9/30/2024

The 3rd quarter proved to be a healthy one for almost all asset classes despite expectations for a normal summer slump. The 3rd quarter was also an eventful one on many fronts, as changing leadership among various asset classes is setting the stage for the next phase of the business cycle. Simultaneously, as we barrel toward a very important presidential election in just 35 days, it is no surprise to hear that common question: what will happen to the markets if Harris or Trump wins? Today, I’m going to tell what will matter more to our economy and the financial markets than the outcome of the election. Understanding the current market regime and the variables that drive it are critical to every investor’s success. This is an important moment, to say the least.

Big Changes in the 3rd Quarter

First, let’s look back at the last 90 days and listen carefully to what the market is telling us. Erase your mind of what you think will happen, what the media is saying and any assumptions about the future. Let’s just observe what IS happening now. Let’s start with our basic asset class performance, including a few notable groups. These are unofficial quarter end results as I am writing on Sunday the 29th of September… one more day to go.

Broad Commodities (GSG) -4.96%

S&P 500 Large Cap Growth (IVW) +3.10%

S&P 500 Index (SPY) +5.33%

Dow Jones Industrial Avg (DIA) +8.66%

S&P 500 Large Cap Value (IVE) +8.59%

Small Cap Value (IWN) +9.81%

Small Caps (IWM) +8.97%

Emerging Markets (EEM) +9.44%

Europe/ Developed Intl (VEA) +7.50%

Long-term US Treasury Bonds (TLT) +8.45%

10 YR US Treasury Bond (IEF) +6.01%

Silver Bullion (SLV) +8.62%

Clean Energy Index (ICLN) +10.89%

Gold Bullion (GLD) +13.96%

Real Estate (VNQ) +16.36%

So, what we witnessed in the 3rd quarter was a clear change in leadership from the top two indices shown in BOLD Yellow, which dominated the markets in the first half of 2024, to an environment that is far broader-based and productive across multiple asset classes. Commodities were the only losers for the quarter, but they are still consolidating some of the huge gains of 2023 and are now looking very constructive – more on this in a minute. It was a great quarter overall, and our clients should be very pleased with results given that we are fully invested across a majority of the asset classes shown above (outside of the top two 😊). If we are listening closely to the markets, we notice a few things:

Treasury Bonds have been outperforming the mighty S&P 500 since about July 10th

Gold is outperforming everything – again, still, in the short-term, intermediate-term, and long-term!

Small Caps are doing better than large caps

Real estate has entered a new bull market coming off two years of declines

Emerging Markets just woke up, driven by a massive new stimulus package in China.

Value has again taken over leadership from Growth

On the last point, it’s critically important to note that value (IVE) has actually been outperforming growth (IVW) in total returns since September 2020. This is the dominant four-year-long “regime” for the markets. I only mention this hard fact because so much of our attention, focus, and capital still seems enamored with the large-cap growth story, which includes the “Magnificent 7” stocks. Indeed, several individual tech names like Nvidia have dominated everything by a wide margin in recent years, but the aggregate performance of large-cap growth compared to large-cap value has been underwhelming. Here’s a 4-year total return chart for those who are shaking their heads.

Value (IVE) in RED

Growth (IVW) in GREEN

There is a good lesson here about risk and return. As investors, we are told that if we take greater risks, we can expect greater returns. Said another way, volatility is the price we pay for returns. The longer I’m in this business, the more I find this mantra to be false. There is no guarantee of greater returns, just greater volatility. Similarly, we also know that compounding is one of the greatest forces of modern wealth accumulation, and volatility is the clear enemy of compounding (see above). The chart above speaks loudly.

Last month, I noted the likely change in the business cycle from Stage 6 angling toward Stage 1, where bonds take the lead. This seems to be happening as well and became pronounced in the 3rd quarter, but we remain watchful and skeptical about the durability of this move in the bond market given the underlying, cost-driven, supply-side drivers of inflation that are still percolating in our economy. This brings me to the main topic of today’s update.

