While most have been out enjoying time with their families in the meat of the vacation month, myself included, we have seen very little change in the character of the markets. Now pushing up to a full year, we see the same asset classes, sectors and countries leading and the same list of laggards. All things are still pointing toward recession in the months ahead.

Note from Blaine Rollins of 361 Capital

We have referenced commentary from Blaine many times in the past as he has a way of laying out current conditions well. I’ll do it again now and here’ the link to his full commentary as of yesterday.

Cracks Forming…

361 Capital Market Commentary | August 12th, 2019

The September 1st tariffs on the rest of China’s imports are looming large and causing the U.S. Economy to slow down further. The big move in the U.S. Treasury market is confirming this fact. If the tariffs are implemented, the ball will then fall into the Fed’s court to try to save the U.S. from entering a recession. Keep in mind that a new recession, and its accompanying stock market decline will factor into who will likely reside in the White House in 2020. So, will Fed Chair Powell and his board cut rates by 25 basis points or 50 in September? Somewhat ironic as to who might have the upper hand in Washington D.C. now.

To complicate the Fed’s decision, some new cracks have formed on the other side of the equator. The global financial center known as Hong Kong has widened into a full crisis with all business and transportation now being affected as the locals fight for their independence. The financial world needs a stable Hong Kong. And in Latin America, the free markets golden president of Argentina has just suffered a political defeat back toward socialism causing their asset values to collapse overnight and ripple through the rest of the continent. In the northern half of the globe, South Korea and Japan have restricted trading with each other and North Korea continues to light up its missile-of-the-week.

For equity investors, the markets have become very defensive with Utilities, REITs, Insurance companies and Defense contractors leading the market. The Gold commodity and its Mining stocks have even joined the leaders which are very reflective of how cautious stock buyers have become. While the valuations of the average stock have moved lower, so has its earnings growth outlook. This is not a time to be a hero unless you have an actual working crystal ball. Meanwhile, it is becoming much easier for investors to create lists of companies that are going to have a difficult time making it through this next downturn. Just dig for those companies with negative operating leverage, too much debt, and high valuations.

Now, we’ll add some additional color.

Investors have had three distinct windows of opportunity to get aligned with what are now very persistent trends. The first started at the stock market cycle peak way back in October of 2018. This was really the obvious kickoff to the new environment we’re in today. This was an opportunity to cut back on stock exposure (which we did) and add back to our Treasury bond positions (which we did). The second zone to make changes was in May of this year when gold and miners took over leadership for the first time in almost a decade. We bought gold, silver, and miners in May. The third event just occurred in August when stocks fell, bonds and gold exploded, following the Fed’s decision to cut rates and the Don’s latest round of market manipulation via Twitter. Oops did I say that out loud?

Obviously, when Trump sees enough weakness in stocks, he rolls out another Tweet suggesting that Tariffs are delayed or going away, like today. Earlier in August, with stocks trading at the top of the price range, he tweets that we’re moving forward with more tariffs. The stock market is his puppet and he can make it dance! How fun! Except he’s using our country’s financial engine as a bargaining chip and I wish he would stop.

Persistent Trends

If we look back to October 1st of 2018 through yesterday, we see some very persistent trends. Stocks are flat to down (S&P 500 down 1.41{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}). Leadership has moved to the recessionary sectors like healthcare, utilities, and consumer staples at the expense of technology, financials, energy, and most other cyclical groups. China is really falling apart and seems to be accelerating. Some might enjoy that fact politically, but I’ll tell you that if China goes down, we all go down. Be careful what you wish for. Europe, Japan and developing markets like Latin America are convulsing with changes in leadership, not a good way, but their markets are sort of hanging in there as they are still relatively attractive on a valuation basis.

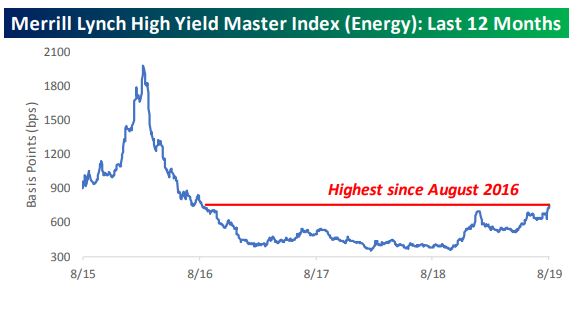

Bonds of all types are still ripping higher with almost no volatility. I find it amazing that money continues to flow out of Treasury bonds and into High Yield bonds. We have traded High Yield corporate bonds off and on, mostly off, for the last couple years with very low expectations. As of last week, our high yield signal went to a sell again. We used the proceeds to buy more Treasury bonds. Treasuries are now core holdings and we are simply moving between intermediate-term and short-term durations. One note of caution for any die-hard high yield investors out there. Spreads on High yield energy bonds just moved past their 2016 highs.

There is a lot of high yield debt wrapped up in energy companies that are in deep trouble. When “spreads” move higher like this, it indicates that these bonds are pricing in a higher default rate. That’s not good for High yield in general and not good for the credit markets. Outside of high yield bonds, the persistent uptrend in all things income-oriented is all good.

