Yes, it’s that time again and I almost hate to add to the pile of market commentary out there. But you asked, so we’ll answer. What do we see happening in the financial markets for the rest of 2021?

Planning First!

Will Brennan, our lead advisor and in house certified financial planner would be upset if I didn’t preempt any market discussion with a quick reminder. Our approach to financial planning has changed with Will’s addition to our team. Instead of starting with investments as a means of maintaining our standard of living, we start with an observation of current income, expense, debt, total assets, and work from the top-down factoring in current investment returns, inflation, and personal longevity assumptions. We seek an answer to one simple question; What are the odds that you will outlive your money? With the E-Money Advisor software, we can offer some pretty detailed projection work to find that answer. If investments need to be changed to make the plan work, then we have a real, unemotional, and empirical reason to make a change to become either more or less aggressive. Planning first, then adjusting your investment mix to ensure success is the right approach. Let’s all keep that in mind for this update as I dive in the murky water of the financial markets.

Markets in the Second Half

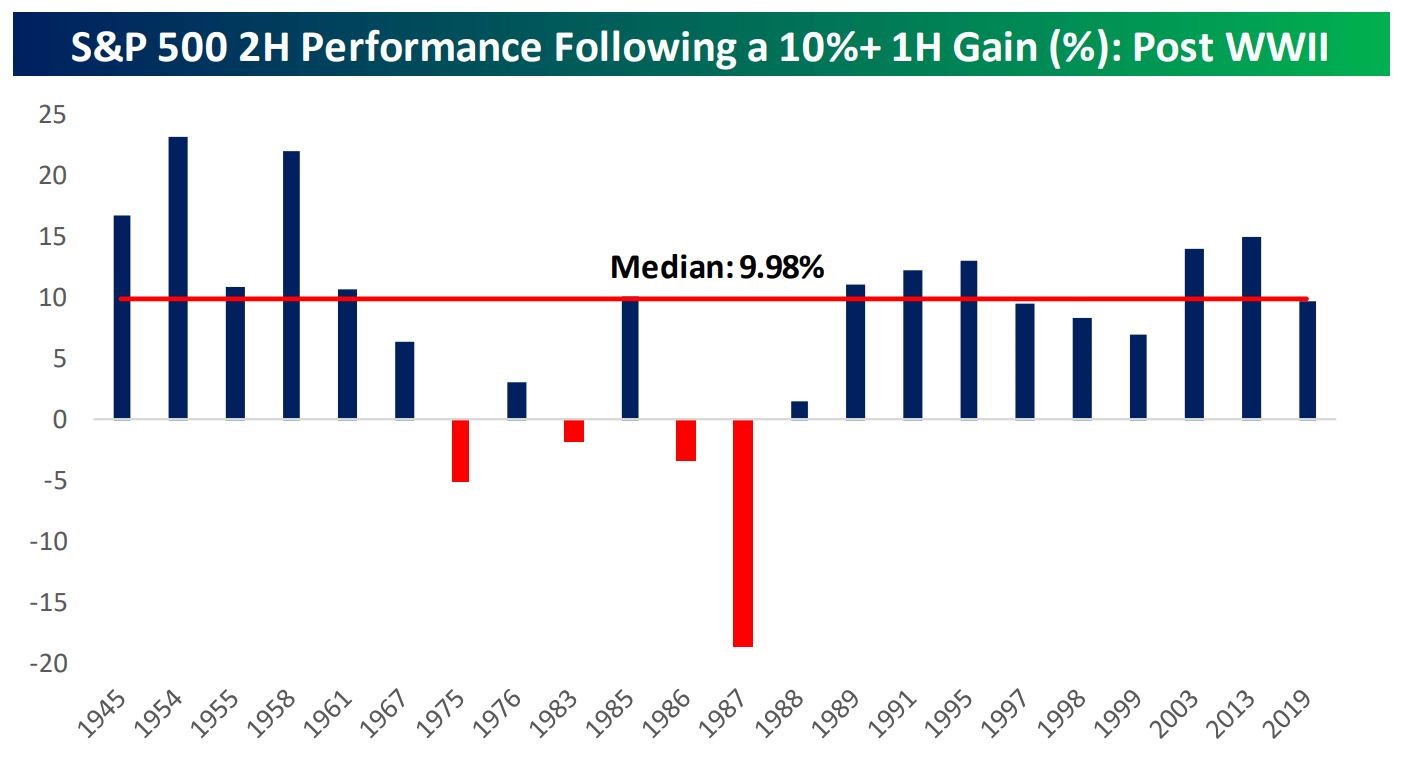

There are a reasonable number of representative big market gain years like we just experienced in the first half of 2021. In fact, there have been 23 years since 1945 when stocks generated more than 10% in the first half, or roughly 31% of all years. Bespoke did some good work on the historical pattern following such strength in the first half. History says it’s going to be a good year and we might expect up to 10% in additional gains from here.

