I get the appeal of owning shares of a specific company. Some part of our ego gets a little endorphin shot when we say, “I own that company”. However, in all but a few cases, given the rise of highly focused, sector-oriented exchange-traded funds, there is really very little reason to own individual names anymore. I’ll package this discussion inside the context of our New Power ESG strategy for our client’s benefit as well as any interested parties.

New Power ESG

ESG? What’s with the new acronym? Our New Power investment strategy has been anchored in socially responsible investing themes and standards since inception in 2003. On our site, we describe the strategy as a “Bright Green choice for discriminating investors”. ESG stands for Environmental, Social, and Governance, which is exactly no different than any of the original socially responsible standards of investing. This standard mandates investment only in progressive companies that do good things for the planet, employees, or have strong governance practices. The principle is that companies who choose to promote unhealthy products like JUUL (vaping) or hurt the environment, like any in the fossil fuel industry, will ultimately face economic hardship as society punishes bad actors over time. Thankfully, we’re seeing a lot of that happen now. Steering clear of bad guys is generally just a good idea, right? Not a lot of mystery here. But today, ESG is becoming a moniker of goodness so we’ve simply chosen to brand New Power with the label for easy identification. Nothing to see here, it’s the same investment strategy we’ve run for 16 years. In fact, we go further to suggest that New Power is an Impact investment as we help investors drive their capital toward companies that are challenging incumbents for the better and driving positive change. Even more, every year, we donate up to 10{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of net income derived from the New Power strategy to non-profits that support climate action and environmental education. It’s all that!

For those in the know, New Power ESG has three concentrations for investment:

- Advanced Energy/Natural Resource Efficiency

- Sector Innovators/Game Changers

- ESG Core ETFs – stock and bond ETFs that have passed the ESG screens

Let’s circle back to the topic of why we don’t need to own individual company shares given the nature of the new breed of exchange-traded funds.

