Wow, two updates in one week. I think that’s a record. I ran across this article from Ben Carlson who writes a blog, A Wealth of Common Sense. I have mentioned Ben before and think he offers a lot of good insight for your every day household trying to figure out personal finance. The article was titled, “The Market Won’t Provide High Returns Just Because You Need Them”. I’m teaching a Business and Finance class at our local high school and this will be part of their required reading next week. It should be for every investor. Here’s the link to the article followed by my own summary, input and observations.

https://awealthofcommonsense.com/2019/03/the-market-wont-provide-high-returns-just-because-you-need-them/

The title of the article is actually ripped from an older quote by the late Peter Berstein, so not an original Carlson. The point of the article was aimed at a recent decision made by the CALPERS board and finance committee to urgently add more private equity exposure in order to generate the returns necessary to pay current and future pensioners/ beneficiaries. CALPERS is the California Public Employees Retirement System – probably the largest public pension plan in the world. Here are the important takeaways from Ben’s article.

- When you feel the need to generate higher returns because of a perceived shortfall or any other reason, you really have three options to remedy the situation:

- Adjust your expectations, lifestyle or goals

- Increase your savings rate

- Take more risk

*1 and 2 are realistic, 3 is for the optimist (aka those who believe that risk = reward)

- CALPERS is adopting the 3rd option by adding more private equity.

- CALPERS is doing so because they are sounding quite desperate for higher returns.

- CALPERS does not understand the real relationship between risk and reward.

Risk = Potential Reward

This is the most important takeaway for all investors to understand. It is also a timely concept considering there is a renewed sense of desperation to reach for risk in order to potentially generate higher returns following the markets’ near vertical run in the last few months.

First, adding risk does not necessarily guarantee higher returns.Adding risk statistically just increases your range of possible outcomes. The optimist will look only at the larger positive outcomes but not acknowledge the potential for larger negative outcomes as well. Hope and optimism are not great planning tools. Adding risk has the high tendency to just add volatility to one’s portfolio with no assurance of a positive outcome over any time period.

Second, there is a time and place for everything. Adding risk might be prudent after significant price declines, bear markets and other unsavory events. We want to buy low and sell high remember. This is especially the case in the current environment which is late, late, late in the bullish cycle and very much on the edge of recession. CALPERS might choose to add more private equity to their portfolio now in order to boost their returns but the timing of that decision is just poor. Add

in the lack of liquidity with private equity and I just wouldn’t want to be a Public Employee in California in the next several decades.

Finally, as the title indicates, the accessibility to higher returns does not always match with your need for higher returns. CALPERS sounds desperate because they have retirees who are contractually receiving payments each month. Not making enough in the way of returns is like defaulting on your loan in the case of CALPERS. They absolutely NEED to make higher returns because they don’t want to increase savings (#2) or cut benefits (#1). Most investor households don’t really need returns like CALPERS, they just WANT them.We all want them. Sadly enough, the behavioral pattern for most drives them to want higher returns after returns have been made, like over the last 3 months. I’ve said it before, but the human brain is not really wired to be successful with investing.