Bespoke Investment Group – Equity Market Pros and Cons, July, 2021.

Not to be the glass-half-empty guy but you might also note that all the red negative bars from 1975 through the crash in 1987 were dominated by stiff and persistent inflationary pressures on the economy. Now that inflation is with us again in a big way (transitory or not), we must respect history and the higher potential for negative results.

Regardless, the second half of 2021 is going to be more volatile than the first half but that just means we all need to buckle up and live with more up and down price action, not necessarily the end of the bull market – far from it. New volatility showed up in March and again in June. The easy money was made in January and February. The same conditions that were established in September of last year, exist today. Specifically, stocks and commodities are trending strongly higher, global bonds are flat to down. Within those asset classes, we see the primary trend of Value investing styles taking a long overdue rest while the growth side of the market is taking up some slack. Similarly small caps are resting, while large caps are playing a bit of catch up. Commodities are just up, up, and away. I do chuckle when I see comments to the effect that commodities have peaked based on the recent correction in the price of lumber.

…. Uh no

Commodities in aggregate, led by energy and materials are nearly straight up. Let’s not make this harder than it needs to be by picking on a few weeks of soft price action in a subset of commodities like lumber, or even copper. The world needs raw materials and will need even more as infrastructure bills are passed in congress. This is a new bull market in commodities after 12 years of deterioration and price declines. Furthermore, this is the first correction of any magnitude since April of 2020 in an asset class that is magnificently under owned and underrepresented in investment portfolios.

Investors would be wise to buy pullbacks until further notice. I would draw special attention to agricultural commodities as well which are also seeing a very minor correction within a very strong uptrend. We plan to add to our position in Rogers International Agriculture ETN (RJA) in the next few weeks.

Bonds are ok for now but the outlook is still pretty thin and unimpressive through 2021. The Fed is really working overtime to keep rates low, while doing some behind the scenes tapering through the REPO cash markets. Effectively they are still buying their own bonds very publicly but selling them at the same time out of the spotlight. They are worried about inflation but don’t want to spook the financial market by raising rates or doing anything that would upset the economic recovery in place. We are trading Treasury bonds only, not investing in them.

Opportunities for the Second Half

In the second half, we see a lot of opportunities but investors are going to have to be very specific about what to own and when to buy. Here are a few ideas.

- Europe and Emerging Markets

Growth and valuations in both areas of the globe are far more attractive than the US. This is a time to carry an overweight position ETFS like EFA and EEM. We would caution that the US dollar is currently on the rise making things a little difficult in this space but this could create an opportunity to buy into the summer for those looking to diversify out of the US a bit.

- Financials, Energy, Industrials and Materials

These are sector opportunities that can and should be bought selectively on pullbacks in the 3rd and 4th quarters of 2021. Several of these value sectors are correcting now but these are the classic cyclicals that should continue to ride the path of economic recovery and infrastructure spending. Disruptors include out of control inflation and change in Fed policy, a change in control in the House or a new painful tax regime. These are not clear and present dangers.

- Gold and Crypto

This opportunity is highly dependent on the direction of the US dollar. Gold and all crypto currency investments have been under rounds of heavy selling pressure since the beginning of the year. Bitcoin is down -47% from the highs in February, Gold is off its June high by -6.5% and gold miners are down about -13%. From a trend perspective, this would be the time and place for any form of currency alternative to find support and begin moving higher again. Given inflationary pressure and the Federal Reserve’s predicament with monetary policy, we still like the opportunities looking forward.

- Return of the Consumer

It’s hard to believe given the thrust in spending we’ve already seen since May, but consumer spending is still poised to jump higher in the second half. As supply chains free up for finished goods, clothing, sporting goods, furniture, etc., the problem of scarcity of items for sale is going away. Mind you, we don’t think that will ease pricing as much as give consumers their first opportunity to buy what they want for the first time since the pandemic started. Our local Lululemon store may be going to a reservation system for shoppers just to manage crowds. (LULU – wink). The same goes for airlines, hotels, and restaurants. The problem from here from an investors’ perspective is that these stocks have already seen explosive price moves over the last year. There is no immediate opportunity here but the consumer discretionary sector should be on your watch list, looking for significant pullbacks to buy.

- Dividend Payers + REITS

As interest rates remain pegged near zero with a Fed that has no options but to keep them there, we should all learn to love and hold high dividend paying stocks. REITS are another perfect option that tend to pay some of the highest dividends and offer a healthy hedge against inflation. These are gold in this environment, stick with them.

