9/9/2024

In last month’s Finding Benjamin post, “We are on the Move,” I daylighted a significant shift happening in the markets in response to a change in the state of the economy and the corresponding business cycle. Our tactical asset allocation approach for risk-managed strategies has subsequently made significant changes in the last three months, and now our work is almost complete. For this month’s update, I’m going to dive a little deeper into some very attractive and timely investment opportunities associated with the US and Global economies moving swiftly into a contractionary phase. Despite that feeling of doom and gloom, we finally see real emerging options for investors outside of mega-cap technology.

Market Timing versus Tactical Asset Allocation

Before getting into today’s content, I want to use a little ink talking about good and bad behavior when it comes to investing. We have all heard about the pitfalls of trying to time the market. It’s very difficult, given that the markets are largely unpredictable. Furthermore, humans are emotional creatures. When we see losses, big losses, losses that persist over months or even years, we tend to lose confidence and begin to think about selling to just cut the pain (anxiety and fear). Eventually, when losses become severe enough, most investors do sell, and they tend to sell at or near the lows. It’s just a fact and one that is well documented by simply observing selling volumes at market lows. This is why market timing gets such a bad rap. Selling at lows and sitting in cash while the market rebounds smartly without you is absolutely devastating to your long-term financial independence, confidence as an investor, and general wealth accumulation. Simply put, most DIY investors don’t have a process, a strategy, or a discipline when it comes to making investment choices. Decisions are largely made on the basis of greed and fear, which again leads to very poor “market timing” results.

Tactical asset allocation is different from market timing in that we are simply following leadership trends in and among asset classes like stocks, bonds, inflation hedges, and even alternatives. Portfolios that are tax-advantaged, like retirement accounts, can, even should, consider tactically changing the weightings to different asset classes based on current evidence and economic trends without the need to guess at the future. We can and should attempt to remain invested in most markets, but our exposure to stocks, bonds, and commodities doesn’t have to be static in all market conditions, right? Think back to the year 2021 when inflation was ripping higher and Treasury bonds were falling 1%/ day. Inflation is not the type of thing that goes away quickly, and thus, one could easily and logically underweight bond allocations inside of our portfolios and instead increase our allocations to stocks and inflation beneficiaries. Clients of ASFA know that we did this in bulk in 2021 and carried only a minimum allocation to bonds throughout 2022 and 2023 while inflation was still running hot. So again, being tactical about our exposures to different asset classes based on current embedded evidence, the stage of the business cycle, and observable trends is not market timing, but it is logical and can make a material difference in your risk-adjusted returns over time.

