Rotten Apples and Realities

Regular readers know that we are neither bullish nor bearish on the general stock market. We leave that to the forecasters who must have a lot of time on their hands. We do call out risks and opportunities as we see them however, focusing more on sectors, specific investments, behavioral economics, and systemic risks. If you hadn’t gathered, the theme for our commentary since April has been about selectivity – where you should invest your hard-earned capital and what to avoid. The market is a bucket of apples right now to be sure. You can find the good mixed in with a few of the rotten types. In this context, we should all be conscious of the rotten apple mantra, when the bad apples can ruin the whole batch. We’re hopeful that the rot stays contained. Today will be a clip fest of interesting charts and data I discovered in my weekly reading finishing with a couple of important reality checks that every investor should understand with total clarity.

Rotten Apples

There are lots of things to like about this market. We’ve talked about real value now leading the markets – FINALLY!!! We’ve talked about the all-time new highs in the broad market and the new leadership coming from the cyclical side of the market rather than the defensive sectors – Good. We’re also seeing the stock markets of the world participate with Europe and parts of Asia actually leading the US higher – Yay! But as we sift through the apple bucket, we are also finding some serious rot just beneath the surface. Here are a few rotten apples.

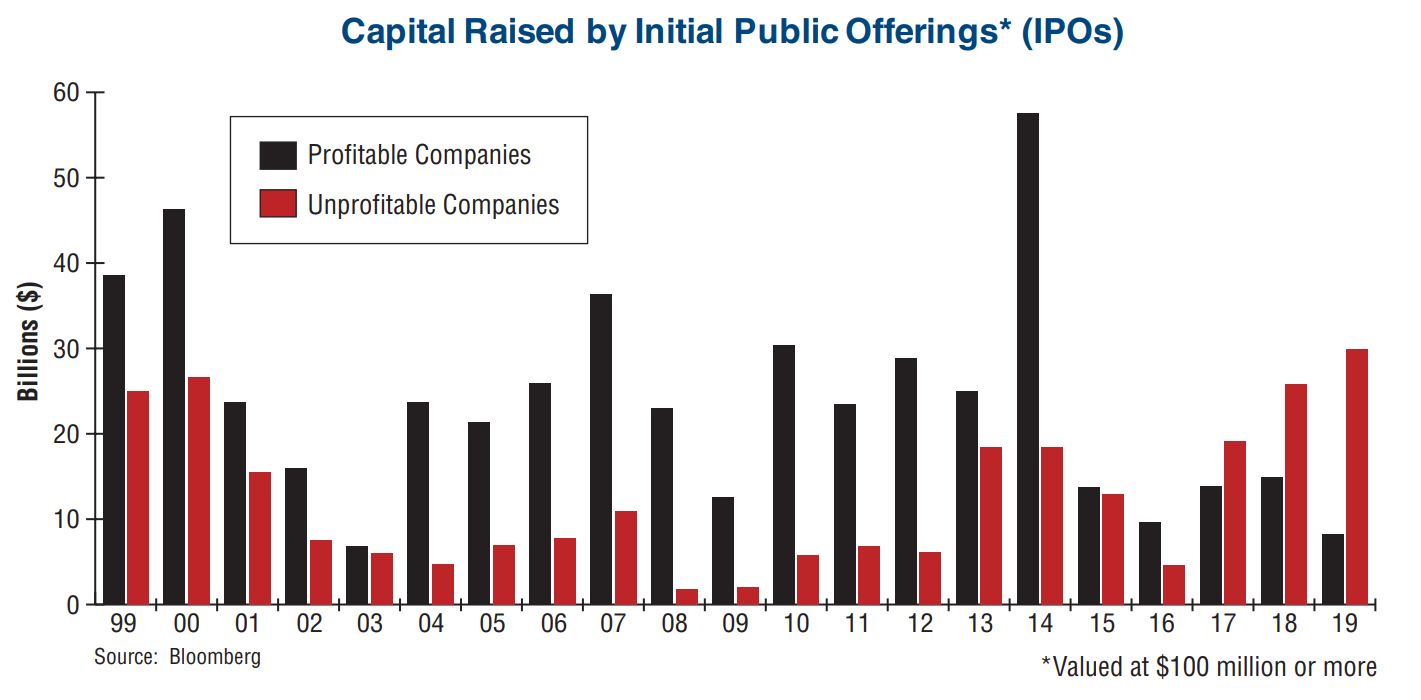

Clearly the stock market has become the dumping ground for unprofitable companies coming to the public markets as a means of offering their founders a very healthy exit plan. Look at the last three years! The new buzz phrase our there is “show me your path to profitability” that’s funny. I’ll just buy the profits thanks. We should all let venture capital and private equity worry about the path to profits. The annual burn rates (amount of net income LOSSES) in the new companies going public are absurd and, in the Billions, (with a B).

There is also something rotten in Corporate Debt. Right now, the rot is in the CCC grade corporate bonds which is where all corporate debt rot begins in the early stages of a recession. Apparently, the default rate in CCC has very suddenly shot up to 11{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} from 3{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}. High yield corporate bonds are the proverbial canaries in the coal mines. When they die, it’s time to be careful/ leave/ run.

High yield spreads are not confirming this all-time new high in the markets. Again, without stating a forecast, we need to watch this rotten apple closely. If it doesn’t get up and go soon, we’ll be heading for the exit. This cart provided by Bespoke Institutional Research

