Ben Carlson of A Wealth of Common Sense posted another gem this morning. He hit my radar on the topic of “Overlooked Investment Decisions” which is something I’ve been covering in client meetings quite a bit. Good stuff for all to remember. Making money net, net, net, net with your investment dollars isn’t often about buying that special stock or fund.

What do Affluent Investors Care About?

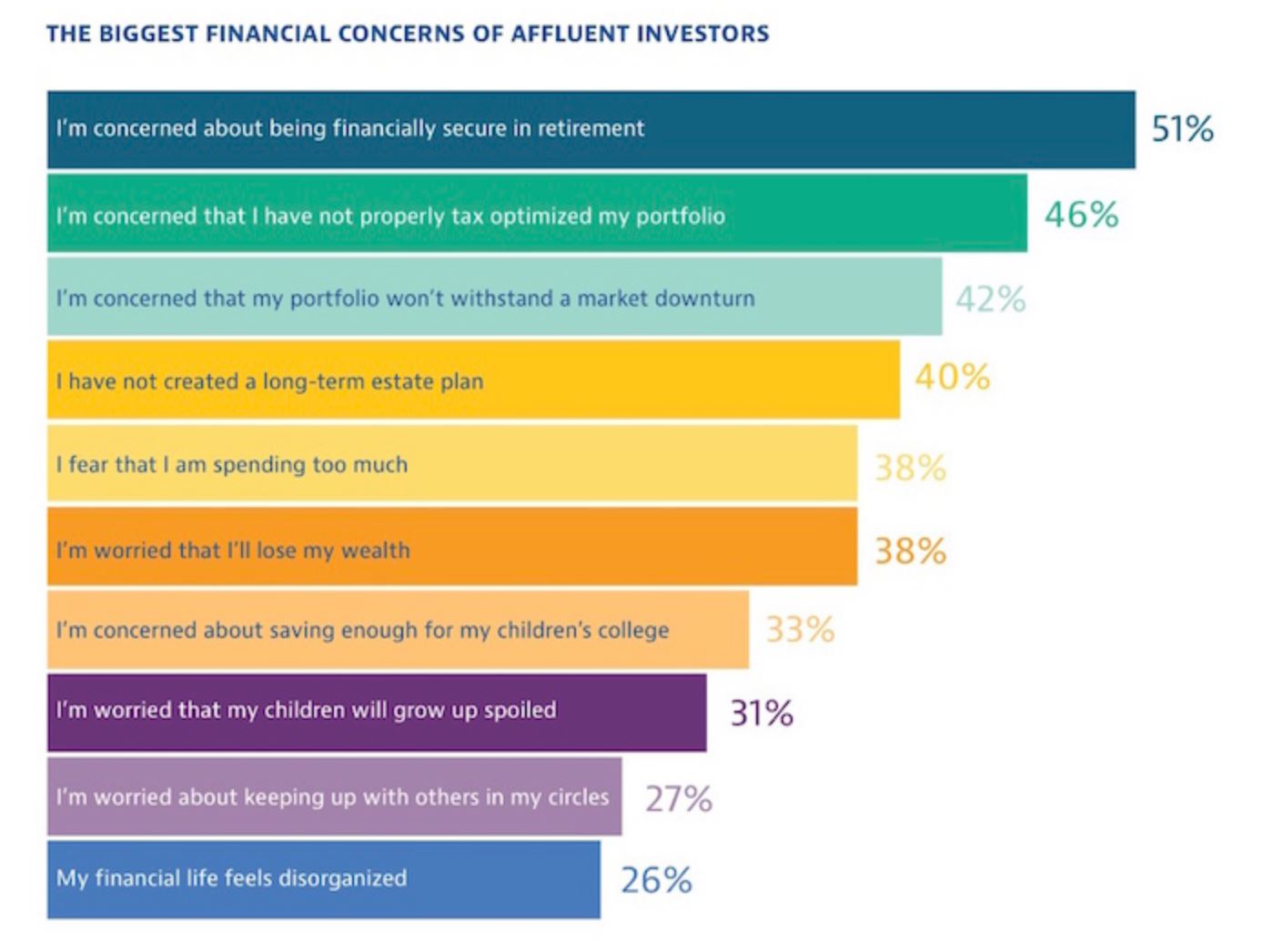

First, let me take a quick tangent into this space. Affluent investors didn’t become affluent by chance (usually). They tend to be well educated, thoughtful folks who really understand how to make money and invest it wisely over time. They are never in a hurry to make a quick buck. They rarely, if ever, reach for that home run investment thing. Nor do they obsess about what happened to the markets this week, this month or even this year. They do care a lot about making a reasonable return and avoiding losing what they have worked hard to accumulate, which is why we know this personality so well. They also pay attention to taxes and plan for long range issues like their own retirement and college funding. Here’s a quick list offered from Financial Samurai that I find to be true to reality in working with affluent investors for over 25 years.

What you see in this list is some obvious preferences mentioned above. First, we see that they don’t want to eat cat food in retirement. Got it. Second, they want to make money but not give so much to the IRS. There is a reason why our firm is moving strong toward Tax Efficient Investment Strategies. For those attending our next Solution Series on the 15th in the Denver Office, you hear about two new strategies that are specifically designed to produce outstanding results for taxable accounts on an after-tax basis without compromising downside risk controls. We have two other long-term investment strategies that are also highly tax efficient with long proven track records of performance. This is what we do. From the list above, we also see that affluent investors care about planning for college costs, spending habits, family issues, making sure their estate is set up correctly and staying organized with everything. What you don’t see on the list is a statement like-

“I’m worried about outperforming the S&P 500 “

They know better, which again, is why they are affluent.

Ok back to the script…

Overlooked Investment Decisions – Comments on Ben Carlson’s article

https://awealthofcommonsense.com/2019/05/4-overlooked-investment-decisions/

I’ll keep this brief and high level because Ben’s article really tells the story. Ben hits on some important points and frankly, I’m pleased to see him come toward the dark side of endorsing and supporting thoughtful and more dynamic investment solutions outside of buying and holding a fixed set of securities.

