Looking Back

It certainly has been an eventful first half of the year. There has been a lot more movement in markets— both up and down. We wanted to give you a few bullet points on what has occurred so far this year and where we see opportunity going forward.

*The performance graphics that follow come from Bespoke Premium research and represent YTD performance figures through 6/30/2018.

A couple things to note:

- Volatility is on the rise. The calm of 2017 was highly unique to the point of setting records. There were no significant drawdowns in stocks and bonds were stable. Those days are gone. Be prepared for more movement in your portfolios as we return to a more normal market environment.

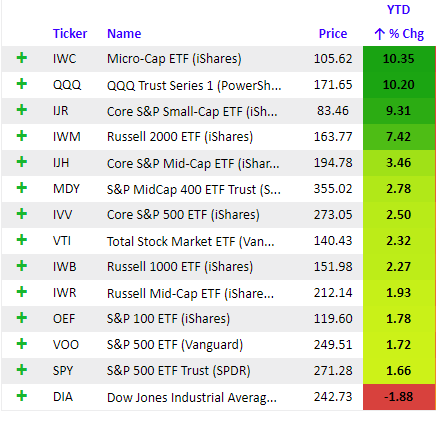

- Most global stock markets were lower the first half of the year. See the graphic of non-US markets below. The All Country World Index Ex-US was down 3.8{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}. The S&P 500 was a bright spot finishing up 1.66{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}.

- There was a big performance difference between small cap and large cap stocks, not to mention technology shares. US small caps were a solid winner through the end of June. We held small cap positions in Worldwide Sectors and in our Blended Asset models to take advantage of this out-performance.

- There was a wide disparity amongst sector performance here in the US. Consumer Discretionary, Technology, and Energy did well. Consumer staples did poorly.

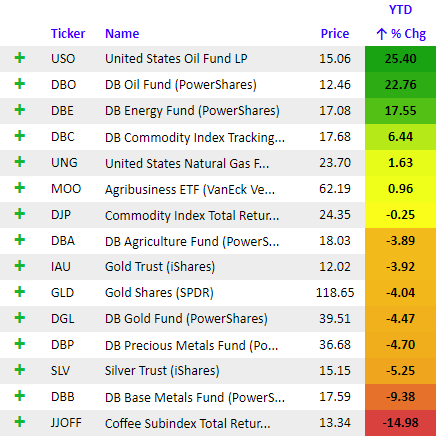

- Commodity indices were positive, but almost wholly due to the rise in oil prices. Many other commodities were down, and in some cases, by quite a bit.

- There weren’t many places to hide in bond markets. Only short-term bonds, bills, and floating rate bonds provided any respite. US credit markets continued to act poorly, and even long-term US Treasuries were down 4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}. Emerging markets were even worse. The Barclays Aggregate, the most commonly used benchmark, was down 2.75{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}.

- Our net exposure model got more defensive on equities at the end of the quarter. Our goal is to preserve capital until there are better trends and valuations to exploit.

Looking Ahead

Despite most global stock and bond markets ending the quarter on a lower note there are some potential opportunities building.

- There could be a great opportunity to rotate out of growth into value. That relationship looks stretched relative to its history.

No one knows when this trend reverses, but it invariably does— and usually out of left field. Nothing lasts forever.

- If we are indeed late in the economic cycle, commodities and the basic materials sector should start outperforming. We can take advantage of that through some sector bets in our equity models and through outright commodity positions in our Blended Asset programs. We will likely look to do both if the signals line up.

- If stocks do get volatile and credit spreads widen, we will be on watch for opportunities to add corporate credit back into our Income models. These are great opportunities for us to add excess return over a passive approach.

- The message is that, while we are a bit cautious on broader stock indexes, we still see some opportunities to make money. As always, our investment process and approach to risk management will guide the way.

Enjoy the rest of your summer and stay cool!

Sean Powers, Chief Investment Officer