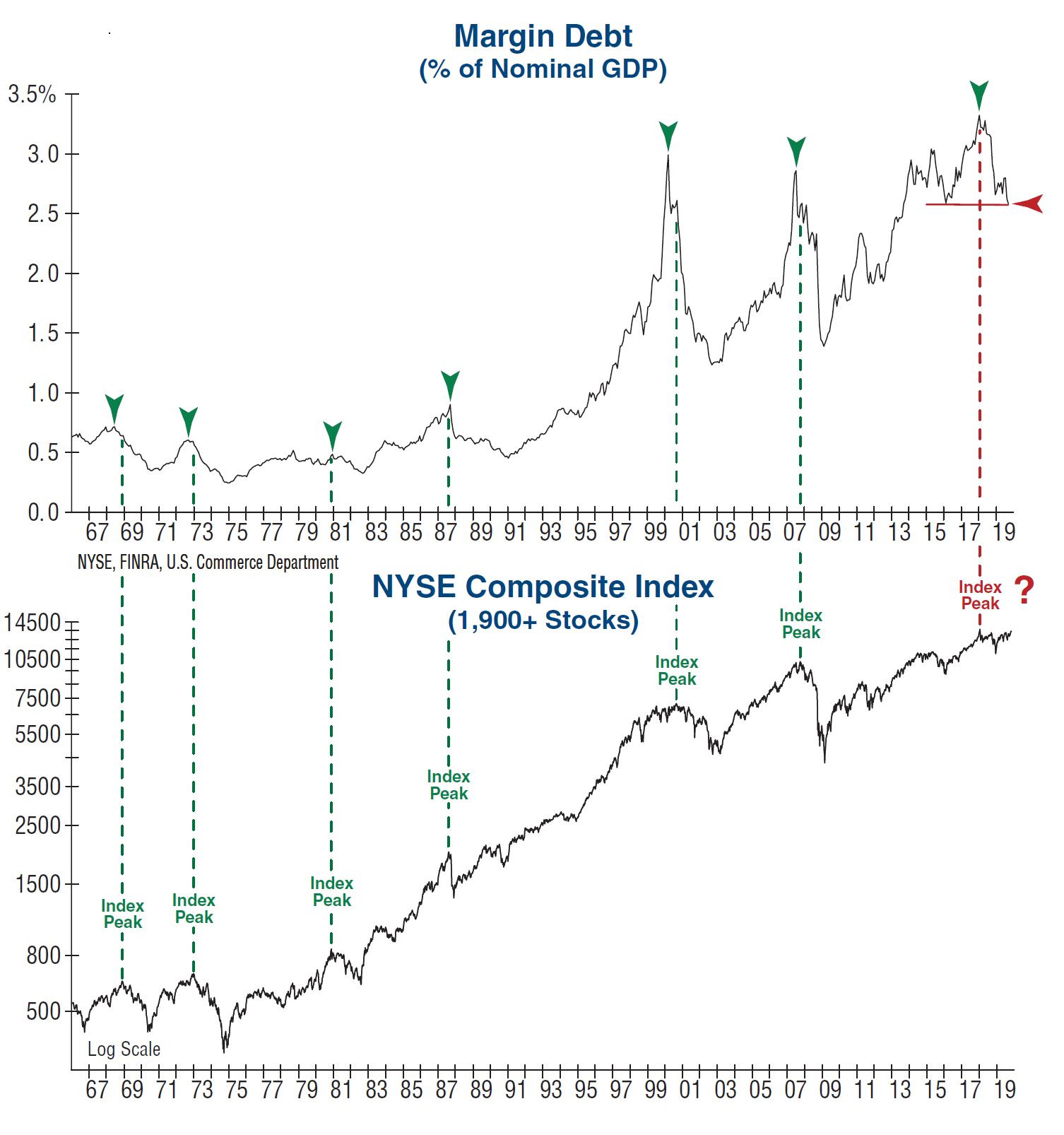

Another canary is the level of Margin Debt being used in the system. Margin debt is highly reactive to market risk, like High Yield corporate bonds. As you can imagine, losing money in stocks is no fun, but losing money with borrowed money bearing interest is just an angry experience. Buying stocks on margin is a thing, a big thing, and used by institutional money managers as WMDs. As Jim Stack of InvesTech illustrates, tops in Margin debt are often the Hallmark of tops in stocks. Not bullish, not bearish, just pointing to this rotten apple.