Bigger Issues Than the Outcome of the Election

As I said in the preamble, it is critically important for investors to understand the market and economic regime as a framework for all decisions, asset allocation, expectations, etc. What do I mean by regime? I am talking about the general environment, the stage of the business cycle, and investors’ appetite to expose themselves to stock market risk, inflationary, deflationary, and other macro variables. There are “Seasons” to the market and our economy, just like we have Winter, Spring, Summer, and Fall. How many of us check our weather apps daily to help decide what to wear or what we can expect if we plan to do some outside activity? I certainly do.

Today, all eyes are on the US presidential election. But it’s important to note that, beyond the social and global implications, presidents themselves tend to have very little impact on market trends. I am regularly asked what will happen to the markets if Trump or Harris is elected. The answer is that you’re asking the wrong question.

The real question we need to address is the fact that we are still running the highest fiscal deficit in history, specifically a $2 Trillion budget deficit which represents over 5% of total GDP, on top of the highest level of U.S. Debt in history.

The ramifications of our current debt and budget deficits are significant today and more so in the years ahead. This factor alone is likely to shape the market and economic regime and consequently dominate policies for the next few administrations regardless of their political leanings.

What are the ramifications? I’ll try to make this simple.

- The current annual interest expense on our government debt is larger than the entire defense budget.

- Neither Republicans nor Democrats seem willing, interested, or able to cut our spending as a nation. The very base of our economy is rooted in government spending, stimulus, low taxes, and cheap money. We have approached a time and place where the Federal Reserve and the Treasury Dept are running out of options to defend against any form of economic downturn.

- US Treasury Bonds are not going to be a dependable asset class looking forward. Sovereign nations are net sellers of US Treasury bonds and switching to Gold and Silver for their reserves. This is a clear response to our irresponsible governance and spending habits at the federal level.

- Gold, mining stocks, and industrial metals need to be part of a modern portfolio.

- The magical results generated by a 60% stock/ 40% bond portfolio in the last 20 years are not repeatable looking forward.

- There is a high likelihood that inflation will kick up again quickly in this new economic regime of historically high debt and deficit spending.

- Social Security, Medicare, and net interest expenses are all increasing our fiscal deficit annually with retiring baby boomers and will require some uncomfortable reform or austerity measures in the next 7-10 years.

- Taxes will have to go up to balance the budget, it doesn’t matter who is in the White House.

Barrons ran this article over the weekend:

