8/15/2024

I’m going to get myself in trouble with my real estate friends and family with this post. The question, and maybe the greatest concern for anyone under 30 years old, is this: How will I ever be able to afford to buy my own home? I’m going to take a stab at a playbook of sorts for this young age group, including facts and current trends, as well as some suggestions. If you play your cards right, you will own a home that is affordable for you as long as you are disciplined about your financial habits over the next 5-7 years.

The American Dream Will Be Yours… Later

My very high-level advice is the same as it has been for the last two years. Let the real estate market come to you on your terms. Avoid the temptation to chase prices or buy anything now and lean into renting for as long as necessary. Okay, but why?

Let’s get rid of a little FOMO first by reviewing a few facts.

*I would encourage you to do your own research and listen to independent sources who track real trends and real data. (CalculatedRisk.com Altos Research or Top of Mind podcast, to name a few).

- Real estate prices peaked in November of 2023 and have been falling since then, with few exceptions. 47 of 50 states are seeing prices fall year over year.

- The supply of single-family homes is up 40% year over year and is rising. The current inventory of unsold homes is 667,000, which is still below pre-pandemic levels but will be there in short order. Prices are falling because inventories are rising while mortgage rates still hover at 6.5%. The sales pitch that prices won’t fall because inventory will remain low is simply not playing out.

- Real estate trends are local, yes. Luxury resort communities are dominated by economically insensitive buyers, so normal market mechanics are skewed. But I’m speaking to the next-gen, who are clearly not looking to pay all cash for a luxury home, right?

