December 9, 2022

I am not an expert in Real Estate but have been a macro strategist for the better part of 25 years. Real estate is no different than any other investment asset class despite the emotional bonds that persuade us to think otherwise. As promised and as requested, these are my thoughts on trends in real estate, both current and future.

Flashback to 2006

In October of 2006, I stood at our annual meeting at the Lakewood Country Club in front of one of our largest attended events ever. I began the presentation with this image, snipped from the cover of the Economist entitled, “The Houses That Saved the World”.

I went on to horrify our clients by suggesting that real estate was a disaster waiting to happen and that we could see up to 15% declines in prices nationwide over the course of the next 2-3 years. I was terribly wrong of course as real estate lost 25% nationwide and nearly 40% in many markets, combined with the bankruptcies of several giant financial institutions and mortgage lenders. This period was fodder for the famous movie, “The Big Short”. On that day, no one could image that real estate could fall even 10%. It simply had not happened in several decades and we heard regularly how inventories were low, demand was high and interest rates were at all-time lows. Moreover, real estate had become a great source of wealth accumulation for homeowners at large, as well as an absurdly lucrative revenue stream for brokers, homebuilders, developers, house flippers, mortgage lenders, banks, etc.). No one wanted to believe that real estate would do anything but go up in value.

This Time is Not Different

Today, there is a near consensus opinion that real estate prices are in trouble for the next couple years. It’s hard to argue with that point of view considering all the things we already know. Affordability, measured as the cost to buy a median home relative to average incomes, is at an all time low. Mortgage rates have doubled from 3.4% to 6.8% in just 11 months. No one wants to sell and trade their current 3% mortgage for a 7% mortgage, right? So, sales have completely dried up and are now down over 40% year over year. However, if one were to look at price trends, you might be surprised to see the Case Shiller National Average still up 10% year over year ending October! I want to give a quick shout out to Bill McBride who offers some of the best work I’ve seen on macro trends with a strong focus on real estate, mortgages, and consumer behavior. You can find him at www.calculatedrisk.com . Much of what I’m talking about today has been said better by Bill with all the supporting data. Check him out.

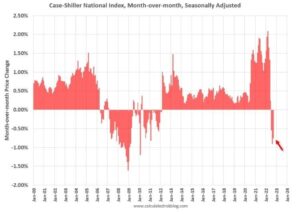

If we were to unpack the +10% YTD, number we would see that real estate prices WERE up over 20% YTD and are now down 10% from that high. Bill likes to watch the month over month price trends which are obviously negative at this point (see below). Prices peaked in March on the National index and have been falling about 1% per month since. Industry people will suggest that the national average doesn’t apply to their markets. Yes, it does and yes it will. Some markets and regions are just early in the trend, and some are later, but rest assured that all ships rise and fall to varying degrees, with the tide for real estate.

Most of the smart people I follow, including Bill are looking for prices to fall almost 20% which would simply erase just the last 18 months of price appreciation. Not a big deal! Especially considering that homeowners are still sitting on a pile of equity, and most aren’t feeling pressured to sell, at least not yet.

This Time Is Different!

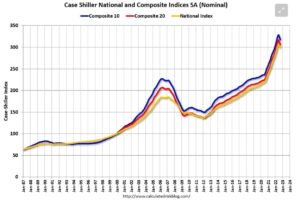

Today, unlike the last real estate price decline in 2007-2010, we have a new force called inflation that is still clipping along at 7%/ yr. Inflation is a bit like wood rot; It’s hard to see the decay that is happening beyond the surface, but it has a way of structurally eating away at your financial foundation. With inflation running this high, even a small loss in real estate prices can have much greater impact on the “Real” value of your property. Let me explain. We can look at real estate prices with or without inflation factored in. If we consider prices without inflation, then we are simply looking at a linear move up or down in an asset without context. Here’s what the price trends look like in absolute values.

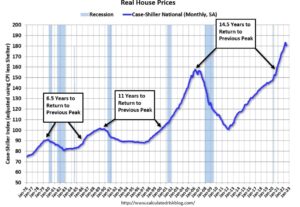

But the context here is your real cost of living including the costs to maintain your home versus the current value of your home. With inflation on the rise we see higher maintenance costs, higher utilities, higher building costs, higher borrowing costs and even higher taxes (coming soon). We also have a higher cost of living in general which establishes a higher benchmark for pricing just to stay even. Therefore, if we care about the state of our wealth and the value of our assets, then we must measure them relative to our variable costs as measured by inflation. This is what real estate price trends look like when factoring in inflation over time (again hat tip to Bill McBride )

Hopefully, when looking at charts above, the important takeaways are obvious.

- Real estate prices have peaked and are just now starting down.

- Real estate prices are peaking from a much higher level than the last peak in 2006.

- Factoring in inflation (aka affordability), we should expect some relatively severe price impacts in coming months unless mortgages come all the way back to where they were in 2020 (~3%).

- Note the time gap between price peaks. I could argue that timing with real estate purchases matters more than location, location, location.

The Big Picture

Now I’m going to switch to demographics as related to very long-term real estate trends. Here are a few facts.

- Households in our country tend to buy real estate from our early 30’s (first homes) and hold properties until we are in our early 80’s. That’s a long time!

- Beyond 80 years old, there is a strong tendency to sell property and move to assisted living, move in with family or otherwise.

- Currently only 13% of our population is age 80+

- By the year 2042, more than 30% of our population will be 80+

- 46% of our population is in prime real estate purchasing age (between 30-39). But that number only grows by 2% until it peaks in 2030.

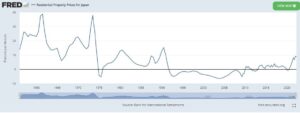

If we mash all these stats together, we see that demand for housing is likely to be strong for another 7-8 years but after that we are sort of facing a Japan style environment with an old and aging population who is not likely to want more real estate and is far more likely to be on the sell side as we move closer to the 2040’s. For those who know the history of Japanese real estate, you know that prices entered the dark ages in about 1990 when their population had become older with a large portion over the ages of 80. Here’s a chart of the Japanese Real Estate prices from approximately 70 years ago to now. Note how the percent change by year stayed negative or near zero for almost three decades. Interestingly, we are just now starting to see prices move consistently higher – need to do some more research on that.

… In Conclusion

It would seem logical that real estate price trends are going to be highly cyclical and far more sensitive to borrowing costs at least for the next 7-8 years. We should also expect higher carrying costs associated with owning real estate starting today. Landlords beware! Today we’re at the top of the cycle but we would look for a next buying opportunity after the next recession (2024) when prices and rates should be lower. We will still see some incredible moves higher as those Millennials and Gen Zs continue to buy the American Dream! However, after 2030 and increasingly until 2042, we will start to see inventories rise consistently as demographic demand starts to wane. When I am 75 years old, I’m sure I’ll look back at this time and marvel at todays’ price appreciation as a thing of the past.

This is some very blunt and non-actionable advice of course. But seeing as how real estate is arguably one of the largest drivers of economy and wealth in our country, it’s worth spending some time trying to understand the big picture and set some expectations looking forward. Homes are wonderful places to live, but maybe we should start thinking about them as just that and not as much of a source of wealth or income. Something to consider.

Enjoy the weekend,

Sam Jones