November 8, 2023

Last week I planned to highlight our New Power strategy in this week’s strategy insight, but realized that we have many more client assets invested in our long-standing Worldwide Sectors strategy. Let’s hit this one first so we can weave in some current holdings and some rather serious considerations as we approach year-end.

Strategy Description

Ripped fresh from our website, this is our description of Worldwide Sectors which is approaching its own 25-year anniversary in January of 2024.

The primary objective of the Worldwide Sectors strategy is to produce consistent, growth-oriented returns over a complete business cycle using individual stocks and ETFs, with lower correlation to the MSCI All Country World Index benchmark.

Worldwide Sectors will produce its best returns in market environments in which there is broad participation and leadership. This strategy has three distinct investment sleeves of approximate equal weightings: Thematic, Domestic and International. Within each sleeve, selection criteria favor securities with attractive valuations and positive relative strength to peers.

Worldwide Sectors is an all-equity strategy that attempts to remain fully invested in all market conditions and will at times experience full stock market volatility. Investors will experience both short- and long-term capital gains over time. Consequently, Worldwide Sectors is more appropriate for tax advantaged/ retirement account registrations.

Ok, so that’s what Worldwide is and the basic framework for the guts of the strategy. There are several reasons why I like Worldwide Sectors and why it remains one of our longest standing equity strategies.

“Themes” are Persistent and Secular

Themes used to be called Sectors, thus the historical name, Worldwide “Sectors”. But Thematic investing is a new and improved version of sectors with ETFs and other funds widely available that offer investors a way to capture mega trends. BlackRock does an excellent job educating investors on the primary megatrends below. In fact, they have a 19-minute video on the subject if you care to cuddle up with your favorite drink for some financial literacy.

https://www.youtube.com/watch?v=mtxiJWjN2SE

As BlackRock illustrates in the video, thematic investing offers investors a more targeted discipline than owning just any broad market index but eliminates single stock risk at the same time. Today, Worldwide Sectors is participating in all five megatrends with current ownership positions as follows:

Technological Breakthrough:

SPDR Communications ETF – XLC (50% allocated to Meta and Alphabet)

I Shares Software ETF – IGV (Big positions in Microsoft, Adobe, Salesforce, Oracle)

Global X Cyber Security – BUG

Microsoft (our one and only stock position for double exposure)

Demographics and Social Change

ARK Genomic Revolution – ARKG (new position! Big in Exact Sciences and Crisper)

Rapid Urbanization

Global X US Infrastructure – PAVE

Climate Change and Resource Scarcity

Rydex Commodities mutual fund

Rydex Precious Metals funds

*Looking to add clean energy ETFs ASAP

Emerging Global Wealth

I Shares Brazil – EWZ

I Shares Latin America – ILF

I Shares India – INDA

I Shares Taiwan -EWT

I Shares Saudi Arabia – KSA

I Shares Emerging Markets Dividend – DVYE

Today we have a US stock market that is cosmetically up on the year, but you have likely heard the truth by now that only mega cap technology is up and up big. Of course, Worldwide has exposure to technology as you can see above, but we certainly don’t have 100% of assets in “Technology Breakthrough” because that would be foolish and reckless. In fact, Technology is the theme that we are poised to reduce in size and take profits in the coming weeks as we find other themes to be far more attractive given recent relative performance and valuations.

Internationals/ Emerging Markets Offer Value

Another reason I am so passionate about Worldwide Sectors is the “Worldwide” sleeve. See above, our exposure to emerging markets is pronounced and justified not only because it fits the mega trend of emerging wealth outside of the developed world but also because this is where we see value across the universe of investment options.

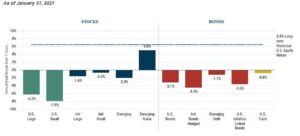

Stay with me as I take a short detour in talking through expected 7-year returns. Jeremy Grantham, co-founder and Chief Investment Strategist of GMO LLC is famous for his 7-year forecasts by asset class. He is also the ultimate curmudgeon. His firms’ analysis has a way of proving right over time but is often seen as wildly out of sync with the markets year by year. In Jan of 2021, I presented the GMO 7-year forecast and received plenty of feedback that this forecast was way too bearish. After all, how could stocks AND bonds be projected to fall at the same time. Unheard of! Well, we know what happened in 2022 – Exactly that.

Remember this is a rolling 7 year forecast not an annual forecast. Let’s see where things stand today compared to this forecast looking back from January of 2021 to present.

US large caps + 17% Way higher than forecast

US small caps -16% Way lower than forecast

Internationals – 4% Lower than forecast

Emerging markets – 18% Way lower than forecast

US Bonds -14% Way lower than forecast

Emerging bonds -17% Way Lower than forecast

TIPS -7% Lower than forecast

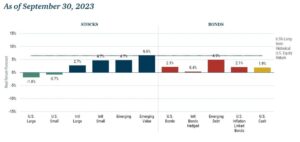

Thus far, the old man seems to be off track. Outside of Large Cap US stocks (aka Technology), every asset class is tracking far worse than his 7-year average expected returns. Here’s the latest from GMO.

Now if we believe the GMO 7 year rolling forecast is good and has a long track record for accuracy in dictating expected asset class returns, which it does, then we can derive several things from the change in expectations over the last couple years coupled with real actual returns dating back to 2021.

In the next 5 years:

- US and international bonds are likely to have a very strong period of outperformance.

- International stocks, especially Emerging Markets should outperform dramatically.

- US large caps are likely to underperform badly while US small caps may do well.

Don’t shoot the messenger because I know and appreciate how much the world has invested emotionally and physically in large cap technology right now. We are bound only by our failure to imagine a different future than the one we live in today. Someone important said that once.

Worldwide Sectors has a dedicated 30% allocation to Internationals and emerging markets. Thus far, it’s been a bit painful as the strategy in aggregate is barely up in 2023 while the S&P 500 is up almost 13% due exclusively to a handful of large cap technology stocks. In the next 5 years, I think it’s going to work out just fine as all asset class returns revert back to what good ole Jeremy suggests.

I’ll leave it there. I can see your eyes rolling back in your head. I am wildly excited with the design and discipline of Worldwide Sectors despite recent performance. The strategy has a long track record of outperforming our benchmark, the All-Country World Stock index (ACWI), net of all fees and doing so with lower correlation and volatility. This a keeper for any investor looking for a thoughtful, managed, stock allocation dedicated to value and thematic investing.

Thanks for reading!

Sam Jones