Rebalancing should not be a mindless effort corresponding some random date on the calendar. Ben suggests that if we are using “rebalancing” as a money management process, we should work to do it in an “informed” way by shifting money from things that are overvalued to things that are undervalued when opportunity presents itself! Sounds obvious but the traditional rebalancing approach adopted by all robo advisors and folks who don’t think, calls for putting money into an asset that is underweight in the portfolio according to some formula for proper weightings on some calendar interval. The weakness here is that you might find yourself buying into an asset class that is underperforming in the past without regard for the fact that this same asset class might still be expensive relative to others. In these cases, you would buy more of something that has higher risk and further to fall over time. Let’s try to buy more of stuff that is actually a good value and sell more of the things that are bad values, eh?

Ben also talks about the importance of focusing on asset allocation itself rather than being a hero stock or fund picker. Asset allocation decisions are about how much you have in the sleeves of stocks, bonds, cash, real estate, commodities and so forth. And asset allocation decisions account for 80-90{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of every investors’ success in both making money and avoiding losses. Just keep it simple and buy free to own indices within each sleeve. The art comes in the form of knowing how much to put into each sleeve and the timing of any changes. This is what we do for our clients.

Investment filtering should be a practice that every investor understands. A filter is a list of investment options within our own unique process of investing. We want to know what we CAN own and what we CANNOT own limiting our choices to a manageable list at all time. We do like shiny objects as simple creatures and there are a lot of distractions out there.

Finally, we want to make sure that our portfolios are positioned properly in terms of their registrations. Taxable accounts should be in more tax efficient structures like a variable annuity or chasing long term cap gains or buying muni bonds. Tax deferred accounts can afford some higher trading frequency and can reach for growth or income; it doesn’t really matter. Risk managed programs tend to trade more than others, so they are better for tax deferred accounts like IRAs. Make sure that your asset “location” is appropriate to avoid giving the IRS or your custodian (trading costs) more money. Again, when a new client comes on board with us, the first thing we do is reorganize their money to be more cost effective and tax efficient. Then we start talking about how we are going to make money in the markets.

That’s it for this week, just a couple good tips and reminders of what every investor should really focus on to build wealth.

Cheers

Sam Jones