The Magic of the Gain Keeper Strategy

Continuing with our strategy insights theme, this update will provide a look under the hood at the unique management strategy we have developed inside our one and only variable annuity. Results have followed the excellent design. Enjoy.

What is a Variable Annuity?

As I drove home yesterday, I listened to one of those Ken Fisher ads on XM radio suggesting that investors stay away from all annuities. He pegs them as evil, full of fees and false promises. Well, first I want to thank Ken Fisher for being such an excellent source of new business for our firm over the years. Investors love Fisher Investments when stocks are in a bull mode. But, there is always the aftermath of gains, the yang to the yin and the great drama that tends to follow. After investors lose 40,50, even 60{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of their portfolios, we tend to see a nice steady inflow of new clients upon realization that risk management is not part of their program. Second, Ken is wrong about “all” annuities. They come in many shapes and sizes. Granted, most are of the type that Ken brands as predatory. They are effectively high cost, broker-sold, commission heavy insurance products chock full of internal expenses that most don’t even know they are paying.

But, there are some good variable annuities.

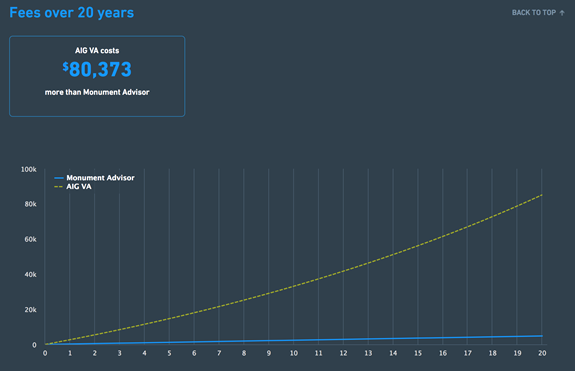

We work with Jefferson National, which has such a unique offering that Nationwide just bought them earlier this year. They describe the offering using the brand “Flat is Beautiful”. Flat describes their cost structure, which is simply $20/ month. That’s it. $20/ month for virtually unlimited tax deferral. NO surrender charges, No internal mortality expenses and No bloated mutual fund fees. Trading is free on their platform and they have a very healthy line up of mutual funds to choose from; many of which offer real alpha opportunities for active managers like us. Their site has quite a few neat tools to do your own calculations as well. Just for giggles, I used their variable annuity comparison tool to compare the differences in costs between the Jefferson National Variable Annuity and AIG’s Variable Annuity, which I owned once upon a time. I entered a few inputs like a base investment of $200,000, a return of 6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}, and my Federal and state tax rates. This was the output looking at cost savings over a 20-year period.

$80,373 in cost savings!

That is enormous considering the account balance was only $200k.

So Ken is right in the sense that most annuities are very costly but he probably hasn’t done his homework to find this diamond in the rough.

The Magic

One of the nice parts about the mutual fund options inside the Jefferson National Variable annuity is that they have a huge universe of leveraged sector, index and country funds offered by the Profunds and Rydex groups. Leverage means that we can own a fund that moves 1.25 to 2.0 times the daily movement of the corresponding index, country or sector. A few examples, which we own today, are:

Rydex 2x Dow Jones Index Fund

Rydex 2x Japan Fund

Profunds Biotech Ultra Fund

Profunds Oil and Gas Ultra Fund

These are fast movers and can certainly cut both ways in terms of adding and subtracting from returns. Our job is to own the leading sectors on a relative strength basis according to our well-defined Selection process. If we do our job well, we get a lot more bang for our buck, given the leverage inherent to these securities. Sounds risky, right? It is if it’s not done correctly. To help mitigate volatility, we limit our total exposure to these funds to 70{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of total available assets, while 30{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} is allocated to fixed income or corporate bonds (or cash). That way, we can manage our notional value (total amount factoring in leverage) of money exposed to stock and keep it under 100{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} while only using 70{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of available assets. The other 30{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} tends to make the ride a little smoother and adds a margin of return to the equation. We also apply the same Net Exposure criteria to the Gain Keeper strategy as we do to all of our strategies, guiding us to heavy cash positions during bear markets. Voila! Again, the success of this program really comes down to execution and timing of investments, like all investing right?

Performance

Please make sure to click through to our Composite Performance Disclosures and make note that past performance is no guarantee of future returns.

Feel free to visit our detailed strategy page on the website for lots and lots of data

http://monthly.allseason.liquidindexes.com/report/1501

A few Highlights

Since inception, the strategy has slightly outperformed our benchmark, the MSCI All Country World Index (ACWI) net of all fees.

Total returns net of fees since inception 3/28/2008- 10/31/2017:

Gain Keeper +71.35{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

ACWI +69.20{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

*Remember, that the benchmark is 100{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} invested in stock all the time and has all the gains and gore that comes along with it.

More importantly, given the downside risk controls, tactical use of leverage and incorporation of the income allocation, our Gain Keeper annuity has generated those returns with only a 45{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} correlation to the benchmark, and statistically clients experienced 45{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} less volatility than if they had invested directly in the benchmark, based on weekly standard deviation measures. This program offers greater downside controls, lower weekly volatility, and slightly better returns. That is a winning strategy that is now approaching its 10 year anniversary. YTD, the strategy is solidly in double digits again. Remember these gains are also tax-deferred, just like an IRA. For clients with larger taxable accounts, recent business liquidation, inheritance, or divorce proceeds, we find Gain Keeper to be an attractive option for sheltering taxable gains from tax, thus the name, “Gain Keeper”. Contributions are not limited like an IRA or Roth but are not tax deductible either. Most of the same rules regarding the timing of withdrawals, as you’d find in an IRA also apply to annuity contracts. When considering the variable annuity, we encourage clients to read through the annuity brochure and contract and let us help you understand all of the details.

So that’s all the magic I have for today.

Enjoy the last days of fall, 8’ of snow in the forecast for Steamboat.

Cheers,

Sam Jones