Since mid-April, we have been talking at length about the sharp rise in market risk from a technical perspective. May has proved why it is important to have strategies that manage market risk. The technical damage has been severe enough to turn most intermediate term indicators down for the first time since last November. In the short term, there is an above average chance that this level will market a Good Buy. But there is certainly growing evidence that we’re saying Goodbye to the bull market of the last 10 years. Our clients should not be concerned. We have been moving aggressively out of stocks since April for our Tactical Equity models while our Blended Asset and Income models have been almost entirely in bonds. Household portfolios in aggregate are in heavy capital preservation mode as they should be considering the bear tracks all around us.

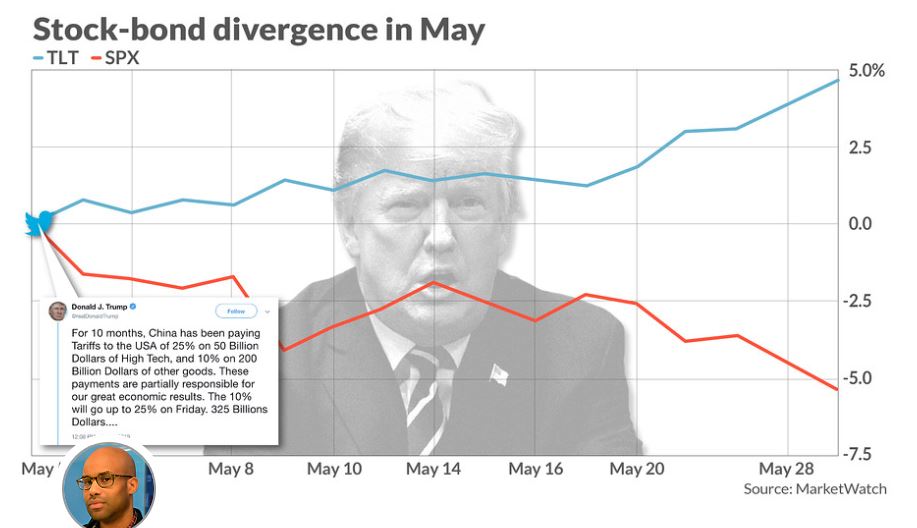

I took this picture of my porch yesterday. Yes, these are bear tracks as we live with several bears in our neck of the woods here in Steamboat Springs. Did the bears just arrive? Nope, they have been all around our property for months. But it took an overnight spring snowstorm to prove that they have been up close and present all along. Similarly, we are of the belief that global stock markets have been in the presence of bear market status to various degrees since last fall. The spring snow that revealed its true nature was our president who is ramping up trade wars with the rest of the world. This is Trump’s bear; make no mistake and he’ll get all the credit. Since his unbridled tweeting on May 1st, bonds have gone vertical, stocks have gone straight down. This does not include the extra 1.5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} losses in stocks today derived from our brand-new trade war with Mexico.

But bear markets do not just materialize without warning. Economic conditions that precede bear markets and recessions take years to accumulate, probably before Trump ever came on the scene. We have been tracking the bear for a long time. These are just the big topics and events we have covered since January of 2018.

- Inverting of the Treasury bond yield curve – yes it matters. It always matters!

- Triple top in the stock market extending beyond a year – check

- A peak in the growth of corporate earnings – check

- All the benefits of the corporate tax cut are priced in – check

- The bond market continues to make a new high every week – check

- Commodities are in a death spiral – check

- Margin debt has peaked – check

- Investor Sentiment hit another extreme high (bullish) in mid-April – check

- Leadership from FANG stocks is gone – check

- Canaries for stock market trouble (small caps, oil, high yield bonds) are dead – check

I have more, but I’ll stop there

When I hear comments in the media like “There are no signs of recession” or “The risk of a bear market is low”, I am just incredulous. Next, they will say, no one saw this coming. Laughable.

To be clear, we are not in a bear market yet (-20{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} or more), but the signs and the evidence that we’re headed that way quickly is overwhelming.

Following our discipline, we have been moving out of stocks for our clients since the end of April. Categorically, this is our current asset allocation breakdown.

Tactical Equity (all stock investment strategies)

45{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} stock ETFs still showing favorable relative strength to the market

55{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} cash

Blended Asset (strategies that dynamically shift between stocks, bonds, commodities, and alternatives)

14{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} stock funds

15{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} Alternatives

50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} bonds

21{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} cash

Income Strategies (Bond and income bearing investment strategies)

95{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} bonds

5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} cash

It’s obvious that we’re in capital preservation mode. This is what your portfolio will look like if you are engaged with strategies that manage market risk.

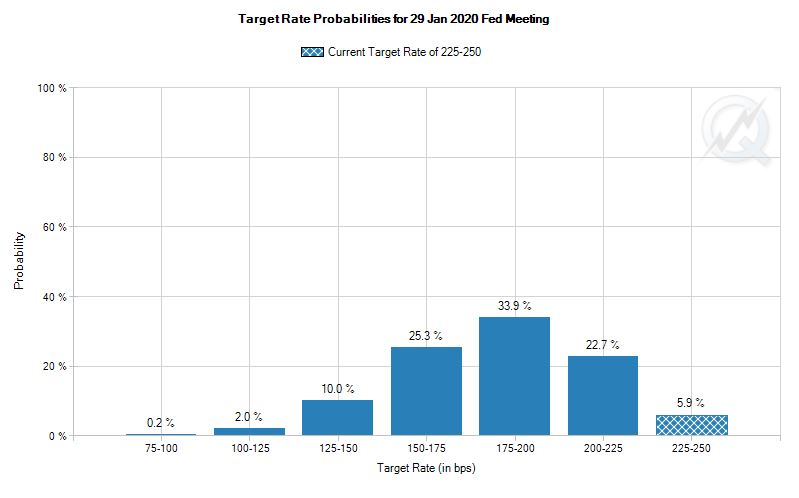

Treasury bonds are currently overbought as they have been appreciating dramatically since March. We are probably looking to take some profits here. However, given that we are now closer than ever to an economic recession, bonds should continue to outperform most asset classes, so we’ll remain anchored here until stocks put in a meaningful bottom. In fact, the market is now pricing in a 37{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} chance that the Fed lowers interest rates by 75-100 basis points (100 basis points is 1{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}) by the end of the year. We said the Fed’s next move will be to lower rates but that is probably too much in our opinion.

Expecting an Oversold Bounce from Here

As always, the markets never move in one direction in a linear fashion. Today, stock market conditions are oversold, and bond market conditions are overbought to the extreme. This is probably not a time to sell stocks, nor is it a time to buy bonds. Those days were 6 weeks ago.

After today and depending on the close, there is a high probability that stocks will rebound.

Younger investors with long time horizons, solid incomes and a long-range view could consider adding back some stock exposure here or even adding some sideline cash to current investments. This opportunity is fragile, however, as bear market risk is significant and prices may go significantly lower before this is all over. If prices hold at the current level, right at the 200-day moving average, this could be a Good Buy. If not, the next stop is the December lows (-16{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}). Good buy or Goodbye? We’ll know soon enough.

For those who are in the distribution phase of there lives, specifically anyone who is not working, retired, or living from their investment accounts for any reason, you don’t have much choice here but to stick with capital preservation. There is just no significant edge here, certainly not enough for you to consider buying stock aggressively.

Decisions you might consider today are therefore highly dependent on where you are financially and your stage of life. I guess I could say that any given day, right?

That’s it for now, stay tuned.

Sam Jones