Sectors are made of stocks

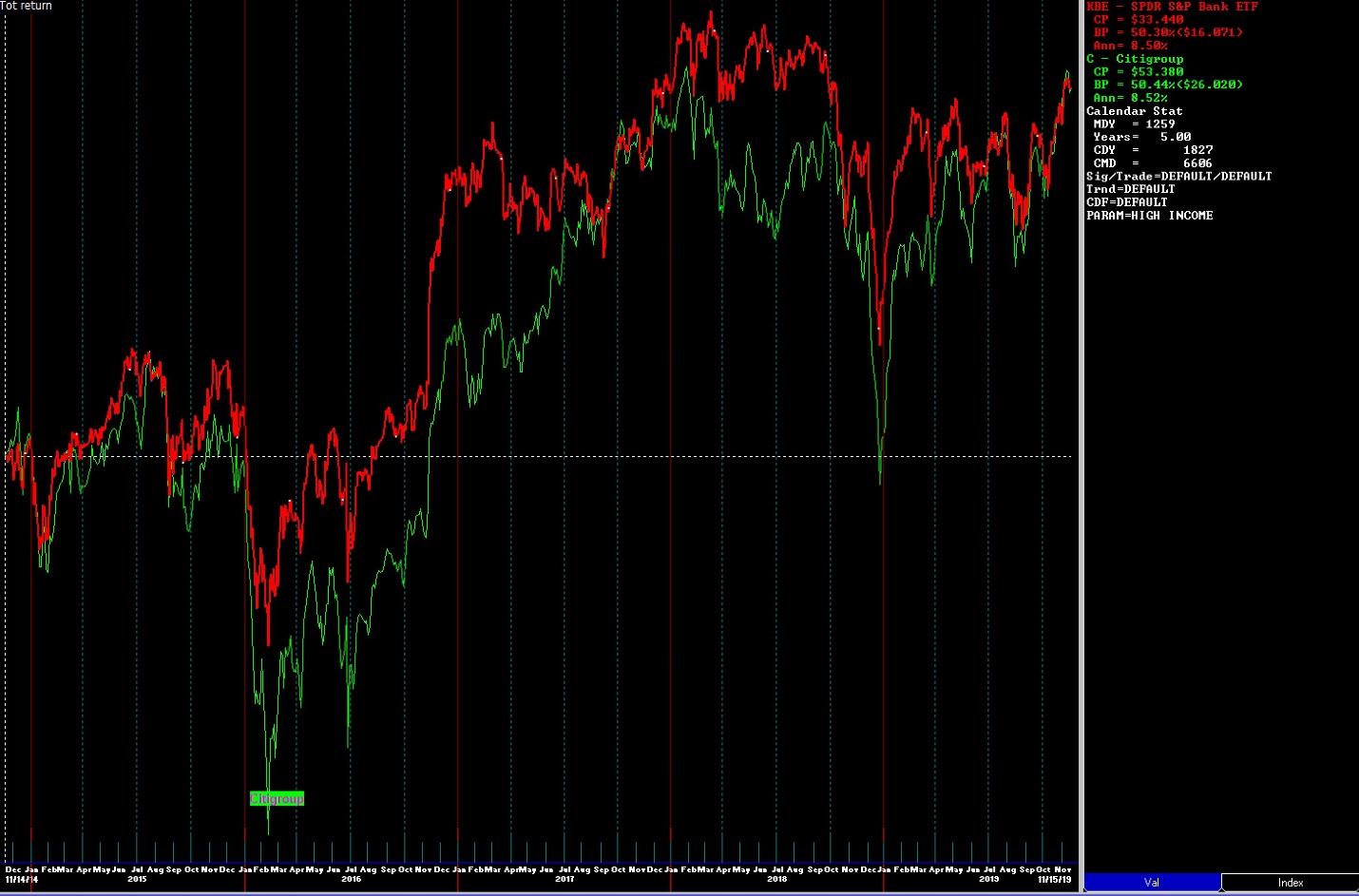

You can do the fundamental work to try to find that stock that will make big returns. Sometimes fundamental knowledge of a company actually yields positive benefits as Jim Cramer on CNBC likes to say. “Do your homework” (and you will get rich!). Or, as many seasoned investors know too well, you might do the good homework, decide that a company is doing great things for shareholders, only to watch the stock price fall spectacularly for years on end. These are called value traps and they are everywhere. I have found fundamental stock research to be a good tool for context and comparisons but a terrible tool for timing individual trades unless you have the patience to wait maybe 5-10 years for the stock price action to finally validate the fundamental data. What we do know, with hard factual data, is that individual stocks track their home sector very closely, especially when it comes to large-cap names that tend to dominate the make up of the home sector. I’ll give you an example in the Banking Sector. Take a look at this chart of KBE (S&P SPDR Bank ETF) in Red next to C (Citigroup) in green. Citigroup is one of the largest holdings inside the Banking Sector ETF so of course, the two securities track very closely.

But you’ll also find that individual names can add a ton of volatility to your portfolio especially when the markets are in trouble. Here’s the same comparison looking back to the financial crisis of 2008/2009. Citigroup was smashed, losing 97{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} and will not recover to new highs for probably another decade, or two. KBE on the other hand, finally recovered in 2017 is trading out to new highs because it owns a lot of other banks outside of Citigroup that didn’t get hammered as badly in the downturn. Why not just own the Banking ETF and avoid single stock risk?

Inside the New Power ESG strategy, we largely own ETFs now. There are so many wonderfully focused ETFs that we can really accomplish our goals without playing the individual stock game for a majority of our invested capital. For instance, in our Sector Innovators concentration, we own the following ETFs;

LIT – Global Lithium and Battery Technology ETF

*the second-largest holding inside LIT is Tesla (TSLA). Why assume all the drama and risk associated with Tesla the company when you can own the whole battery, lithium sector in a more diversified way. Tesla will not rise without LIT because LIT owns a lot of Tesla (among other things). Sectors are made of stocks!

FIVG – Defiance Next Gen Connectivity ETF

-Do you think 5G is big and happening right now? We do. We want to own the whole sector, avoid picking the wrong stock, and potentially missing this generational adoption of new connectivity standards.

IPAY – ETFMG Prime Mobile Payment Systems ETF

-Did you notice that cash registers are gone? We all use square, Paypal, Venmo in our daily lives now. But IPAY also adds the stability of owning Visa and MasterCard which are probably the greatest investment return generators of all time.

HACK – ETFMG Cyber Security

-This landscape is full of individual stock land mines as we’re really talking about technology and software. Some are making it, others are not. But HACK owns the whole cybersecurity sector which is growing steadily and consistently as we all need to spend money creating walls against cyber bad guys.

ROBO – Global Robotics and Automation ETF

-Sadly, for American labor, the robots are indeed taking over any job that is routine and repeatable. Political ranting will not change this macro trend even slightly as the long-term costs of automation are far less than maintaining employees. ROBO owns all the primary players in this space and allows us the opportunity to play another important macro trend without stock picking.

BLOK – Amplify Transformation Data Sharing ETF

-You know we like blockchain as a technology. Adoption is happening all across the globe but there are very few players in this space in the individual stock world. Here, the ETF sector fund gives us a chance at basic exposure in a relatively thin new sector.

We have several other sector fund ETFs in the New Power ESG strategy, but I’ll leave it there for now.

New Power ESG is now a Blended Asset Strategy!

The BIG, BIG news about New Power ESG is that the strategy is now formally a Blended Asset strategy. In recent months, several new Green bond ETFs have surfaced, giving investors an opportunity to diversify their ESG portfolio into bonds that represent clean energy projects and other green income opportunities. The amount of money flowing into these green bonds is astounding and we feel confident moving into this space for a portion of the New Power strategy. In the end, owning bonds in this strategy should smooth the return stream a bit making it more tolerable for our clients as a more consistent return generator. We will be re-categorizing New Power ESG as a Blended Asset strategy in all digital material over the remainder of 2019 so please look for that change.

That’s it for now

Sam Jones