Stock Market Versus a Market of Stocks

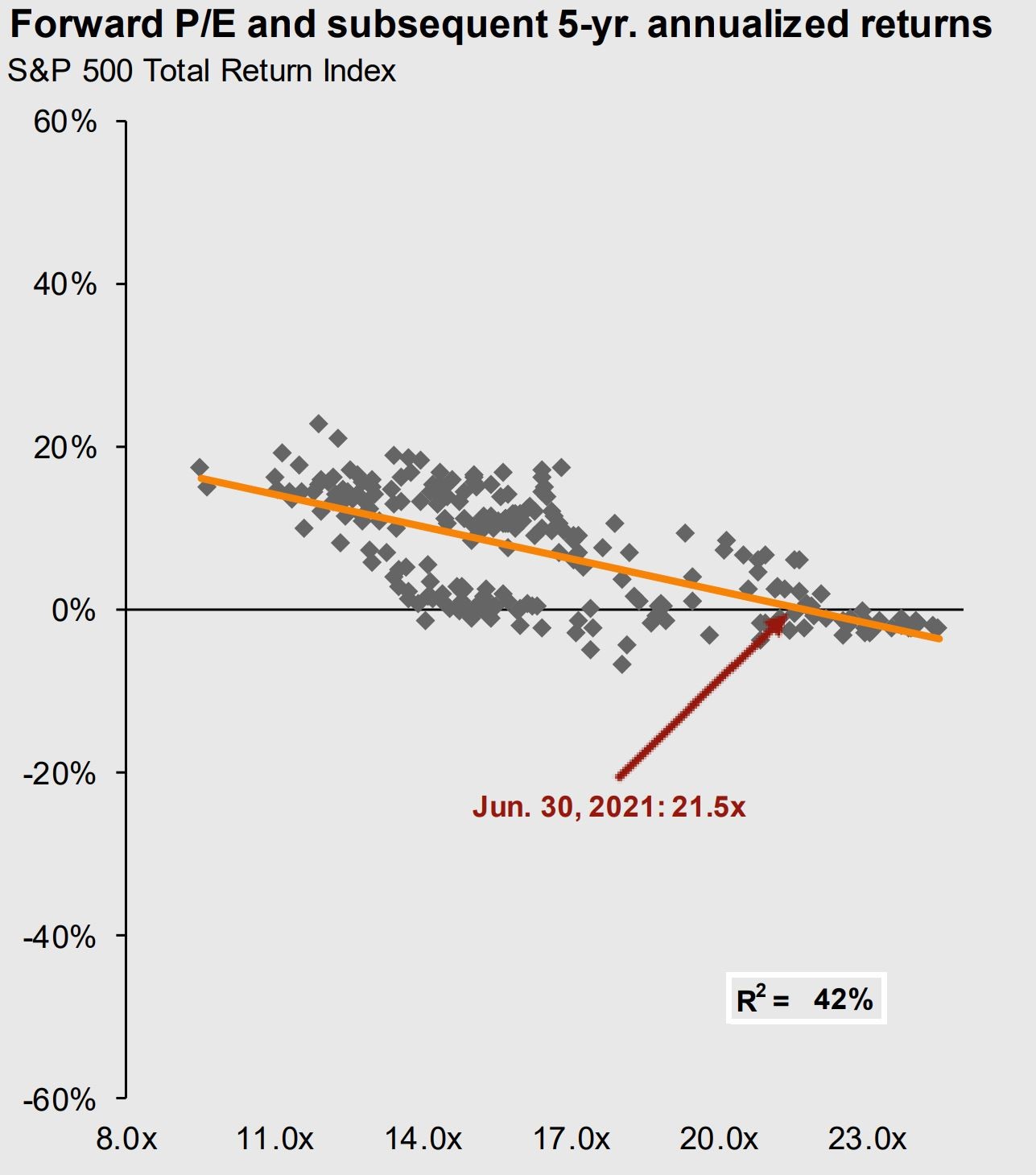

People always ask what the stock market is going to do next. I couldn’t tell you, no one can. What we can see and identify clearly are price trends, valuation differences, sector strength and weakness as well as macro variables that will directly impact parts of the financial markets. We believe, with solid evidence, that the environment for investors changed dramatically in late 2019, early 2020. Specifically, we moved from an environment dominated by the performance of broad index investments to a market that offers great opportunities for investors willing to be more selective about what they own. If one is simply committed to owning “the market” through any index strategy, you will experience higher volatility and lower returns for the next 5 years than any time in the last decade. It’s just math according to the work of JP Morgan (Guide to the Markets Q3, 2021).

Owning the market through index investments is not wrong mind you, even as a core piece of your portfolio. But the tide is turning now and there are huge opportunities to generate non-correlated, high risk adjusted returns if one is willing to look at the markets through a more selective lens. In our shop, we build complete portfolios that include thoughtful indexed strategies while blending in more active, selective, and non-correlated investment strategies. The magic is in maintaining the right mix of both approaches for your situation.

That’s it for now. Thanks for reading.

Sam Jones