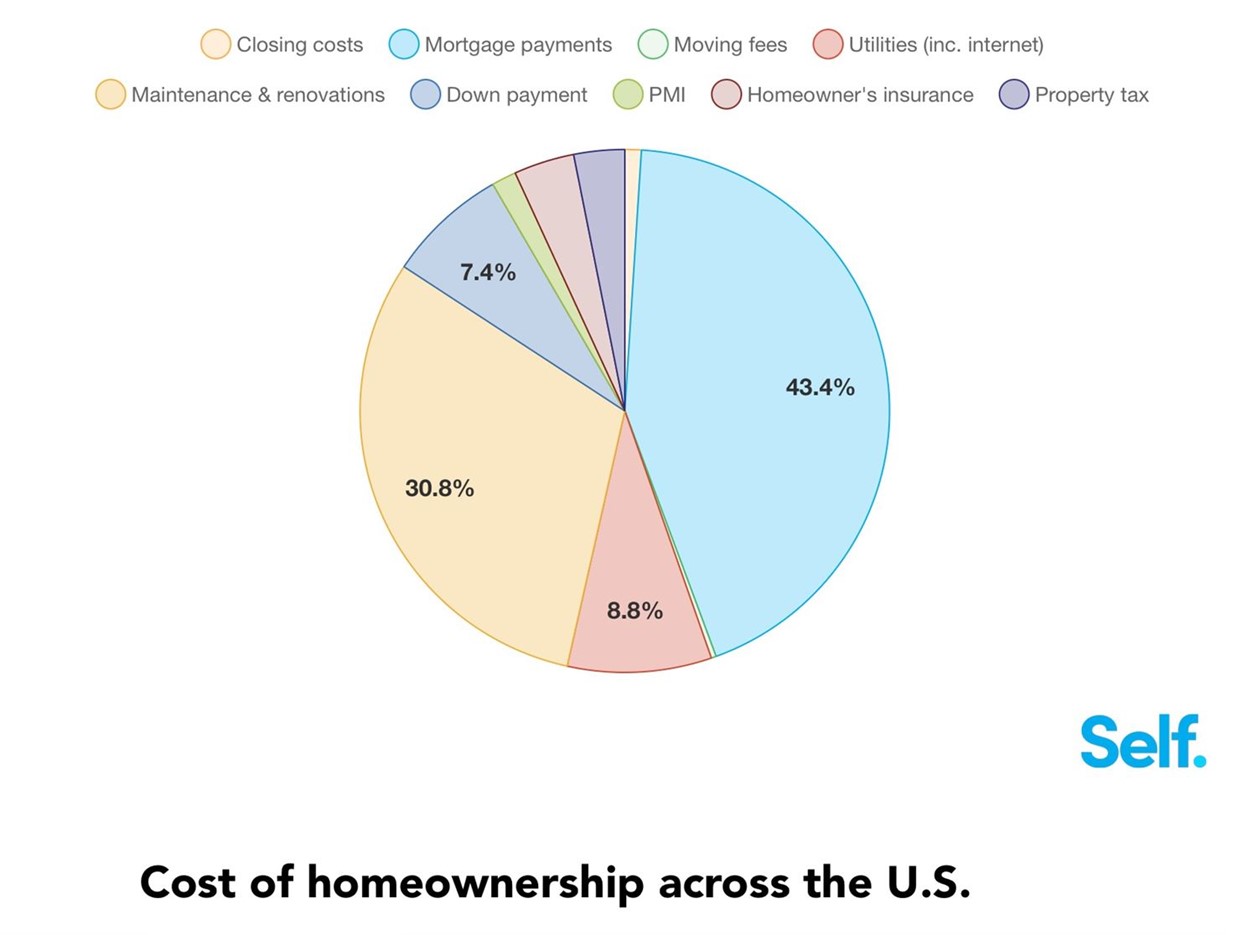

- The total cost of ownership (TCO), which I have spoken about at length, has been rising nearly 20% annually since 2022 (Taxes, insurance, utilities, maintenance). Take a look at the chart below. 73% of TCO falls into Mortgage servicing costs (principal, interest, taxes, and insurance), maintenance, and renovations. By owning a home, you naturally accept responsibility for these two GIANT costs that come with home ownership. Remember, both slices of the pie already represent 73% of total ownership, and they are both rising.

The Alternative of Renting

After nearly three decades of real estate prices rising on the back of nothing other than three decades of falling interest rates, we have all been emotionally conditioned to believe that owning real estate is THE means of building exponential wealth. We literally call home ownership The American Dream. Kudos to the marketing machines for branding that dream with homeownership. The next generation has witnessed their parents’ experience accumulating real wealth by way of real estate, often living in very nice family homes or visiting the family vacation property. The suggestion that we need to own real estate is compelling and overwhelming if one is looking backward. Not owning real estate is seen as a failure. I am empathetic to the Next Gen, who must just be tortured by the hard reality that the American Dream is factually not for them, or certainly out of reach for all but a few. The hard truth is that Baby Boomers and Gen Xers like me have effectively pulled forward real estate returns from future generations and put them in our pockets. We have done so by pressuring the Federal Reserve to keep rates artificially and unnaturally low for far too long. Do you think Jerome Powell feels a little pressure to drop interest rates now – again? You are witnessing “pressure” in real time if you pay attention to the news.

I’m still going to offer a playbook towards ownership, so stick with me.

Renting a home or shelter of any sort feels bad, or so we are told.

“I’m just throwing my money away”

“I’m paying someone else’s mortgage, and they are getting rich on me”

In our Next Generation research this summer conducted by our intern, PJ Shaw, she discovered that owning a home is a top financial priority for Millennials and Gen Z. I fear that it’s going to take years and years of real estate being recognized as an unproductive and costly financial asset before this embedded psychology breaks. We’re in year two.

I will reiterate a bold prediction now.

Hard asset real estate (including TCO) will continue to be the worst-performing asset class in the next decade. You can etch that “quote” on my gravestone as long as you include the date, November of 2023😊

