Investor Frustrations (Including Ours)

These are the hardest types of markets for experienced investors. Count us in the camp of those who are maxing out on frustration. This update will serve as a confession of sorts without wanting to sound defensive about our decision-making and current orientation of our three investment categories. This is an important moment for all investors to stick to their knitting so feel free to lean on our discipline if you need some mental support.

Three HUGE Investment Opportunities – Not Working Yet

Wouldn’t it be great if you saw an obvious opportunity (or three), plunk down your hard earned cash and it just rewarded you right away? That happens occasionally but not often. Typically we recognize opportunity and then we wait and wait and wait for it to show up. We’re still in that waiting time now but getting closer to that great “I told you so period”. It’s going to be really hard for us to contain our smugness in the future concerning all of the stupidity we see today where the dumb money continues to pile on to yesterdays’ winners. We’ll try hard to be empathetic and compassionate but I’m not sure I’m going to be mature enough to wear those big boy pants.

Let’s review the three HUGE investment opportunities that we see looking out over the next 3-5 years.

- Emerging Markets will be one of the best performers.

- Market strength will shift from Growth to Value in a reversal of winners and losers

- Timely Risk Management by way of owning cash, commodities (maybe), bonds and other non-correlated asset classes will preserve your mental and physical capital giving the OPPORTUNITY to buy aggressively when others are selling in panic at much more attractive price levels.