Gold Rally Is Sending a Warning. It Relates to the U.S. Debt

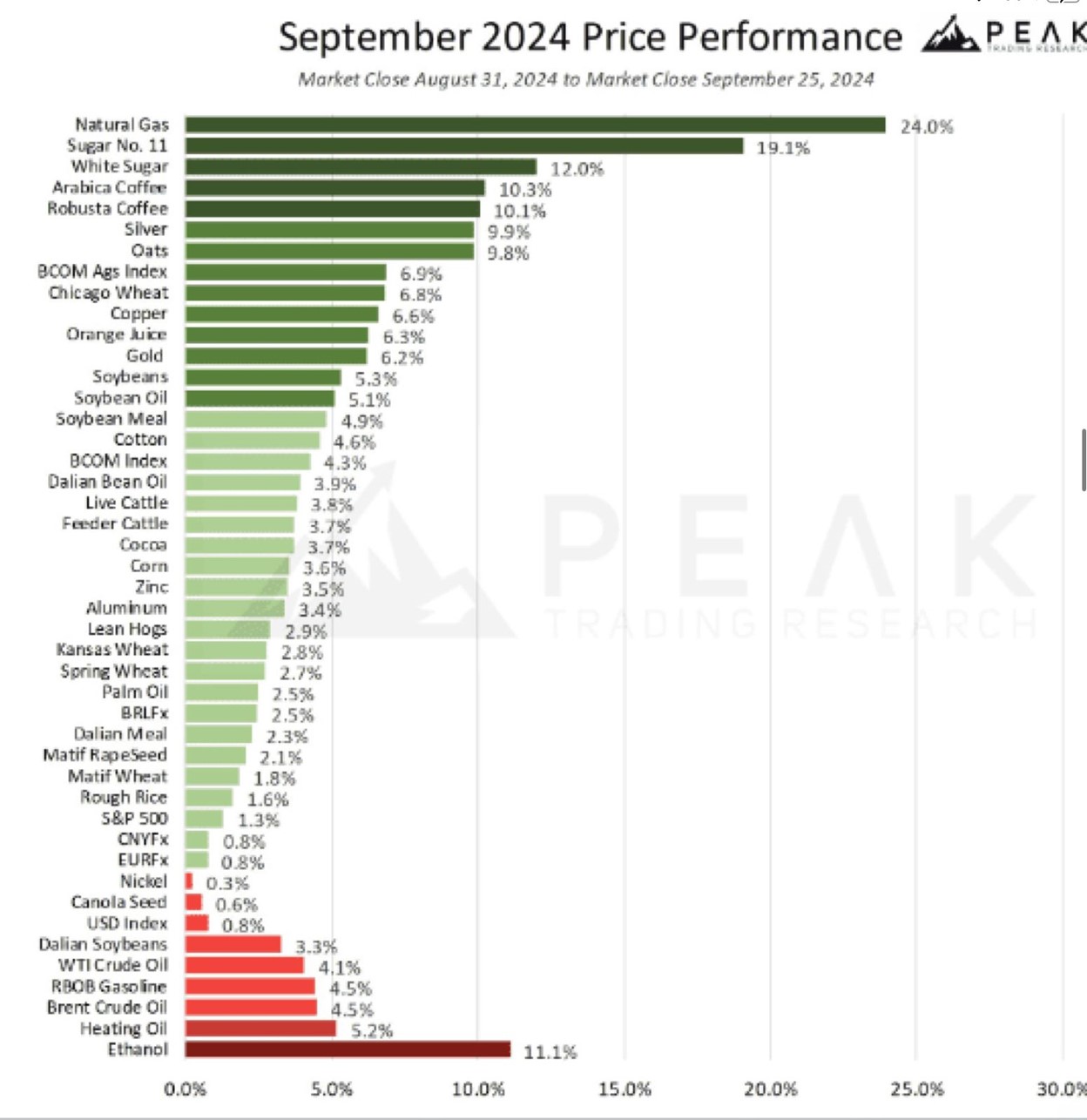

Commodity Prices Are Way Up in September

As a confirming input variable, I want to finish with a quick update on commodity prices. Our current variety of inflation is less demand-driven and more cost-driven. I’ll explain. The Fed has done a great job of containing the demand driven type of inflation but look at what is happening on the cost side of inflation. Commodity prices continue to march higher with the sole exception of oil and gasoline.

I’ve said for several years now that the Fed has little control over the real drivers of inflation. These, again, are cost-driven variables: Things that add cost to our prices (aka inflation) and things that will not yield to changes in interest rates.

- Climate change adaptation – Hurricane Helene!

- Nationalism, reshoring of manufacturing and tariffs – Inflationary!

- Geopolitical conflict and wars

- Retiring baby boomers leading to higher entitlement costs

- Shortages in housing stock

- Shortages in raw commodities

- Mandatory infrastructure spending

- Absurd levels of US federal debt and deficit spending

As I write, we are already seeing some signs that inflation is bottoming even while the economy remains soft. This would be an unwelcome development, obviously, especially since we haven’t solved the real problem of our Federal Debt and Fiscal budget deficit.

The summary statement is this. This election will matter a great deal, perhaps more than any other, in terms of the direction of our country and the very foundation of our democracy. But, from a market and economic perspective, investors would be wise to focus more on the current regime, which is dominated by cost-driven inflationary forces punctuated by our fiscal deficit. When the weather starts getting colder and Winter is on the horizon, we simply select from our cold weather clothes options and put away our summer gear. This change in regime is a change of season, no different.

This is complicated stuff, and honestly, most investors have very little understanding of how to reconstruct their portfolios to accommodate. This is what we do for our clients, so they don’t have to worry about it. We make the changes and reallocate as needed in our tactical investment strategies. Please reach out if you need help.

I’ll leave it there for this month.

Thank you to all of our clients for another great quarter. We appreciate your trust and confidence and look forward to seeing you at our virtual annual meeting on October 24th at 5:00 pm MST. Don’t forget to register for the event!

Cheers

Sam Jones

President, All Season Financial Advisors