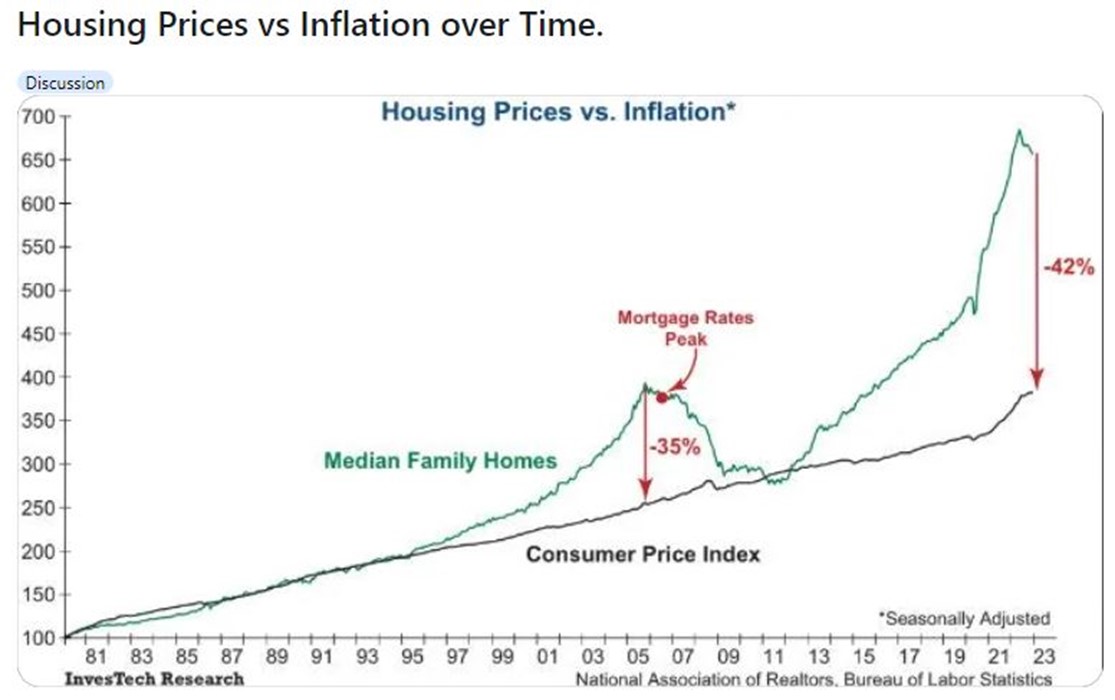

Performance is always relative, mind you. Real estate prices don’t need to fall dramatically, but they are very likely to lag almost every other asset class and continue to be “dead money” as prices inevitably retrace back to their historical return trend of inflation (see below)

Ok, back to the argument about renting

A few facts:

- 8 million “units” were purchased since 2011 as investment properties (aka rentals, many of which are now short-term rentals by way of Airbnb).

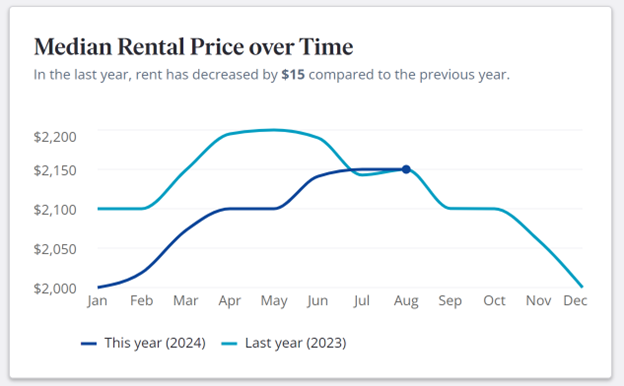

- Rents are now falling year over year, not by much, but the data shows that rental rates peaked around April of 2023.

The Playbook

First, get yourself in the right mind frame. There is no shame in renting now. In fact, it seems pretty clear that this is a smart place to be considering the rising and unaffordable costs of home ownership versus the falling costs of renting. The trend is your friend!

Second, understand that the main reason why real estate perceptibly seems like such a winning investment is that paying a mortgage is a form of forced savings. Also, understand that most good Americans are not very good about their saving and investing habits unless they are forced to do so (aka paying a mortgage). If you think about it, paying a mortgage is exactly the same as saving a reasonable chunk of your income and investing it in equity (home equity). And if you fail to pay your mortgage, there are consequences like foreclosure and nastygrams from your lender.

Now consider this option as a renter.

Take any money you would have put toward a down payment on a house, invest it, and get yourself on a forced savings plan to contribute to that account every month for the next 5-7 years as if you were paying a mortgage plus carrying costs!

Here’s a real example

A typical mortgage payment for a 2-bedroom house in Colorado with principle, interest, taxes, and insurance is now a little over $4000/ month (assuming a $500k mortgage at 6.5% on a 30-year fixed). Now add the average annual additional costs of ownership, which are conservatively estimated at $800-$1200/ year. But you are still paying rent, which will run about $3000/ month for the same two-bedroom place in Denver.

Ownership costs

$4000 + $100 ($1,200 annually) = $4100/ month

Renting costs

$3000/ month

Difference

$1,100/ month

Can you save and invest the difference of $1,066 – $1,100/ month?

Do you have the discipline and income to support this forced savings plan beyond your rental costs?

Do you think you will have more or less money at the end of 7 years to put down on a house? You will have more, much more.

Of course, the greatest threat to this plan is that real estate prices will increase and go parabolic without you. Considering today, we are already at a 40-year high of unaffordability based on current real incomes, prices, and mortgage rates, that would be a very low probability event.

Other Good ideas:

- Look to lease a home that you might want to own (lease to own!) Current owners will love to keep their super-low 3% mortgages and lease to you as a potential buyer, applying your cumulative lease payments to the eventual purchase price when you have enough money to buy the place. If rates don’t come down substantially soon, this will become a thing, just like the 70s and 80s.

- If you must buy now, do buy the ugliest house in a good or emerging neighborhood. Use the next 5-7 years to incrementally improve the property while prices fall. Building sweet equity is never a bad thing, especially now.

I’ll leave it there for today. Please don’t hate on the facts if you disagree; just do your own research and feel free to challenge any of the above with a good set of evidence. For the next-gen, we want you to have the opportunity to own assets, put your stake in the ground, and build your own wealth. You have incredible opportunities today and will have an opportunity to own your own home, but it will probably be later in your life than you might expect.

Best of luck to all. We’re here for you!

Sam Jones