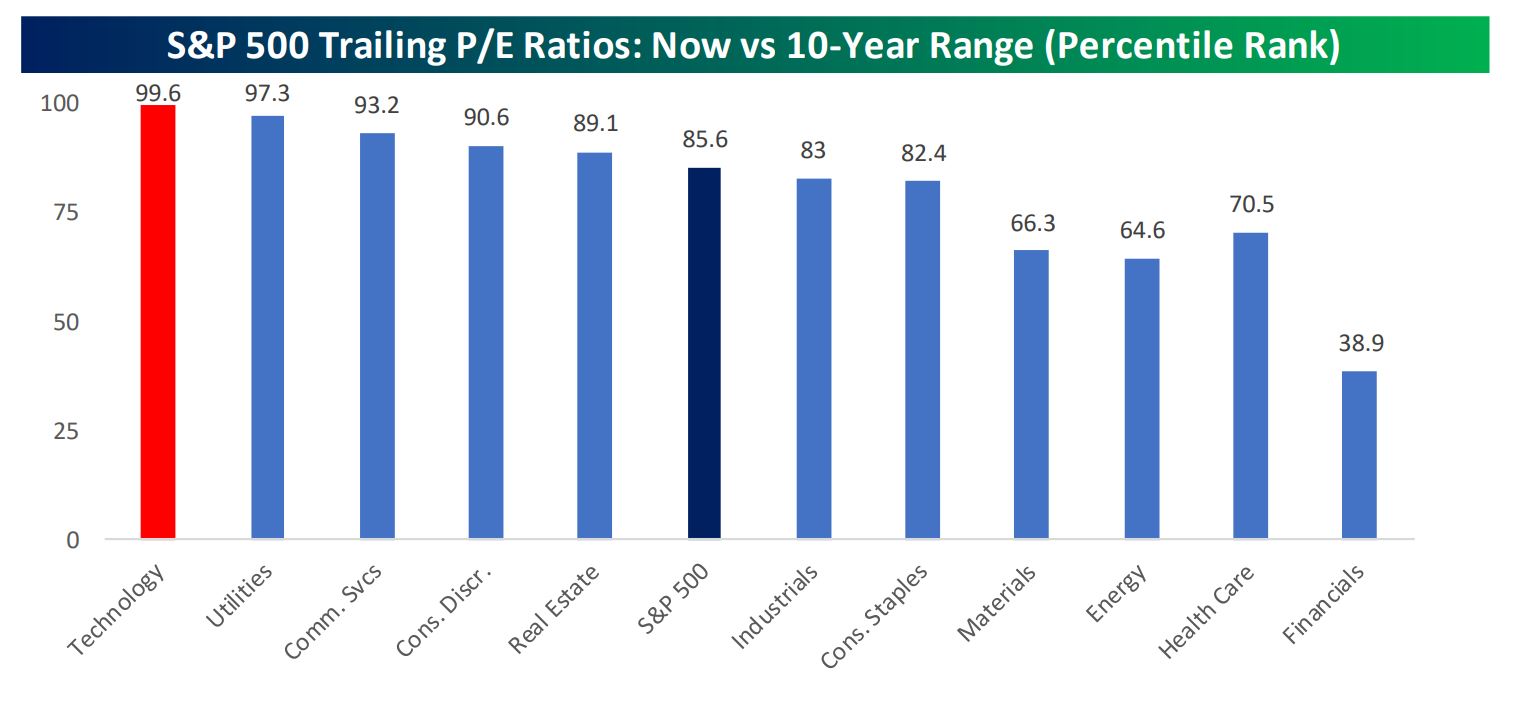

More Rot to be aware of. In this case, be careful about taking a big bite out of Technology. I will tell you will complete confidence, that technology is the number one sector in every investor’s portfolio. How do I know? Because technology is the largest weighting in the S&P 500 and investors seem very comfortable owning S&P 500 indices in bulk in their portfolios. Technology is now in its 99.6th percentile in terms of trailing P/E ratio. In layman’s terms, that means that Technology is literally red lining and has only been this expensive in 0.4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of all periods in the past. Technology can continue higher, but I’ll say that the risk-reward of owning technology now, or by way of your oversized S&P 500 index, falls into the bad planning category. Looking at this chart, we should all focus on the right-side sectors where value lives.