Business Cycle Moving from Stage 6 to Stage 1

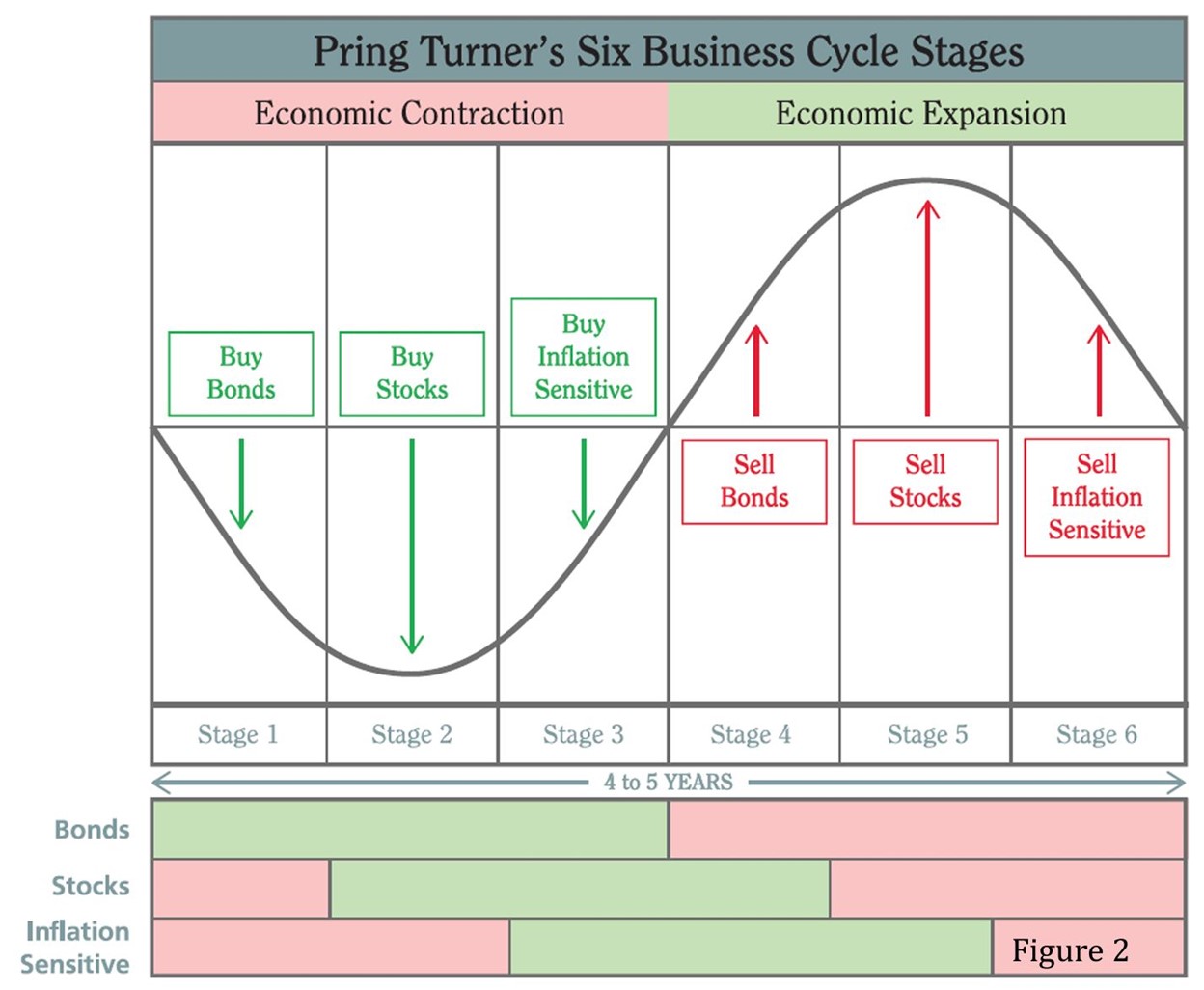

I’ve shown this illustration from the famous work of Martin Pring a thousand times, but here it is again.

