April 19, 2022

If you are reading this, congratulations! You made it through another tax season! As one tax season ends, unfortunately a new tax season begins. More precisely, we find ourselves nearly a third of the way through the 2022 tax year at this point. With that in mind, we wanted to share a high-level overview of how the US tax system works and a couple of key tax-related items to keep in mind for 2022.

How the US Tax System Works at a High Level:

We add up our income from all sources while subtracting items like retirement plan contributions, HSA/FSA contributions and healthcare premiums (among others) to arrive at Adjusted Gross Income (AGI). Next, we apply a deduction (either standard or itemized) to arrive at taxable income. From there, we apply the applicable rate to the different types of income that we have and deduct any below the line tax credits (child tax credit, for instance) to arrive at tax liability. Once we understand our tax liability, we compare that to the amounts that we have had withheld for Federal Income Taxes (or paid via estimated tax payments) throughout the year to determine how much we owe (or are due to be refunded) at tax time.

Below is a listing of a couple of key tax-related items to keep in mind for 2022:

2022 Standard Deductions:

Single: $12,950

Married Filing Jointly: $25,900

Ordinary Income:

Ordinary income is taxed progressively according to the following brackets:

Items included in ordinary income include the following:

- W-2 Income (Wages)

- 1099 Income

- Social Security (*up to 85% of SS benefit is taxable, depending on provisional income)

- Rental Income

- IRA Distributions (including Required Minimum Distributions)

- Short Term Capital Gains

- Interest Income

- Non-Qualified Dividends

Long Term Capital Gains

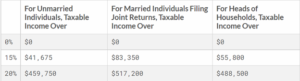

Long Term Capital Gains and Qualified Dividends receive preferential income tax treatment according to the following brackets:

Did you realize that there is a 0% long term capital gains tax bracket? For tax year 2022, a married couple can realize $109,250 ($83,350 + Standard Deduction) of Long-Term Capital Gains and Qualified Dividends and pay $0 of tax. Pretty powerful when you step back and think about it.

2022 401k / 403b / 457 / TSP Plan Contribution Limits

Under Age 50: $20,500

Age 50+: $27,000

2022 Roth IRA Contribution Limits:

Under Age 50: $6,000

Age 50+: $7,000

*Modified Adjusted Gross Income must be under $204,000 for MFJ filers ($129,000 Single) to contribute the maximum amount to a Roth IRA for 2022. If your income is more than these figures (or close), please let us know and we can investigate whether you are eligible to make a backdoor Roth IRA conversion*

2022 Health Savings Account Contribution Limits:

Under Age 55: $7,300 ($3,650 Single)

Age 55+: Allowed an extra $1,000 per individual per account* *An additional HSA account may be necessary

All this information aside, it is never too early to start thinking about tax planning for this year and beyond. If you had an unusual or unexpected tax burden for 2021, please let us know so that we may find a time to review your specific situation in the coming weeks and months with an eye on working towards eliminating surprises for 2022. Who knows, maybe we can even find ways to improve your tax situation this year and on a going forwards basis. If nothing else, we can help you understand your tax situation so that you can feel more confident and in control rather than in a defensive position come tax time.

Will