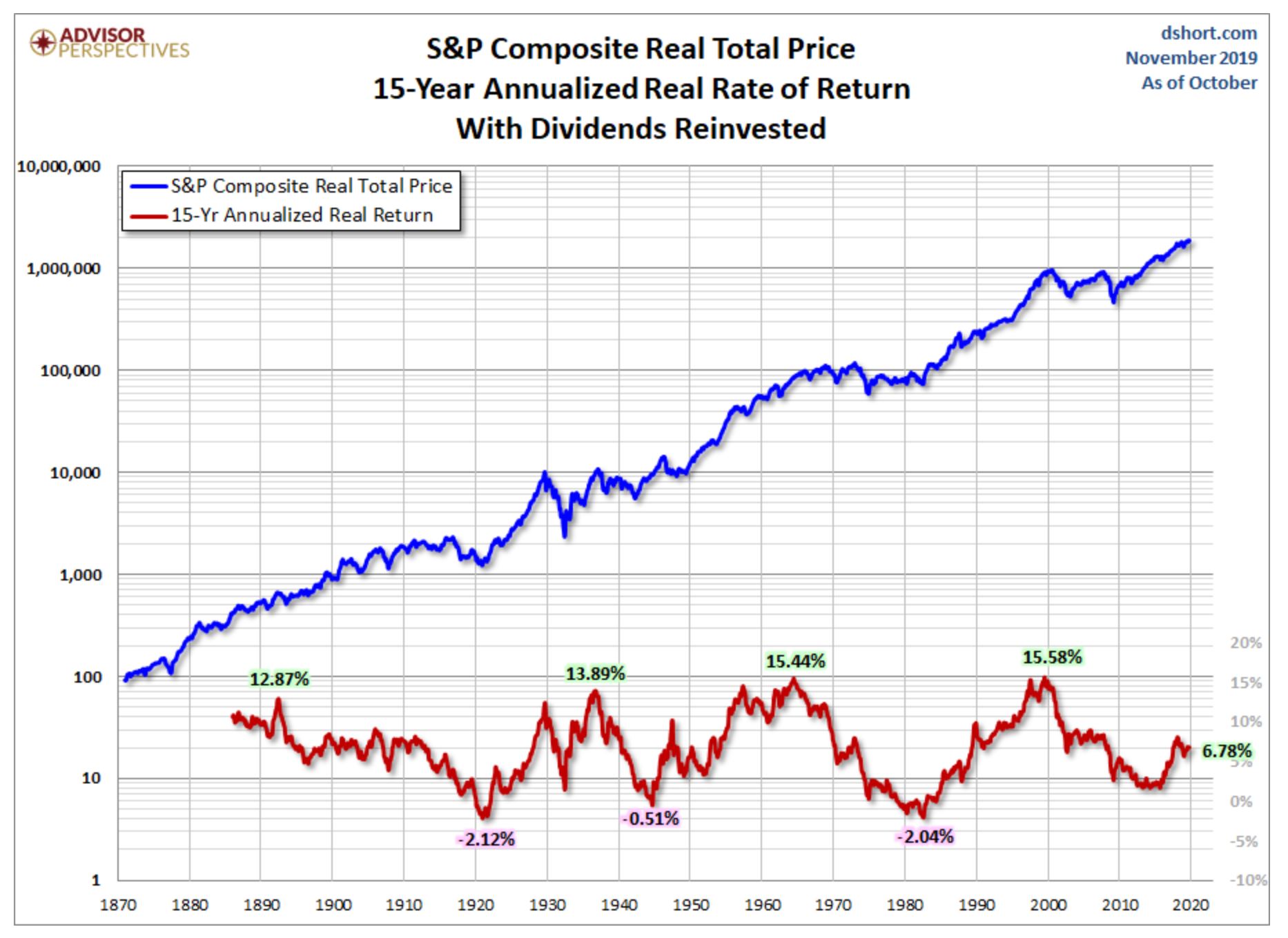

I’ll leave you with two reality checks. Spend some quality time with these (and your family) this week. The first is a return chart of the S&P 500 covering 15-year periods – thanks to Steve Blumenthal of CMG capital for highlighting this material from Advisor Perspectives in his weekly “On My Radar”. In our shop, we answer the question of Why Manage Risk? with this simple answer; Because Your Investing Life is Short. As a matter of fact, investing lives are historically about 16 years long. That means you are seriously saving and investing for about 16 years of your working life. Of course, it should be much longer but for as much as our industry encourages saving early, very few really do until they feel they have a lot of discretionary income to invest. And when does that happen? You guessed it, later in life, like around age 45, even 50 years old. I’m hopeful for the next-gen who seem to be actually saving early but we’ll see. Anyway, look at the return chart below and you’ll see that there is a definite pattern to the 15-year return stream coming from stocks. We’re about halfway through the range now, so there is real potential for higher prices in the years to come. But, looking at the big picture, you must know and understand that there are long periods of time when markets are just unproductive and risk management becomes critical to your welfare.