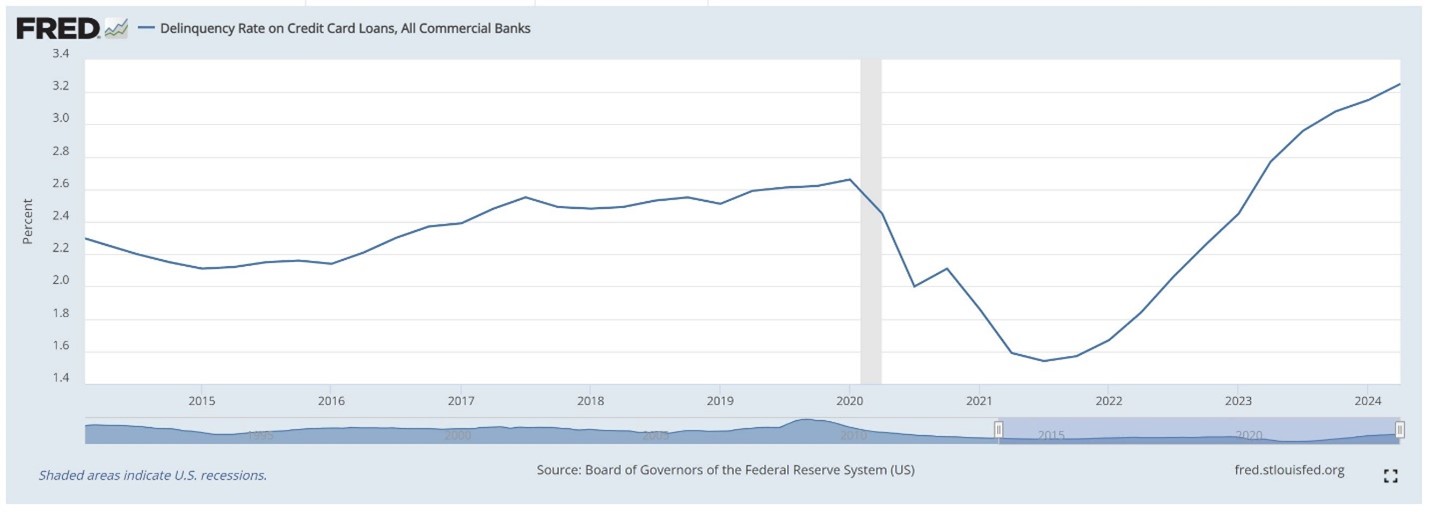

This is a very blunt guide and illustration regarding investment allocations for the different phases of the business (economic) cycle, but the pattern, sequence, and consistency of the various stages have held true throughout time. Economies will expand and contract forever and always. The trick of course is to accurately identify where we are in the business cycle. If one were to simply and casually read headlines or listen to any form of financial media, you would hear a clear and consensus view that the US (and global) economy is getting weaker month after month following the peak in early 2022. While economic growth is still factually positive, the trend of slower growth is leading us toward that eventual state of contraction which we formally call a recession. As investors, our tactical decisions regarding allocations to different asset classes are always based on the trend and direction of the economy and not the ultimate destinations for formal events like the “Recession”. Today, the business cycle is in Stage 6 above based on economic evidence like a weaker job market, falling leading economic indicators, negative consumer savings rates, and a 10-year new high in consumer credit card delinquencies.

Even the Fed is clearly stating that the US economy is now weak enough to justify cutting interest rates and becoming more accommodative in their monetary policy. The facts are clear: Growth is slowing (Stage 6) but not yet negative or contractionary (Stage 1). Nor have we formally reached a recession (Stage 2).

We can also simply observe what’s happening in different asset classes to confirm what the business cycle is telling us. Today, the bond market is making new highs, while the US stock market appears to have peaked on or around the 10th of July. In sync, we are watching the commodities complex and other inflation beneficiaries, which have shown clear signs of weakness since peaking in June. Trends and leadership in stocks, bonds and inflation sensitives are clearly suggesting that the business cycle is moving from Stage 6 back to the beginning of the cycle in Stage 1.

Ok, so what does that mean?

What might a smart, observant, and logical investor do if they are inclined to embrace Tactical Asset Allocation according to the business cycle investment guidelines above?

You know the answer

We want to do the following:

- REDUCE your exposure to stocks, especially anything that is clearly overvalued or highly speculative.

- REDUCE your commodities and inflation beneficiaries, Things like energy, basic materials, hard assets, or natural resources allocations.

- INCREASE your allocations to bonds and other interest sensitives.

Please note this is not a recommendation to any individual investors to make specific trades or any buys or sells of securities. Every investor’s situation is different, and care should be taken to consider individual tax consequences, risk tolerance, and investment objectives.

New Opportunities in Bonds and Interest Sensitives

Finally, we have arrived. Let’s walk through some options that are clear and present today. I want to say that this commentary is probably specifically targeted at investors who are currently sitting on great gobs of cash, maturing CDs, and money market funds, all of which are going to start paying less annual interest at the end of this month. This is a great time to consider redeploying cash to other more productive interest-bearing or dividend-paying securities.

First up is equity and mortgage REITS– which are paying between 5- 9% on average. I’ve heard a lot of chatter about the dire situation of commercial office space, high vacancy rates, and enormous discounts for select commercial properties under contract. The situation is real, and the situation will get worse through the end of 2025 as debt for these properties comes due. You might ask, why on earth would we consider buying an equity REIT (Real Estate Investment Trusts that own actual properties) or a mortgage REIT (owns mortgages of all types) in this environment?

