October 7, 2022

This market is a lot like waiting in a traffic jam. It’s never fun and some of us handle it better than others, but we know that eventually the road will open, and we’ll hit the accelerator again. This will be a quick update and follow up to our annual meeting presentation (recording now available here for those who missed it). The intent is to give you some mental peace as you head into the weekend knowing that we are still waiting, very defensively positioned, for the developing bottom in both stocks and bonds.

Jammed Up

I think most drivers are aware of the amazing WAZE app that shows traffic patterns and best ways to get from A to B during rush hour. I won’t go into any city without it personally. As I look at the sea of red on my quote box today, I can’t help but think this is a lot like a traffic jam where we just have to sit, breathe and know that it will end soon.

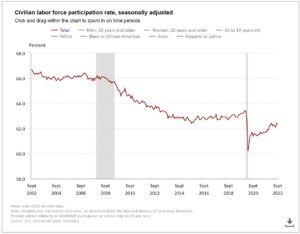

The Employment Report released today was the cause of the market’s dive as the monthly number of new hires came in slightly above expectations. The market was hoping for a more recessionary number. But let’s unpack that for a moment. First of the all the economy ONLY added 208,000 jobs last month, a mere 8,000 more than expected. Not exactly a blow out number and 200,000 new jobs is actually pretty soft historically. A big number is almost twice that amount in an economy that is actually growing. Second, there is context to any unemployment figures. Since 2002, our Labor Force Participation rate has been falling steadily and is still well below the last peak set in 2019.

This is a function of early retirements, or others who are still eligible to work by age, but have dropped out of the work force either by choice or involuntarily. Looking at the chart above, only 62% of eligible workers are actually working in our country. That deserves some more research but not today. When we have a shrinking labor force (read aging population), any small uptick in employment numbers is going to make us look far more fully employed than we really are. That’s simply not representative of what’s happening across the working population at large.

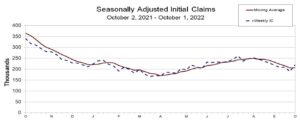

Finally, we have to also keep a close eye on the claims for unemployment at this stage which is also telling a different story than what you heard on the news today. Take a look at the right edge of the chart below. Do you see the sharp curl UP as claims for unemployment just jumped? So today, we’re all jammed up looking only at the taillights in front of us and wondering how long we’ll have to sit in this traffic. But if you could see the “jam” from the perspective of WAZE, you would know that employment is not nearly as strong as suggested today, and we’re on the very cusp of a change where the Fed is going to recognize we’re heading fast toward recession. I’m guessing November will mark the end of the current rate hike cycle.

While We Wait

Just like any traffic jam, we ultimately settle into resolution that this is going to take a while. We can do some lane hopping but we really know it won’t matter much as all lanes are all jammed up. Stocks and bonds are the lanes, and they are both jammed up. Today, our risk managed strategies remain defensive, heavy in cash and hedged with short positions. It’s been bloody since August. Consequently, we have cut exposure to the markets since it became obvious that interest rates were not done rising in sync with our menacing Federal Reserve (argggg) despite the very obvious recessionary pressures globally. These are our cash positions in our various risk managed strategies and we literally don’t get more defensive than this in almost any market conditions.

STRATEGY Current Cash Position

Freeway High Income 56%

Retirement Income 64%

All Season 20% (+10% short position)

Worldwide Sectors 23%

New Power 37%

Gain Keeper Annuity 40%

Our biggest risk today is that we are grossly underinvested considering the upside potential of this market, but we have to stick to our discipline and trend following rules. When there is nothing to buy, we wait and hold only positions that are generating income or significantly outperforming the broad markets. That’s where we are today, waiting, fuming, but ultimately knowing that we have some open road not too far ahead.

Have a great weekend and know that your capital is largely out of harm’s way, and we are looking forward to the next BIG thing in the markets – rising prices!

Have a great weekend,

Sam Jones