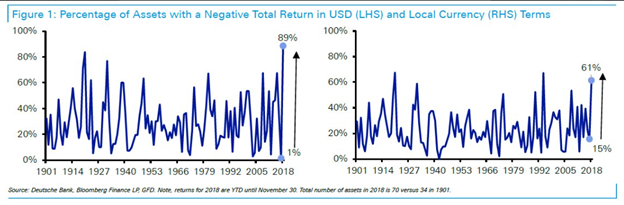

Experts say diversification is one of the only “free lunches” in the investment business. Well, October felt like we were back in the middle school lunch room dodging bullies trying to flip our tray! Practically every asset is down on the year– a short term disappointment, for sure, but not a reason to abandon our discipline of spreading risk around. Below is a graphic from Deutsche Bank showing the percentage of assets down on the year:

In US dollar terms 89{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of all assets are down on the year.

We are still in the middle of a complex stock market correction that began in October. Whether selling begets more selling is open for debate. Our exposure to stocks remains low until we see more evidence of a durable low.

Despite the volatility we are continually screening global markets for opportunity. This year notwithstanding, most times, there is a bull market somewhere. Even now, there are a few things in the bond market that are starting to meet some of our criteria (to buy and sell).

….. Select Bonds Look Attractive

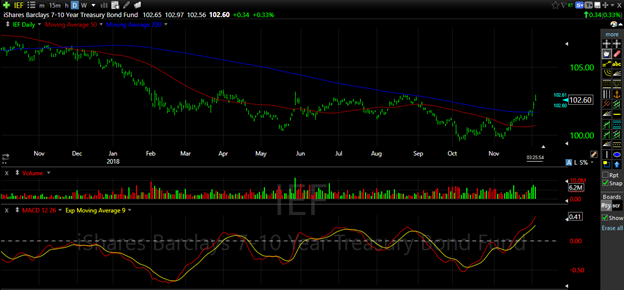

US Treasury, agency mortgages, and municipal bonds look like decent investments here. Rate hikes have the effect of slowing down the economy. The Fed historically has raised rates until something breaks. Last time it was housing, but most times it is the equity market. When that happens, there is a “flight to quality” into US Treasuries. We already own IEI (3-5 year Treasuries) and IEF (7-10 year Treasuries) and will look to add to those positions. Based on the chart below, prices are breaking above resistance on decent volume:

For taxable accounts high yield munis are looking reasonably attractive. We started a position in the Van Eck Vectors High Yield Muni ETF (symbol: HYD) and will likely build that over the next several quarters. We are also researching several other muni closed end funds that offer higher yields and a decent technical picture, including products from Nuveen, Blackrock, and Eaton Vance.

It is important to note when conditions have changed. Rate hikes look they will start to slow down the economy early next year. Global central banks will reduce the size of their balance sheets early next year for the first time since the global financial crisis. While certain pockets of value stocks may hold up better, it is likely that stock indexes will continue to experience more volatility.

Even with lower starting interest rates, quality bonds will start to play a more important part in portfolios as the global economy starts to slow down.

…… While Other Bonds Do Not

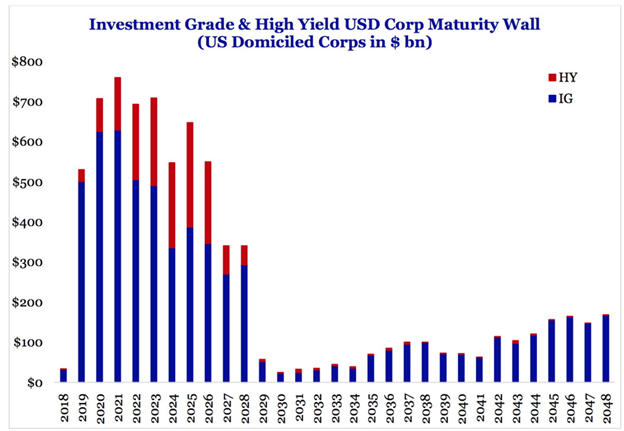

While Treasury and municipal bonds look decent, the corporate credit market looks the opposite. Low interest rates and a slew of corporate share buybacks resulted in large issuance of corporate debt (see chart below). With zero risk-free interest rates investors were more than happy to take grab more yield in corporate bonds.

The Securities Industry and Financial Markets Association (SIFMA) estimates that total corporate debt has grown to $9.1 trillion through the middle of 2018 from $4.9 trillion in 2007 (source: https://www.cnbc.com/2018/11/21/theres-a-9-trillion-corporate-debt-bomb-bubbling-in-the-us-economy.html).

Now, a bulk of that debt is coming due in the middle of peaking profit margins, slower economic growth, and higher interest rates. The economics for carrying that much debt are far more challenging. Our view is that the market has only just started to price these tougher conditions. In fact, the high yield bond ETF (symbol: HYG) has been weakening all year but has yet to become overly volatile (see chart below)

We are taking the other side of corporate credit using the Rydex Inverse High Yield (symbol: RYIHX) in our Blended Asset models. This position benefits from wider interest rate spreads when corporate bond prices fall, thus offering up some protection against our remaining stock positions. Corporate bond spreads and stocks tend to move in the opposite direction. If volatility continues in the stock market this position will benefit. I will be doing a more expansive piece on corporate credit next week.

A New Asset Class

We have seen a large shift in price action over the last quarter. Equities, commodities, and most bond markets all fell simultaneously. Nearly every asset is down on the year except US large cap indexes (and tech). We are late in this economic expansion which likely means cash and high-quality bonds start to play a more important role in asset allocation decisions. Cash is an asset class again– one that currently earns close to 2{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} risk free. We are on the lookout for some bargains, and the good news is we think we see a few on the horizon (emerging markets, software-as-a-service, some alternative energy, alternative technology).

Looking Forward

There is a distinct difference between managing volatility versus managing risk.

What do I mean by that? When stocks are trending higher, managing volatility means upgrading into the stronger sectors while avoiding the ones that aren’t working. When the economy and earnings are growing, there are a multitude of stocks and sectors to own. Price action tends to be more methodical, and drawdowns are manageable.

Managing risk comes into play when the market trend turns down. When that happens, our goal is to try and keep drawdowns manageable by raising cash. That way, we know we can earn them back rather quickly once conditions improve.

We are now patiently waiting for that setup and will communicate to you when we see clearer opportunities ahead.

Sincerely,

Sean Powers, Chief Investment Officer