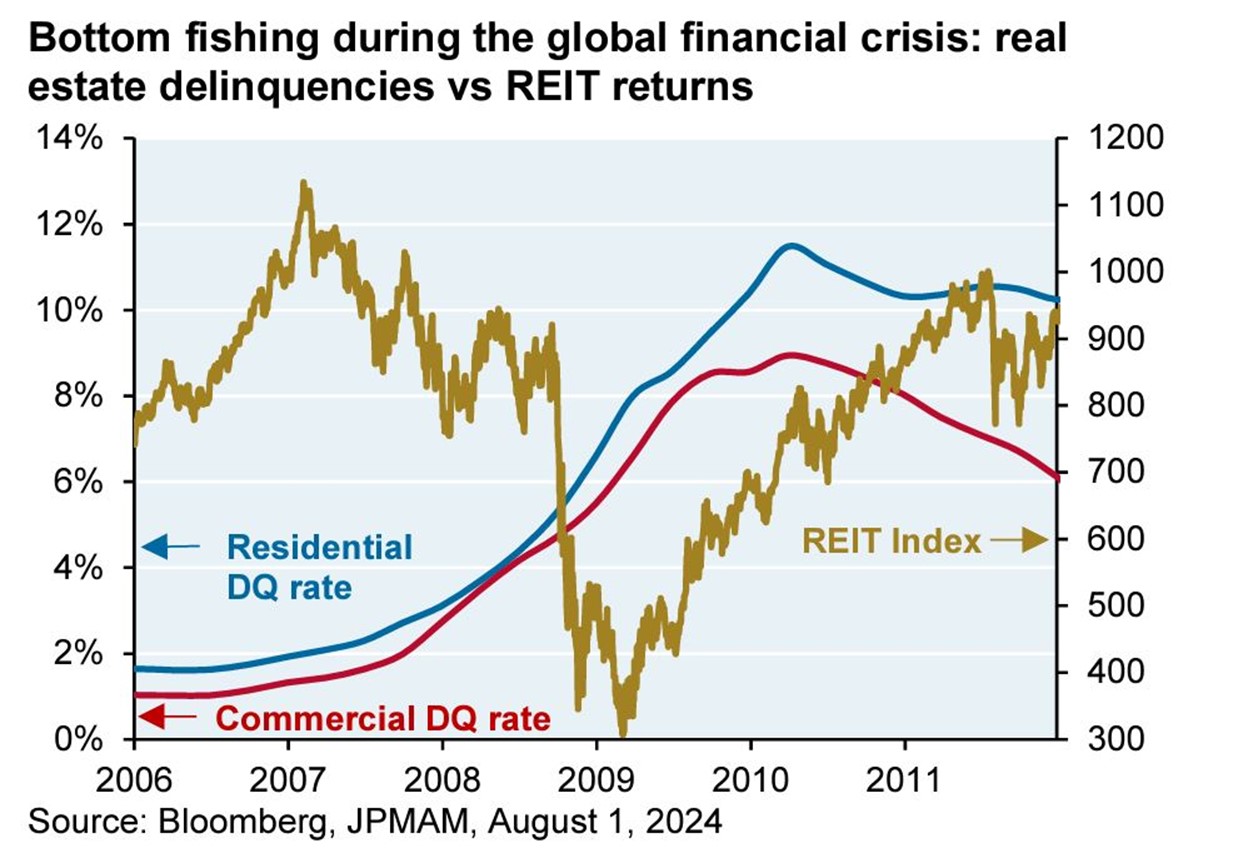

The answer is that the Investment REIT market has already been devastated from a pricing standpoint and is already rising from deeply depressed lows of last year even while delinquencies and defaults are rising. This is what happens in every cycle. Liquid securities and investments form tops and bottoms before we see actual events occur on Main Street! Take a look at this chart provided by JP Morgan, which shows how Investment REITS bottomed in 2009 while real estate defaults and delinquencies (DQ) were just starting a long and painful climb higher. By the time the Residential and Commercial DQs were peaking, more than 70% of the multiyear bull market in investment REITS had already occurred.

The same thing is happening today.

Delinquencies and defaults are just now rising dramatically, but REITs appear to have put in a long-term bottom and are now rising in a new bull market trend. See below

The All Season Multi-Asset (MASS) Income strategy is largely a REIT investment strategy and is benchmarked to VNQ, as shown in the chart above. But MASS Income also has exposure to other similar interest-sensitive asset groups like Preferred securities, BDCs, Utilities, high dividend stocks, and fixed income. The strategy has a current estimated annual yield of 8.42% in dividends and interest. The exciting opportunity is that prices are also finally moving strongly higher as investors are bidding up the values of these interest-sensitive securities. Total returns for REITS and our MASS Income strategy are strong YTD and getting stronger daily despite the recent weakness in the overall stock market.

Emerging Market and International Bonds

From the traditional bond universe, I especially like the setup and attractiveness of emerging markets and international bonds now. These are paying higher rates than US Treasury bonds by 1-2% and are currently riding a wave of contractionary economic inputs. Most foreign central banks are far ahead of the US in terms of cutting rates in response to their own weakening economies. You might also know that the US has the highest level of public debt and the largest fiscal deficit of any country in the world. Honestly, it’s not a great backdrop for owning US treasuries. If you must own US Treasuries, there is no need to own anything beyond a 10-year maturity, and even this is probably just a trade, not a long-term investment.

