Finding Value

I’ve been thinking a lot about this topic. We’ve moved forward in this economic phase to a place where value is being ignored and forgotten. In my years of experience, forgetting to focus our purchasing behavior on what is “valuable” is truly a mistake and one that can be devastating to your financial well being.

What is Value?

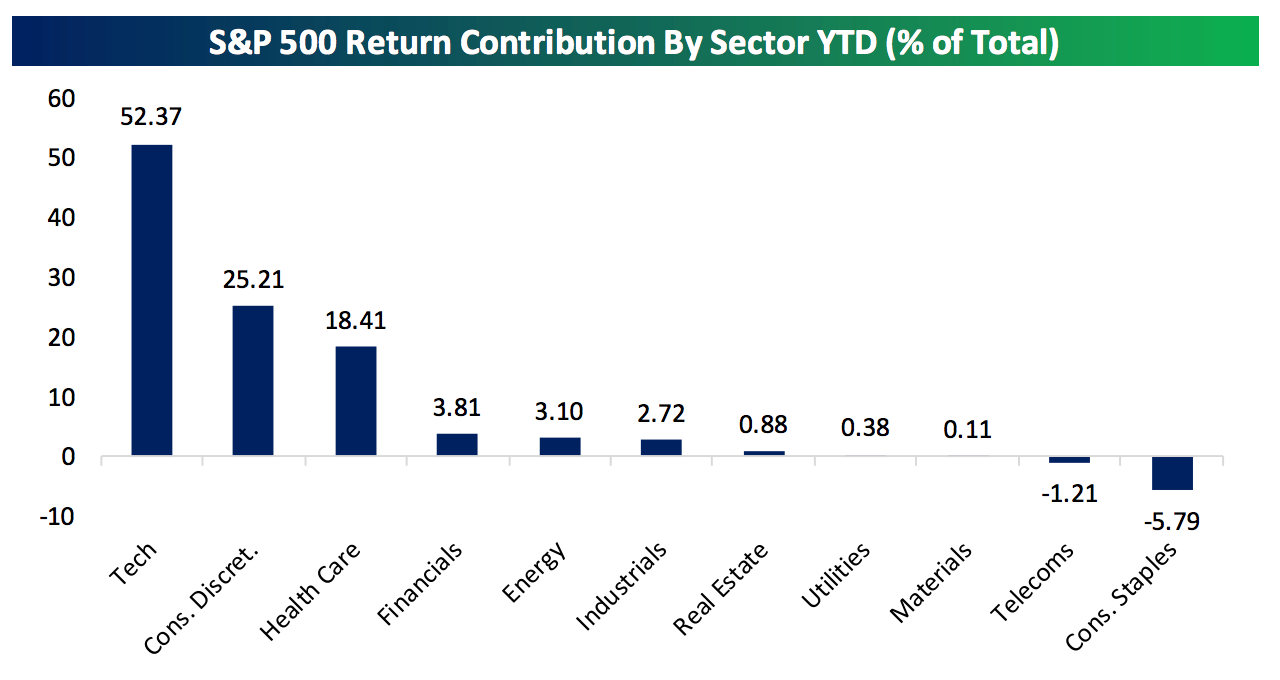

Value doesn’t have to mean a value stock like a traditional utility or consumer staple company. We are simply looking to buy things (stocks, stuff for our homes, food, cars, healthcare, etc) that are presented to us as “Valuable” offerings. These are opportunities to pay less for something that provides real benefit to us, so why wouldn’t we always and forever remain focused on value? Well the answer is that we tend to lose our minds, especially when it comes to investing and trend following. Today, everyone knows that the only place to make money in the financial markets is to load up on Facebook, Apple, Amazon, Netflix and Google (FAANG) right? No doubt, these are great companies but they are currently priced/share as if they are going to be the greatest of all companies for the next two decades. I don’t see value in today’s prices in these names. They can go higher but they won’t become any more valuable to us in the process. As a matter of fact, we think most of the FAANG trade is done at this point and downside loss potential is considerable. And guess what has been driving the US stock market to these levels? It is these same very few FAANG names inside the technology and consumer discretionary sectors, which account for a combined 77.5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of the gains in the S&P 500 this year. Take a look.

