Is your portfolio prepared for a storm? What risk management triggers do you have in place? What variables are you monitoring to ensure your exposure is targeted and maintained properly? These are the types of questions we are looking to answer when stress testing a portfolio and tailoring strategies for success in the future.

Three things we can do to help:

- Stress-test your portfolio

- Optimize tax efficiency

- Minimize exposure when markets begin to sour

We understand that there are a lot of DIY investors out there, and that is exactly why we are launching this Lighthouse Project. We want to reach those who are genuinely interested in protecting gains from the second-longest bull market in history. (Eight and a half years without a 20{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} drop in the S&P!) We are not claiming to know when we will see The Bear, or The Top, just that there are ways to adjust exposure and allocation as markets age and change to provide for downside protection. We rarely but wisely use shorts, we rotate sectors, we focus on value and we manage tax consequences.

The Lighthouse Project is a call to our readers to introduce us to new readers online. I know that copying and pasting a link into your digital feed is sometimes nerve-wracking. We sincerely believe that you will be doing a favor to those who follow your lead by making the introduction.

Our technology and experience allow us to assist DIY investors in finding weaknesses, unbalanced allocations, tax inefficiencies and more. We want to offer this free consultation as the market continues to rise. It is in everyone’s best interest to be well informed and we feel we are qualified to be providing this valuable insight.

Please stay tuned to Lighthouse Project announcements, we will specifically design these for sharing online. We hope to introduce individual investors to our system of risk management, stress-tested portfolios, and native tax efficiency so as to provide robust protection before The Bear eats someone’s lunch.

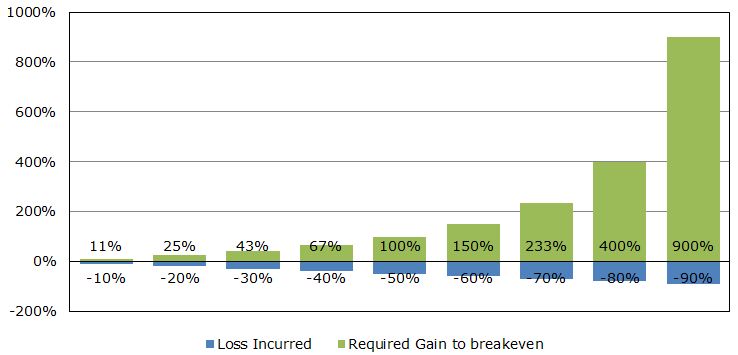

Let’s do our best to avoid situations that lie further to the right on the “breakeven post-loss” graph.

Thank you for being a Red Sky Report Subscriber and for sharing our insights.

Alex Osmond CFP®