Back to a WINning World

Gerald Ford brought the acronym, “W.I.N.” to the American public encouraging thrift and savings in the administration’s fight to Whip Inflation Now. They made cute buttons but I’m not sure that anyone would be dorky enough to wear one even in 1974. The evidence of what we see today is completely at odds with what we are told or hear regarding inflationary pressure that is building in the system. Here’s what we SEE and what every investor needs to know about where to put their money now.

Late Cycle Evidence

I’m not going to call it inflation anymore because there seems to be a clear and purposeful intent to convince the American public that inflationary pressures are not real, present or existent, and we should expect the campaign to continue for several reasons. The first is that our bond market would simply collapse if we all agreed that inflationary risk is rising dramatically. The US debt to GDP is way off the chart, now 329{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} as of the end of the last year. As Steve Blumenthal of CMG Capital points out, trouble usually begins when any country’s debt to GDP rises above 90{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}.

We’re not alone. This is a global thing and it will end very badly.

- Japan 590{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- France 480{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Germany 279{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Greece 360{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- S. Korea 357{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Netherlands 725{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Denmark 585{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Canada 332{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Italy 360{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Portugal 488{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Ireland 828{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Spain 397{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Sweden 467{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- Switzerland 382{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

- UK 476{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

So of course, any notion that inflation (whoops) is rising would be unwelcome news to the issuers of debt who happen to be the same entities that report inflation numbers – da Gubermint. The other main reason is that our entitlement programs like social security and Medicare are indexed to the government reported inflation numbers. If inflation rises, then all of these payments must also rise according to the COLA (Cost of Living Adjustment) rules. Social Security and Medicare are not solvent as is. So once again, as a country, we literally can’t afford to report inflation honestly or accurately.

Let’s use the phrase “Late Cycle Evidence” instead of the word Inflation so as to be consistent with what you’re hearing.

Here’s the evidence that we’re in a very Late Cycle environment – which are contributing factors to rising prices and a rising cost of living.

Tariffs, Trade Wars and Protectionism Check!

Rising wage pressure Starting now – Check!

Full Employment and labor shortage Check! Check!

Strength in Commodities Check

Bond market falling apart Check

Stock Market becoming selective Check

Rising US dollar Check

Rising Healthcare costs CHECK OMG

Rising essential services costs (Trash, Water, Utils) Check!

Rising housing costs (rent and ownership) Check!

Overstimulus with tax reform act Check!

Federal Reserve raising Interest rates (x6) Check

These are the recessionary pressures in the system today.

None Check

No joke, there are none today.

Investment Options During Late Cycles

Honestly, at this stage of the cycle, there aren’t many places to invest in outside of inflation hedges, commodities and a few currency trades. Bonds suffer, stocks stagnate and become selective making it tough to make money broadly. But commodities are kings here for a while so we need to get a bit unconventional with our portfolios (our specialty!). This is a typical intraday performance screen of a diversified portfolio that I am seeing more and more often. Forget all the symbols, just look at the colors. Green is up and Red is down on the day.

There are two things that are up: Commodities and the US Dollar. That’s it. Basic materials and small caps are hanging in there but there really aren’t many places to look for strength.

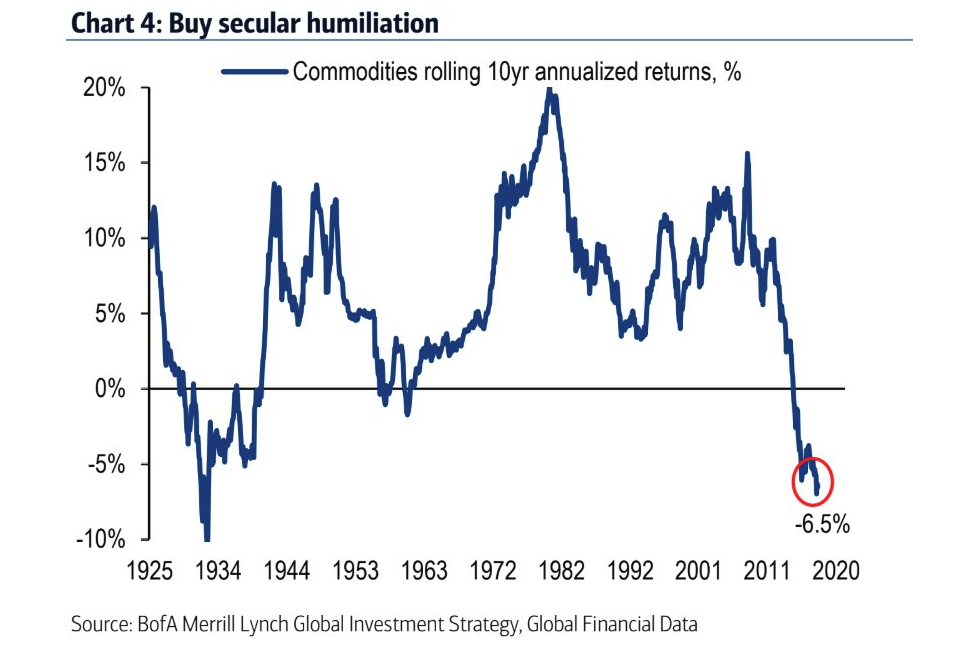

Here’s another eye opening chart that our CIO, Sean Powers sent me yesterday. It shows the 10-year rolling annualized returns for commodities. If you have any sense of fate—or believe in the concept of reversion to the mean—you’d have to believe that commodities are likely to rise from here and run hot for many years. Not possible? It’s possible. We haven’t seen commodities this oversold since 1934!

Emerging markets are the bottom of the list and under some serious pressure as of late. These countries tend to rely more on borrowing so when borrowing costs rise, they run into trouble. We have cut back dramatically on our emerging market positions and reallocated those funds to commodities, energy and domestic small caps.

Overall, our Net Exposure model is still positive as of last Friday (+9 out of a range of +20 to -20) so we need to give this market the benefit of the doubt. However, several of our indicators are angling back toward zero including seasonality which is now fully negative (Sell in May and go Away). Buy pullbacks is the right approach still but consider a heavier allocation to those Late Cycle investment options when you’re ready to hit the buy button. If you don’t know what or how or when, give us a call.

That’s it for now and dust off those WIN buttons!

Stay tuned.

Sam Jones