At the same time, the US dollar is now getting weaker than most other foreign currencies, especially the Japanese YEN. A falling US dollar provides an additional currency boost to any form of investment overseas, so we are seeing international and emerging market bonds move strongly higher with almost no daily or weekly volatility. 12-month total returns for international bonds are now up quietly over 10% and almost 15% for emerging market bonds. Compare this to a CD or money market fund earning less than 5% now, and you get the point.

Municipal Bonds

Munis offer a very compelling alternative to cash and US Treasuries, and they come in tax-free or taxable forms. Taxable Muni bonds generally offer annual interest rates that are about 2% higher than tax-free options. Tax-free Munis should be used in your taxable brokerage accounts and are especially attractive for high-income earners paying tax in the 30-35% bracket. The All Season Freeway High Income Strategy has an 80% allocation to high-yield, tax-free municipal bond funds, ETFs, and Closed-End Funds, which offer annual tax-free income of 4-6%. For high-income earners, that equates to an after-tax yield of 5.40 – 8.10%. My personal view is that income tax rates for high-income households are going to rise dramatically in the coming years regardless of who is in office, given our current Federal Debt and $2 Trillion Budget Deficit. There is just no way around it. Tax-free Muni bonds are launching off a multi-year low in price and paying high tax-free yields as we head into this environment. Win, Win, Win. The All Season Freeway High-Income strategy is our best-of-class strategy in this space.

Taxable municipal bond funds are also in a sweet spot. To be clear, interest paid is taxable in these securities and, therefore, appropriate for lower-income investors or even retirement accounts. Investments are made in municipal and state securities rather than federal ones, but I’m seeing some very attractive yields in this space that are far above those offered among federal bonds. I’m watching two funds now that are paying 7.32% and 8.3%. Amazing! Please note that taxable municipal bonds have about the same price volatility as a traditional long-term US Treasury bond, but at least you’re getting paid for it.

Utilities

I want to offer a special shout-out to Utilities even though, as a sector, they are already one of the best-performing sectors in the market and clearly overbought in the short term. First, utilities are interest-sensitive and fit the task of finding new opportunities in this new Stage of the Business cycle. Second, utility rates are rising, and our dependence on a stable electrical grid may be the highest in modern history. Think about the whole AI frenzy and the demands for electricity from new data centers and server farms. Think about the transition to EVs and the electrification of HVAC through Heat pumps in residential and commercial buildings. Finally, think about how little we have invested in grid infrastructure and capacity in the last two decades. Wrapping it all up, we see and know that utilities and grid services are going to be the epicenter of several major innovation themes for the foreseeable future. Utilities are not nice, but they are essential, and we will pay whatever price is charged for this essential service. Their pricing is perfectly inelastic in economic terms. So, dear investor, if you are looking for a sector that is more than recession-resistant and probably orienting more towards a growth industry like waste management a few years ago, think about utilities. Did I also mention they pay 4-6% in annual dividends? Please be patient with Utilities now, as they are way overbought in the short term. Buy pullbacks – as usual.

Final Note on THIS Business Cycle

Every stage of the business cycle has a different length of time and is subject to different structural inputs. Regular readers know my opinions regarding sticky inflation in this particular economic cycle. Today, the first wave of inflation is in decline, but there are no long-term structural issues in play that are likely to keep inflation higher than desired, with the real potential for second and third-inflationary waves in the next 5-7 years. These structural inflationary issues are:

- Climate change adaptation

- Nationalism and reshoring of manufacturing

- Geopolitical conflict and wars

- Retiring baby boomers lead to higher labor costs

- Shortages in housing stock

- Shortages in raw commodities

- Mandatory infrastructure spending

- Absurd levels of US federal debt and deficit spending

All said, it is likely that our visit to the interest sensitive side of the market, may be just that, a visit. I see strong evidence that the business cycle will see a compressed Stage 1 environment where we own all the above, but we could find ourselves right back into the inflation beneficiaries before long. Let’s keep our eyes and ears open to what the market and data are telling us. Stay tuned!

I’ll leave it there for now. I hope to have given you a few ideas and got you thinking about changes that can and should happen in response to our current position in the business cycle. This is our specialty, what we do for our clients, and the very namesake of our firm, All Season Financial Advisors.

I hope everyone is enjoying the early fall, my very favorite time of year.

Regards to all

Sam Jones