As you may or may not know, All Season Financial Advisors is celebrating its 25th year in business.

Even after 25 years, the company continues to evolve. As Sam alluded to in his letter, the company continues to add staff, technology, and new tools to offer you a more well-rounded wealth management experience.

In that vein, I wanted to review one of our new tools today.

It is called Riskalyze (www.riskalyze.com).

This award-winning platform is designed to gather data to start assessing the risk tolerance of a certain individual. It accomplishes this feat through a series of questions surrounding gains and losses. We like their philosophy because it addresses the concept of potential losses (hard to envision in this market …). In other words, the questions don’t just focus on gains—i.e., how much do you want to make over the next 6 months—but, it also addresses how much would you be willing to lose.

The goal is to quantify your risk tolerance in a 0 – 100-point scoring framework (what you would be willing to risk for a certain amount of gain). Zero means a willingness to take no risk, while 100 means you are willing to take a lot of risk.

There is no “right” answer.

This is not a final exam either. Your answers could change because your circumstance might change (job change, retirement, inheritance, etc.).

It’s just a starting point.

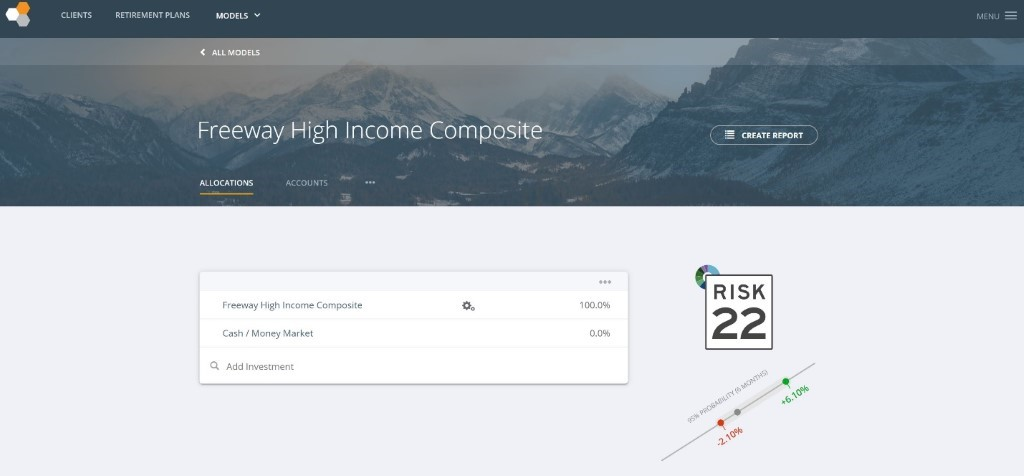

After getting your risk tolerance score (for example, my score was 55) we assess what All Season models we ought to use in your asset allocation. Each of our models has been scored according to the Riskalyze methodology which focuses on return, volatility, and drawdowns. Below is an example of how our Freeway High-Income model scores:

A score of 22 indicates a lower risk which is about right since this model focuses on bonds.

The goal is to combine lower risk models (Bonds) with higher risk strategies (Equity) to match your risk score. Our aim is to construct a more customized asset allocation for you that you can stick within good markets and bad.

In the past, we’ve allocated assets based on Client Profiles https://allseasonfunds.com/getting-started/how-to-start which were geared towards age and life circumstances. With this tool, we are trying to get more refined inputting your overall portfolio together. We will still review your cash flow, retirement goals, other financial goals, etc. in determining your investment mix, but the risk tolerance score from Riskalyze will be added to our analysis.

Over the next six months, we will be reaching out via email to have you fill out a Riskalyze questionnaire. It will arrive via email and take 5 minutes. We don’t expect a ton of changes in most cases, but we want to use this additional measurement to make sure we have you in a portfolio that will meet your financial goals and you can stick with.

Please reach out with any questions that you may have.

Thanks again for your confidence in us!