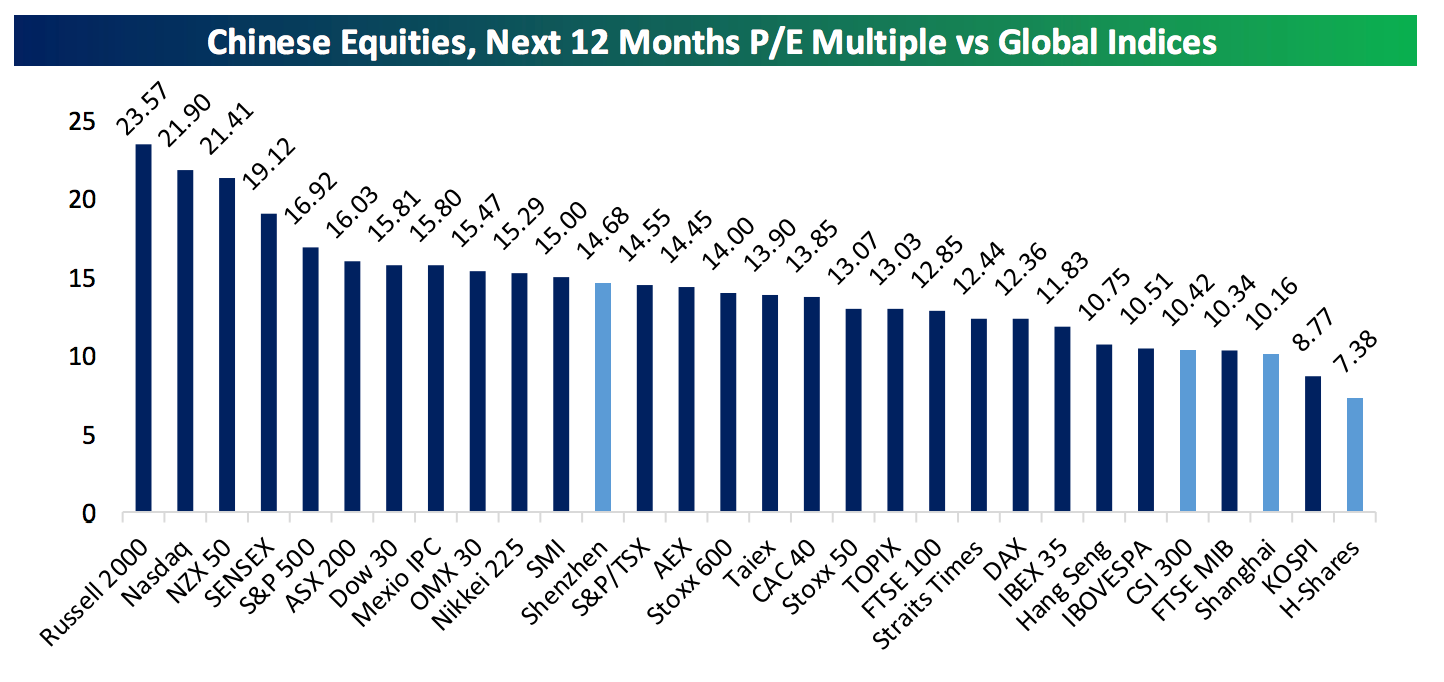

You have to remember that value comes in many forms. We can find growth companies that are now trading at a discount. That’s a value right? There are lots and lots and lots of these available in the market today outside of FAANG. Most of these are among materials, industrials, energy, consumer staples and select healthcare. We own some and are buying more now. We can also look for countries like emerging markets or China that are GROWING FASTER THAN THE UNITED STATES OF AMERICA (sorry for the big letters), but are now priced at less than ½ of the US stock market in aggregate. Here’s a snapshot from Bespoke last week comparing country valuations using next 12 month P/E mulitples.

If you’re looking for something of value to buy in the way of country specific index exposure, lean on the right side of the chart where you’ll find all things developing and Asian. The least attractive indices in the world are found in the US markets.

Our Worldwide Sectors strategy, as the name implies, has a high allocation to internationals but thus far international indices are all negative YTD, yes all. Consequently, Worldwide Sectors has understandably underperformed the US stock market. We have reduced our international exposure and carried more cash this year but will quickly reengage with full international exposure once these countries stop falling. Not to fear, the strategy is still producing double-digit numbers on an average annual basis since we retooled the strategy in 2016. (Please review our composite performance disclosure links). It’s just lagged a bit so far in 2018.

If I were a bettin’ man, I would add to our Worldwide Sectors strategy right now as the strategy is becoming more “valuable” relative to the US market with each passing day.

I’ll give you a few other examples of value as I see it today, more on the consumer (non investing) side of the story. Plugin Hybrid Electric Vehicles are now presenting some very attractive values compared to their gasoline powered brothers. I have a 2018 EV comparison Chart of all models of electric powered vehicles. if you would like a copy, please send me an email. There are a few takeaways from the chart.

- There are now 43 models of electric or plug in hybrid electric vehicles to choose from. More are coming each week.

- The battery range on all is pushing higher – reaching for 100 miles on a charge – way more than most of us drive daily.

- 16 of the 43 models are now less expensive than their gasoline equivalents and still offer State and Federal tax credits.

- The new Electric Jaguar (I-Pace) is a better value than a Tesla Model X.

- PHEV vehicles with All Wheel Drive are coming fast – awesome!