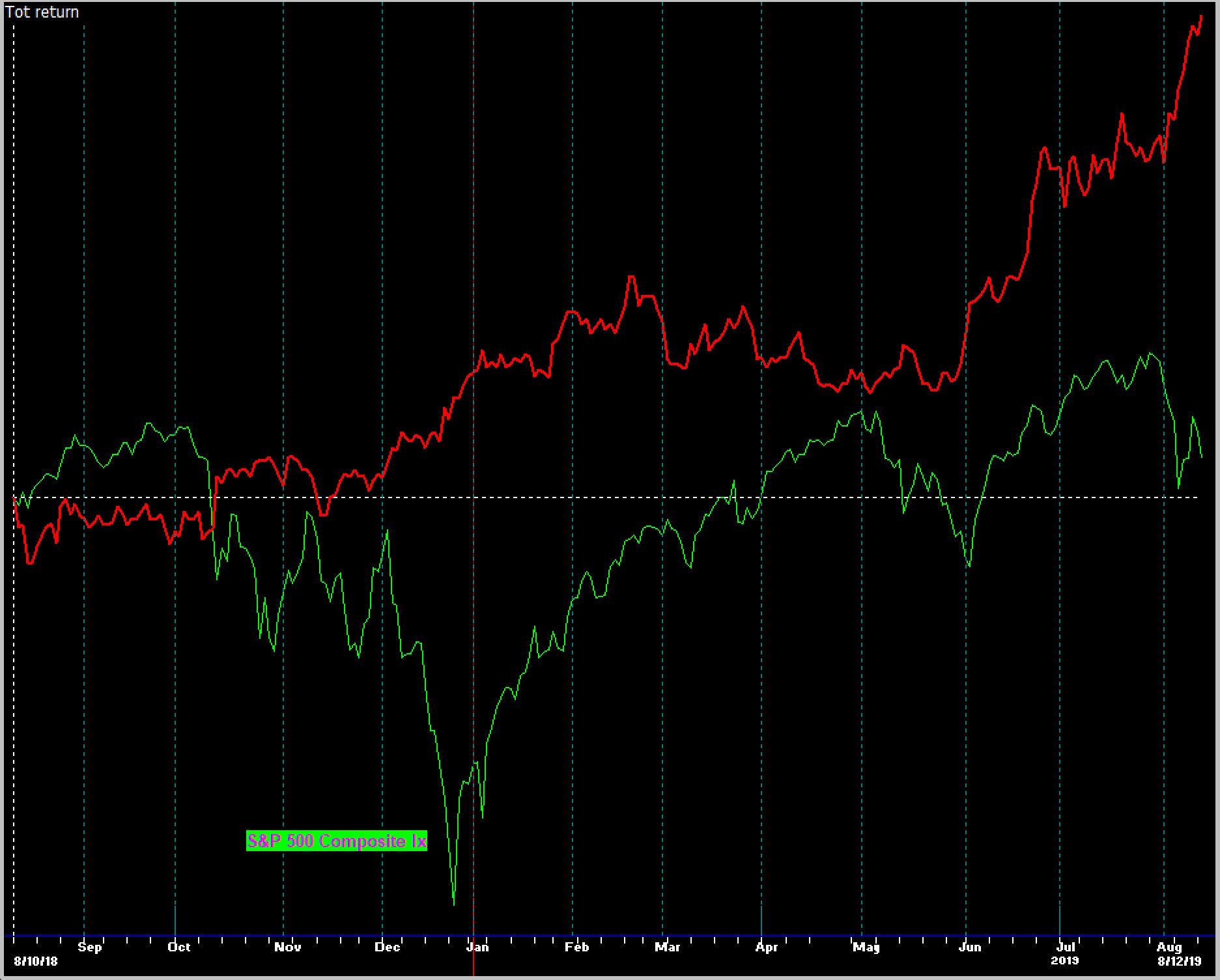

Gold, silver and the miners have also established new bull markets as of the last several weeks. Admittedly, precious metals are hard to own and generally have not been productive to anyone’s portfolio for many years. But when precious metals get going, they can defy gravity for a long long time. We have anchor positions in precious metals in Worldwide sectors as well as all Blended Asset strategies since May and have added to those initial positions consistently through the summer. We’ve got plenty of gold and silver now. Here’s a quick 12-month chart of Gold bullion in Red versus the S&P 500 in Green.

Precious metals are really a currency play banking on competitive currency devaluations. China devalued the Yuan last week. Thank you! The Euro is giving up ground as well. Unfortunately for Trump and the Fed, the US dollar is left hovering at an uncomfortably high level. We expect another long cycle of currency devaluations as countries work their magic to drive favorable trade. Who wins? No one except owners of precious metals. The trend in precious metals is persistently higher. I wish I could say the same for base metals like copper which tends to track the state of the US economy. Copper is trading at a two-year low and can’t seem to get a bid. What is copper telling us about the US Economy? Nothing that stocks and bonds aren’t also telling us right?

Heading Toward Recession

Nothing we see today tells us that we are on a different path than the one we have been on since last October. That path leads to recession. Until conditions change and the persistent trends of today change course, your portfolio should be aligned with a pending recession. We’d be happy to help evaluate your holdings anytime if you are not already a client of ASFA. We have an evaluation tool called Hidden Levers that will evaluate your current holding for exposure to all kinds of macro, micro and market risks complete with estimates of downside and upside potential.

If the markets are right and the US economy heads into recession, we should all consider our decisions today as it relates to personal finance. I’ll give you a few ideas.

- This is not a time to reach for that big expensive purchase that might threaten your monthly cashflow. Recessions proved a great opportunity to buy cheap stuff (later).

- Feel free to pay down any debt with an excess cash reserve. Debt rates on anything are higher than the return on stocks or cash. Bonds are still productive and generating healthy returns. Paying down debt with stock money might prove to be a great “investment”. I suggested as much in January of 2018 https://allseasonfunds.com/red-sky-report/melt-up-and-the-best-investment-for-2018

- Seek or stabilize current and future income streams. Job hopping now is ill-advised. The last one in is usually the first one out.

Stay tuned. There is a lot at stake in the next couple of months.

I hope everyone is enjoying the summer!

Cheers

Sam Jones