Bringing It Home

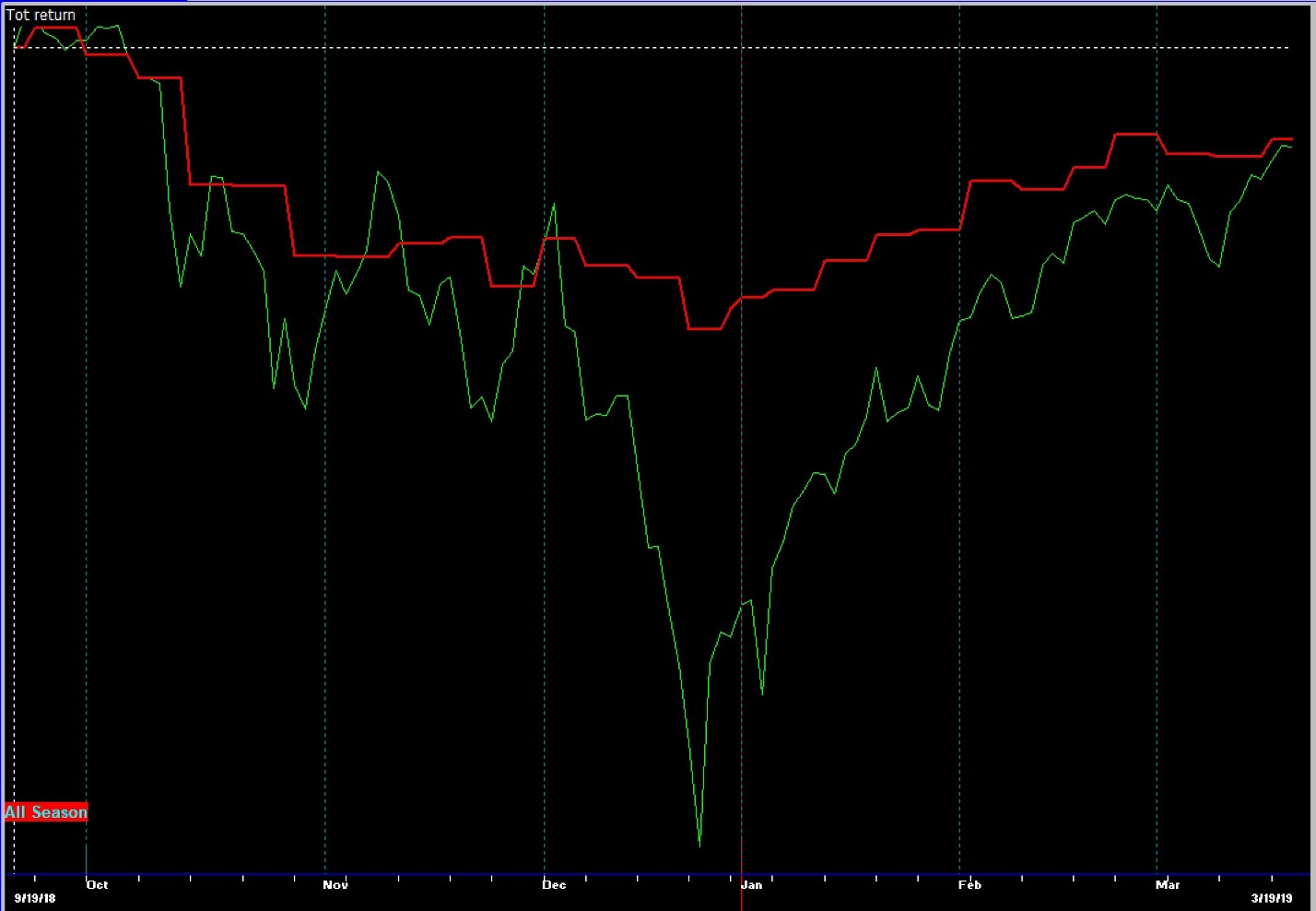

The end of every long bull market in stocks is always a frustrating time for us as risk managers, and probably a few of our investors.There is a perception that returns are accessible if only we would take on more risk. Of course, 90 days ago, the only feeling out there was oriented around eliminating all risk and panic to sell everything. Our strategies have been outperforming the broad market since last October, mostly by avoiding the massive losses in November and December. We’ve made some decent returns in 2019 but nothing like the S&P 500 which is up about 12{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} YTD. Still, by simply avoiding the deep part of the down cycle, we don’t have to make that much to stay ahead. Here’s a quick snap of our All Season Strategy (Red) net of all fees versus the mighty S&P 500 index (Green) over the last 6 months as every one of our clients has an account here.