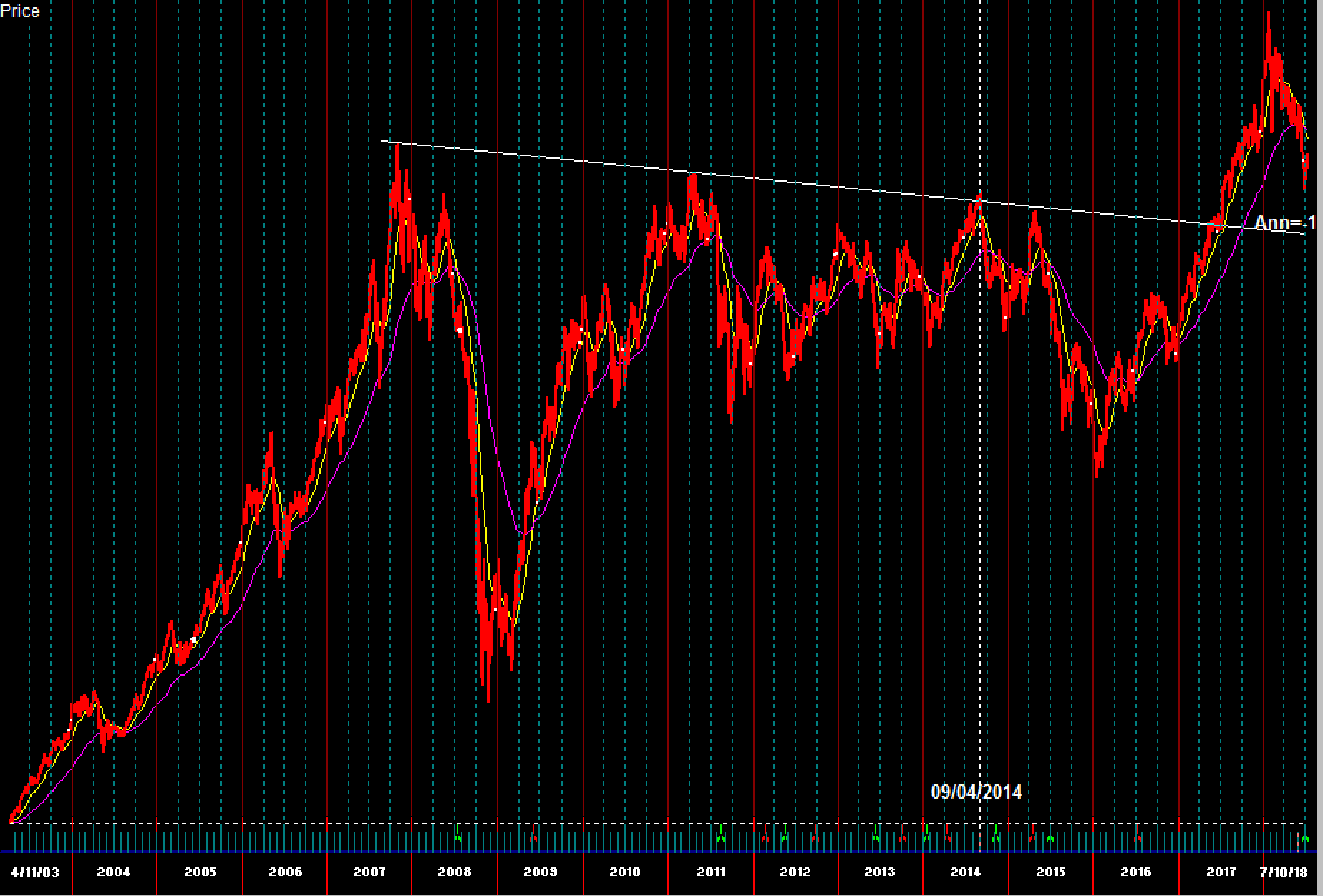

As I said, none of these opportunities are really working yet, or at least being recognized by the financial media yet. Emerging markets were leading the US domestic environment for much of 2017 but we were forced to close out those positions in May when our investments broke support and lost relative strength to the domestic stuff. We’ll be back for another round once Emerging market funds push a little lower (about 5.3{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} to be exact). Here’s a quick chart of the EEM exchange traded fund in red. We believe it will work it’s way back to the white line which is now showing strong support from 2017 and provide another nice entry point for some outsized returns into 2019.

The Growth to Value thing is also pending recognition but we believe it has started behind the scenes. I’ll give you an example by way of our High Dividend stock strategy, which now has a 25{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} commitment to “Deep Value” stocks. Since the beginning of June, 4 of the 5 stocks in this particular sleeve are up between 13-15{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} through yesterday. Meanwhile the mighty Nasdaq 100, the growth investor’s home base, is up a little over 4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} with much higher daily and weekly price volatility. Someone out there, besides us, is accumulating the value stocks and prices are quietly starting to surge ahead. However, if one were looking only at the aggregate indices, this subtle shift would be hard to see. Last week Sean Powers posted a chart of the relative strength between growth and value, which is clearly stretched as far as it was back at the top of the last dot.com bubble in 2000. Here it is again.

Is this time different? No it’s not. It’s never different, just subject to delays and patience.

What about the Risk Management Opportunity? That may still be in play but it’s been very frustrating. The mini-crash of January eliminated everyone’s gains for the year in about 13 minutes of time when the markets were actually open for trading. As we said in early January, before the crash, parabolics never end well and this one didn’t either. After a grinding few weeks in February and March, we finally saw a tradable low in early April from which we issued our first “Calling All Cars” for investors wishing to add new money. It was a good call then. Now, we’re up off of those lows but the condition of our net exposure model has been “leaking” lower as Sean puts it. Last week it slipped negative for the first time since April and is currently bouncing around the zero line, let’s call it dead neutral. With that guidance our risk management system isn’t providing us with enough evidence to stay fully invested. As I write, the S&P 500 is pushing out to new rally highs and seems headed for a retest of the January highs. Frustration! Fear of losing is giving way to fear of missing out even as our indicators are not yet confirming this most recent rally. Frustrating! What we find interesting is that the recession trades and defensive asset classes are now our leaders since the highs in June. What? There is no sign of recession and yet the new leadership is found in utilities, consumer staples, healthcare and bonds! What gives? Perhaps the rumors of no recession in sight are not that reliable? Somethin’ ain’t right sheriff. So the opportunity to preserve capital and follow a well-defined risk management system has not played out well – yet.

Our Orientation By Investment Category

As a reminder, we have three different investment categories with several representative strategies in each. Each category is designed to carry a torch in our client’s account portfolios. Here’s how we are positioned in each of the three categories.

