Check Your Pulse

Now that March is behind us and the markets have finally done the unthinkable act of going down over the course of a quarter, this is a great time to take your pulse and look inwards at your own Risk Capacity. Until you really know yourself and understand this concept, you’re going to be prone to making unproductive investment decisions. This commentary is oriented toward non ASFA clients who are struggling with what’s happening in the markets.

Know Your True Financial Situation

You might feel some anxiety when the market falls 1000 points, or 3000 points as it has done since late January. It lost a clean 10{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} most of which happened while you were brushing your teeth at night or maybe enjoying a late lunch. Naturally, we want to check our account balances and do a little damage assessment. It’s a bit like falling off a bike. You crash, you sit there for a moment, feeling numb, and then take inventory on your scrapes and bruises. That’s we suddenly sense pain.

But the level of pain associated with market losses, even if still on paper, is really a function of your personal capacity for risk. I’ve discussed this before at length. As a reminder, risk capacity gets to the heart of what you and your household can really tolerate in the way of volatility in your net worth on the basis of your true financial situation. In other words, risk capacity is based on your net worth, your living expenses, your age, your income, your future expenses and your general financial situation.

This is often enormously different than how you might think of yourself in terms of your willingness to take risk!

We might think, hey I’m a risk taker. I want to make big money and take a swing at big opportunities like crypto currencies or Canadian Marijuana companies or that next big IPO. But when these things don’t really work out like we expect, and we begin to recognize big losses, our high risk tolerance has a funny way of becoming highly risk averse and we sell, at the lows, for a huge loss.

Risk Capacity defines your eligibility to invest in stocks or other risk assets, not your perceptions of yourself, which are often at odds. The most tragic cases are those who do not have very high risk capacity (low net worth, sketchy job security, running out of peak earning years, etc) and are looking to their investment portfolios to bail them out or make up for lost years of not saving enough. I see this a lot. Honestly, it’s wishful thinking based on need not reality. The markets will only produce so much in the way of gains over time regardless of your financial needs.

Of course, this is an extreme example but I do see many many portfolios that are way too exposed to stock and stock index funds for a market that is showing this level of mean reversion and volatility.

So this is a great time to have an honest conversation with yourself and it’s not too late to do so. If your portfolio is not allocated according to your risk capacity, you will ultimately behave badly at the wrong time. That looks like selling in panic at a time and place when you should not. It can also look like chasing (buying) something like the FANG stocks just as they are seeing their final hours of price gains. This happened in mass around the middle of January and most are now down 15-20{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}.

In our firm, we work hard to ask the right questions of our clients, know their real financial situations through our intake process and build portfolios of strategies that align with their true risk capacity. Our clients have all heard us say, “no, we need to stick with the current allocation because of where YOU are in your financial life”.

Risk Capacity moves very slowly, while willingness to take risk shifts with the wind.

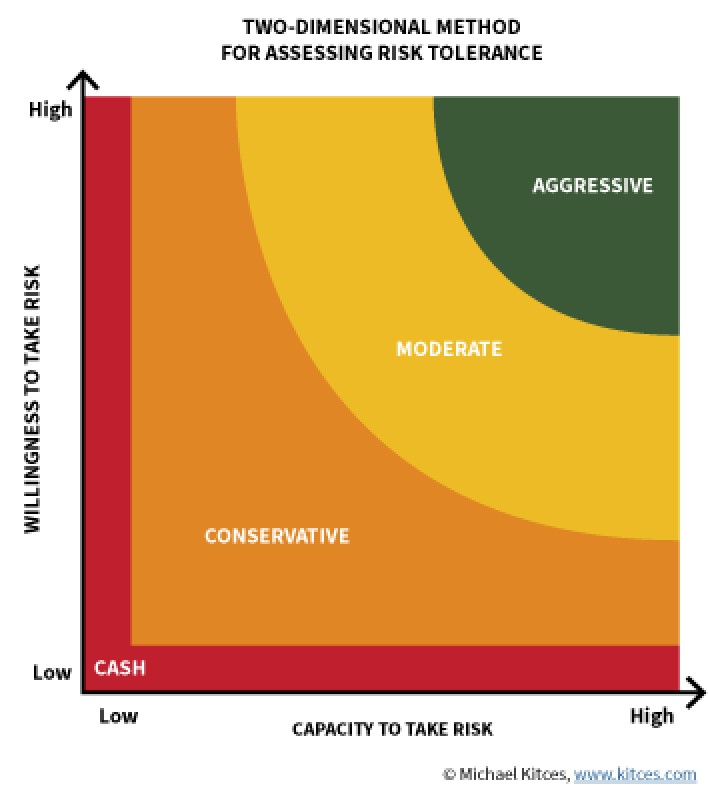

Here’s the chart that I’ve shown many times of the relationship between Risk Capacity and Willingness to Take Risk provided by Michael Kitces of www.kitces.com . What you’ll notice is that very few investors would actually find themselves in the upper right hand corner. That little piece of pie is pretty far out there as a cross section of both high Risk Capacity and high Willingness to Take Risk.

You’ll also recognize that the vast majority of investors should maintain conservative allocations or may not even be eligible to invest because they are still in the Red Zone (Cash).

I remember listening to Jim Cramer of CNBC who said in no uncertain terms that you are not ALLOWED to invest in individual stocks at all until you have at least a $100,000 account. I hate to agree with Jim but he’s probably right.

All of this is inconsistent with what I see today under the hood of prospective client portfolio statements.

I’ll step down from the pulpit and leave you with an action item to consider.

On January 12th, 2018, we launched The Lighthouse Project (https://allseasonfunds.com/red-sky-report/the-lighthouse-project)

This is a no obligation, free and easy, opportunity for any non-ASFA client who feels they may be more exposed to more risk than they should (wink) considering the very real change of character in today’s market.

Through the process we will:

- Stress test your current portfolio holdings for

- Assess your tax efficiency

- Recommend solutions to better control your portfolio returns

Please contact us if you’d simply like a second opinion on your portfolio. It’s not too late to make changes and reorient your portfolio for the new investing environment.

Don’t take our word for it. I just read this from Jared Dillian who is a highly seasoned market guy with decades of real time experience.

“I can say with a very high degree of confidence that we have now departed the low volatility regime and entered a high volatility regime. Everything that worked for you for the last several years will no longer work. I don’t even know what that is, but it is definitely true.”

Jared Dillian 3/29/2018

That’s it for now. Enjoy the long holiday

Cheers

Sam Jones