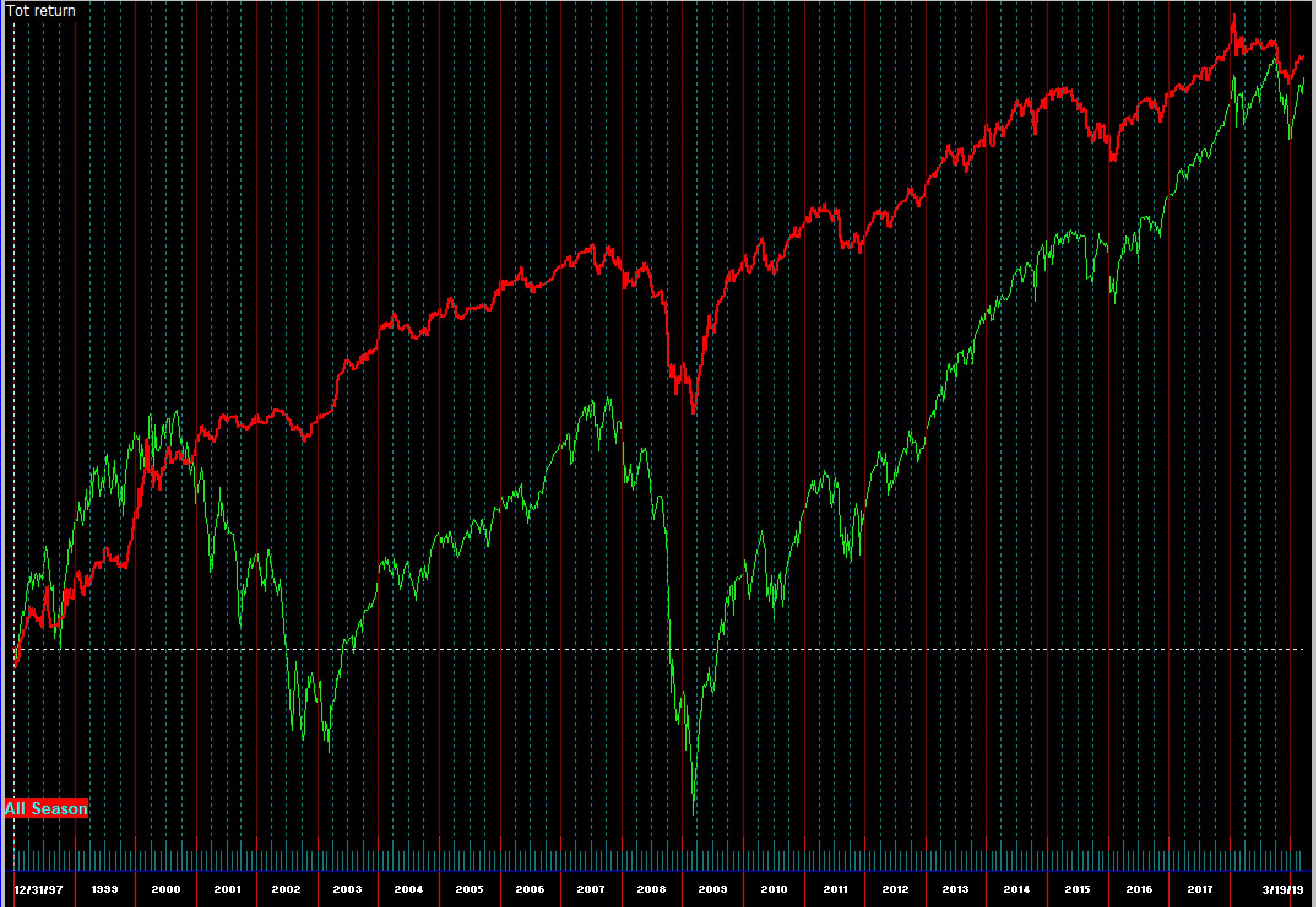

On a much larger scale, going back to the inception of our strategies in the late 90’s, you’ll see the same pattern emerge looking at years, not months.We don’t have to beat the market every year, because we don’t experience the big downside losses. We’re very much about dynamically adjusting risk according to market conditions and giving our clients a tolerable experience with positive, consistent returns over time. In the end, we tend to outperform with much smaller declines in the value of your accounts during tougher market cycles. Here’s the same All Season strategy and the same S&P 500 since inception.

Back on topic, when we WANT to add risk to our portfolio, like now, we are often doing it close to the very worst times to do so.Adding risk for you might look like buying an overblown tech stock or biting on the sales bait of a passive index portfolio somewhere. We might even NEED to make returns because we have shortfalls in our net worth or retirement goals. But there are good times and bad times to add risk to your portfolio. Our risk managed strategies are already in great shape to win this war, after having lost a few battles recently. For the next year or two, our very highest value to our clients is likely to be oriented toward income and very selective growth opportunities, but mostly preservation of wealth. When conditions are right for us to back up the truck and add risk, we’ll gladly do so. This is not one of those times. What can you do for the next two years? #2 – Save more and generate the highest income possible to accumulate investible cash.

Great article Ben – thanks for the reminder!

Cheers,

Sam Jones