behalf of our mutual clients*

Schedule a Free Portfolio Analysis

Let’s talk to find out how we can help you.

303-837-1187

Or you may complete the form below and we will be in touch with you as soon as possible to schedule a consultation.