- The best teen car in the world is a Subaru Cross Trex Plug In – $20,500 after tax credits and your teen never has to pay for gas.

Or you could buy a giant new suburban or luxury SUV that gets 16 miles to the gallon and costs much more than anything on the list – no value.

Here’s another one

I just bought a pair of prescription glasses from an on-line company called Warby Parker.

They have an on-line tool that measures your face, suggests frames, sends you 5 frames at a time to try on at home for free. When you’ve decided what you like, you order on-line, send in your prescription and they arrive in your mail 10 days later custom made for you! Total cost $95. Normal cost for a cheap pair of prescription glasses and frames (maybe $300-$500?). They even have 15 locations now where you can get a “valuable” eye exam. Love the Stanford grads challenging the status quo.

Finally, I’ll finish with real estate.

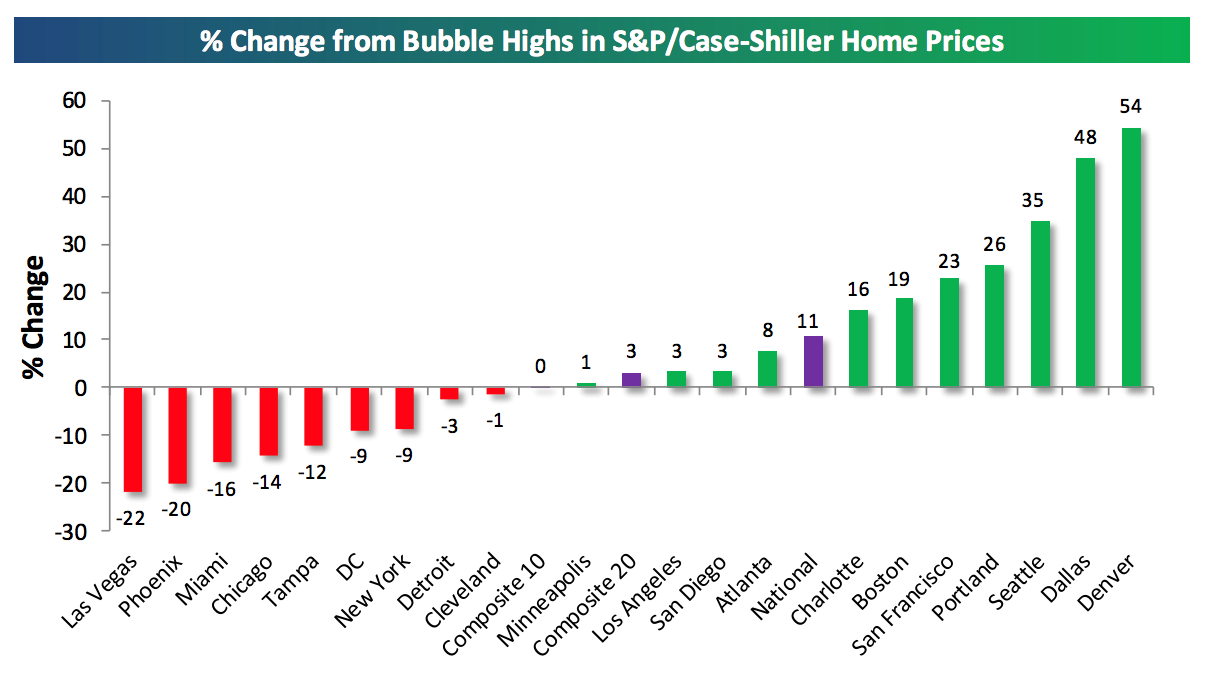

If you’re buying real estate now or anytime in 2018, you’re really not making a decision based on value in most cases. It’s an emotional decision. Anyone who knows anything about real estate will tell you there are only three things that matter; Location, Location and Location. I agree because no one wants to live next to the dump or under power lines or a highway. However, if you actually want to make money in real estate, there is only one way to do it. You make your money in real estate on the buy side. That means, find things that are a good value in real estate, buy them, upgrade them and sit for 20 years or more. You should be able to beat inflation over time as a rate of return. I can hear you laughing. Consider this, with the exception of Seattle, Dallas and Denver, real estate purchased in 2006 (Bubble highs) has not kept up with the rate of inflation. Of course this doesn’t account for your annual carrying costs like a mortgage, insurance, taxes and upkeep either.

But there is no value in today’s real estate market. Prices have pushed up to nosebleed levels in most of the country and the environment is becoming hostile in terms of carrying costs (rising taxes, interest is no longer deductible, rates on the rise, etc). Again, you make money in real estate on the buy side and this is not the time to be locking into expensive digs in my opinion.

So this is one of those keep it real updates in an age where value has been forgotten. Things will always revert back to real value, which is why guys like Buffett have had such long and impressive investing careers. Be very careful about what you own or are considering buying here. We believe we’re on the cusp of a significant change.

Happy fall!

Sam Jones