Tactical Equity Strategies (Worldwide Sectors, High Dividend and New Power)

All three strategies are carrying about 14{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} cash with the remainder invested in individual stocks and select World Stock Indices, according to strategy discipline. Each of our client households has accounts in this category to various degrees so you should know that you have plenty of stock exposure by way of your Tactical Equity accounts. The torch carried here is to track the stock market and participate in upside gains when they are available. At the moment, selection is the name of the game with half of the market above the zero line and the other half below YTD. See last week’s Red Sky Report.

Blended Asset Strategies (All Season, Gain Keeper Annuity and Foundations)

These three strategies pursue a more dynamic asset allocation approach where we shift assets to asset classes that offer the best risk adjusted returns. That doesn’t mean the BEST or STRONGEST returns on a daily basis but rather the best returns for a given amount of daily volatility and price risk. Our system here is leading us lightly toward defensive domestics stock funds but heavier now into commodities, the US dollar, real estate and bonds. That’s right, the selection screens are moving us out of high beta stock funds and into non-correlated asset classes even as the stock market seems to be the best place for your money. Risk adjusted relative strength is telling us a different story! The torch carried by our Blended Asset strategies is now one of diversification against our Tactical Equity (stock only) strategies and a heavy stock market that is moving further and further out on the risk limb.

Income Strategies (Retirement Income and Freeway High Income)

The income strategies are finally becoming more productive and now fully invested in a variety of diversified bond funds. These include high yield municipal bonds, floating rate funds, investment grade corporates, emerging market debt and very short term treasury bonds and treasury bills. This is not the set up for big gains in this strategy yet and won’t be until the High yield corporate bond market becomes more attractive, but we’re pleased to see all time new highs in these strategies in the last week with virtually zero stock market, inflation or interest rate risk exposure. Again, all of our households should have exposure to our income strategies as part of their overall portfolios to varying degrees. The torch carried here is about safety, security, income, mild growth, peace of mind and pure ballast against a nasty cycle in the world stock markets.

It Hurts to be Unconventional

As I said, the hardest times for experienced investors are times like these. We see the risk in overblown growth stocks, we can taste it and smell it, but we feel our clients’ want and need for positive returns always. Like many, we feel compelled to reach for gains and chase the market higher for fear that our clients will not like us sitting in things other than stocks like Facebook, Amazon, Netflix, etc. Well, we’ve just been at this for too long, I suppose. Having closed out those types of trades in late 2017 (sold Facebook, Amazon, Microsoft, Alibaba and many others), we’re going to stick to our knitting of following our system and patiently waiting for real value and opportunity. That’s going to be a bit painful if the US stock market continues to blast higher because there isn’t much value or opportunity there anymore. This message is therefore really about patience and understanding. When markets are in transition, shifting from a healthy productive environment like 2017, to one that is more prone to losses and much higher volatility like 2018, we have to emotionally tell ourselves to stop reaching and wanting what is not readily available. It’s hard and we feel that stress as much as anyone.

There are opportunities but not where the armchair investor is looking and maybe not now. The opportunities are in names you’ve never heard of, in sectors that you’ve never invested in, in asset classes that you don’t understand. Honestly, if the guy on the street would do a little homework, they might see it too but most don’t seem interested in actually learning or researching as much as just doing what seems obvious (always the wrong choice with investing in anything actually). Indeed, we feel fairly confident that we are approaching another one of those textbook behavioral econ moments when the mass of investors are just blindly running with the herd not really aware of their exposure or what lies ahead.

I’ll finish by reiterating the lead sentence of our Explicit Investing Creed as it seems like a good time to do so.

We are seeking “Success” over a reasonable “Judgment Period” by knowing when to embrace and reject conventional wisdom regarding perceived market trends, “Risk” and opportunities. Superior, above average, results over time are only achievable through unconventional decision-making, experience, and discipline.

I hope everyone is enjoying these hot days with a nice balance of work, fun, family and cold drinks.

Cheers

Sam Jones