Last one

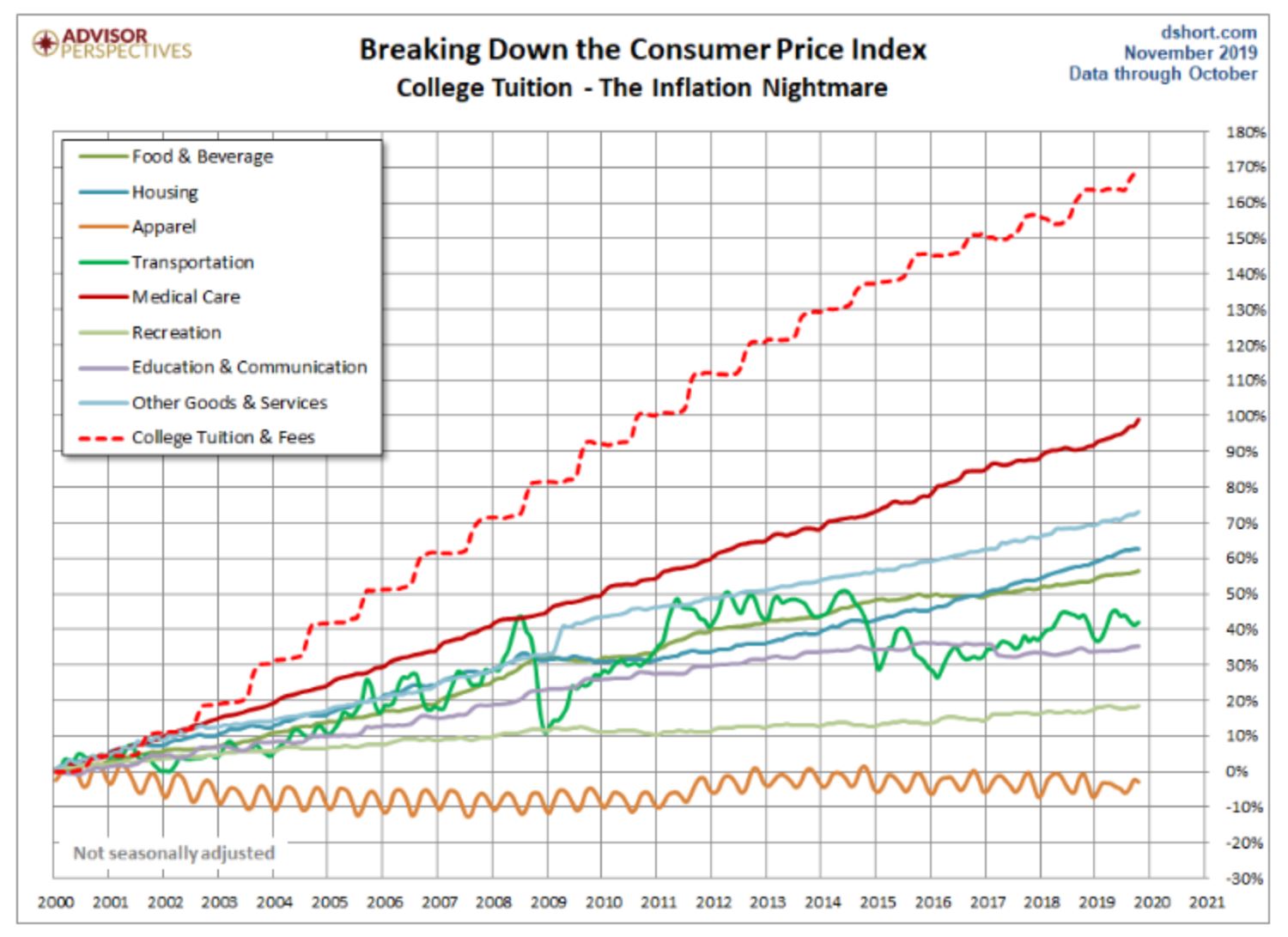

Inflation is real and really with us in many aspects of our lives. Not shown on this chart is the 1{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} consumer price index which is supposed to reflect all of these expenses. This is the biggest lie of our time – that inflation is non-existent. Total BS unless they are only measuring the real costs of apparel? I’m about to embark on my first round of college tuition for my 18-year-old son. Saving diligently for 18 years, investing aggressively in a solid stock market and I’m barely able to cover the cost of college which is growing at 8{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} annually. Healthcare costs, housing, food, you name it. Inflation is very real and very embedded in our daily spending habits. Real returns on investments over the long term and real inflation are the big levers in your life. Plan accordingly for these realities and you’ll be fine. Avoid or ignore them and you will find yourself living a life you didn’t expect.

That’s it for now. Avoid the rot and keep it real with respect to your market expectations and spending habits. I hope everyone has an incredible visit with friends and family this Thanksgiving. It’s everyone’s favorite for good reason. We all have a lot to be grateful for. Cheers.

Sam Jones