February 27, 2023

It’s that time again. Time to discuss cash and how it fits into your financial life. Cash is becoming the new sheriff on Wall Street as it hovers at that magical 5% level now available in money market funds and short-term T-Bills. How should we think about cash, right here and right now, in light of other opportunities and our trajectory towards recession. Everything you’ve been asking yourself right here and right now, right?

Detour!

Let me take a few minutes to talk about the market action in the last month before we dive into the cash discussion. I should have seen it coming. No trend occurs in a straight line. Nearly to the day following my last update, the Federal Reserve chatter box and a few marginally inflationary economic reports forced the financial markets on a detour from our path toward recession. The February detour has been a little painful frankly, more so than indicated by the major averages. The US dollar moved almost vertically higher for the month beating up our international exposure and anything in the currency hedge world including our gold positions. Meanwhile, bonds of all sorts, fell out of bed and are now crying on the floor as the notion of “no recession/ no landing” seems to have entered the psychology (I am laughing out loud right now… and crying on the floor). Speculative stocks with no earnings, super high valuations, disastrous balance sheets and no worthwhile business models, also took the beatings they deserved. The broad US stock market indices also gave back a chunk of what was made in January BUT, the uptrend that began in October of 2022 is still intact. In fact, from a technical perspective, most indices broke into new uptrends in January and have simply pulled back to a nearly perfect, textbook new entry point if this level holds. This appears to be a healthy short-term pullback within an uptrend – my favorite! Obviously, the next two weeks will be very important for the state of our “relief rally”.

So, February has been a detour. The road ahead seems pretty clear to me. The US is still headed toward recession but as we’ve just seen, it’s never a straight path. Let me explain the situation using a highway analogy.

We (the economy, GDP, spending) were on the highway travelling at 100 miles an hour from 2020-2021. Then our engine got a little hot (inflation) and we needed to slow down a bit. In 2022, we slowed from 100 to 60/mph. Now, in 2023, we look out the window and relative to 100 MPH, it feels like we could get out and walk, but we’re still going 60 miles an hour! Smoke is still coming from the hood; our check engine light is still on. We need to slow down more but we’re still movin’ pretty fast right (says the Fed)? The Fed is committed to having our vehicle stop in a complete parked position. They have said as much many times. They will raise rates until they break something and that something is the US economy. You see, they know, and we know that inflation will remain a problem until demand falls dramatically and the only way to crush demand is to put our economy into a recession. Failure to put the economy into recession quickly will lead to a more entrenched and longer war with inflation and eventually lead to catchy 2024 campaign slogans like that of Dwight D. Eisenhower in the early 50’s.

The Fed simply cannot engineer a soft landing because inflation will just flare again.

Remember, we are following the 70’s playbook again. Inflation AND recession will dominate the environment. 12 months ago, I wrote about Stagflation (stagnant economy with inflation). That’s where we are, I have no doubt. So, the road to recession, with persistent inflation should mean SELECTIVELY higher stock prices until the Fed finally buckles and considers dropping rates which might not be until 2024 at this point. More on this in a minute. Bonds can do OK but won’t really get much traction until recession realities become more dominant. Commodities are going to chop lower as the economy gets weaker and weaker in the months ahead but could do ok in light of inflation. That’s just how it happens, once we get back on the road and off this detour 😊. My advice don’t take the detour. Stick to the road with your portfolio allocations.

Cash and an Investment Choice

Ok here we go. Today we find ourselves in that always intriguing moment for those who like the idea of stable, risk free 5% returns on their money. I will say with confidence that the vast majority of investors, especially those on fixed incomes, retired, or highly risk averse investors might find cash (money markets and T-Bills specifically) very attractive now. After all, if we’re heading toward recession and stocks are all over the place, why not just sit back, collect interest and wait it out? Let’s talk through that emotion.

First, I hear you. There is a case to be made for carrying higher cash for a portion of your portfolio now that’s it’s earning a higher yield. The best bonds out there in terms of yield are bonds with maturities inside 1 year. Longer term bonds have higher price risk and lower yields making them relatively unattractive. Meanwhile, money market funds are paying 4.12% annually! I can certainly make a case that assets sitting in cash earning at least 4% are just as good or better than your best Treasury bond paying the same rate but with price and maturity risk. In other words, I’d rather sit in fully liquid cash than Treasury bonds or even T-bills of any sort and our portfolios reflect that choice. Clients might recognize that we have exited our few remaining Treasury bond positions bought last October and have a higher “cash” position where we are now earning reasonable interest every day.

Cash in the Bank

You can also do a little searching and find banks paying slightly north of 4% in “high yield savings” with no fees and no minimums. We haven’t seen this since 2007. But here’s the problem. Bank money is not ready to invest. It must be moved into a brokerage environment where you can make a different investment if and when you choose to do so. In my experience, money that lands in a bank, tends to stay in a bank even while stocks might be ripping higher for months and years on end. There is a certain amount of energy, conviction and definitive action that is required for one to move money between institutions. That conviction is rare and money in savings tends to sit there for a long, long time. Again, sitting and earning 4% is not terrible but let’s consider some comparative realities.

Cash Does Not Earn More Than Inflation

If you think about how interest rates on cash are derived, it comes from the Federal Funds rate, controlled by the Federal Reserve. And the Fed Funds rate is dictated by perceived inflation. Their job is to match the Fed Funds rate with their perceptions of the real rate of inflation. Ergo, yields on cash will naturally tend to match changes on the real cost of living. To some, that’s a great hedge against inflation. To me, I look at that prospect as a game that can’t be won. If you had 100% of your liquid wealth in cash, you would never have an opportunity to increase your wealth in real terms, or net of inflation. Now, if you have all the money you need to cover your living expenses to your last day of life and die with 0.0 dollars, then you’re all set! But some people want to leave some of their wealth to family or charities. Some don’t want to risk running out of money before they die. Some might not feel so confident in their assumptions about anticipated costs of living down the road. Some might live a lot longer than they think. Some might know after many years on this planet that inflation is grossly understated in our country and cash will only track stated inflation rates (which excludes “volatile” housing, energy, food and nearly anything you actually need to spend money on). You get the point. It’s not quite that simple and there are a lot of unknowns and risks associated with a 100% cash position.

Cash Versus Stocks

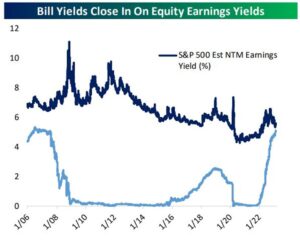

As I said in the prolog, we have moved to an intriguing moment in time. Take a look at this chart from Bespoke (www.Bespokepremium.com).

What you see is that the yield (or interest) on a T-bill (or cash) has approached the estimated earnings yield on the S&P 500. The earnings yield is the inverse of the Price to Earnings ratio. Said another way, Cash is just about as attractive as the prospects of owning the S&P 500 considering estimated future earnings of the underlying stocks. Hmmmm, why would we want to own stocks? Well, here’s where we need to be very careful with our investments and allocations outside of cash. First let me state a few realities.

- There are many many stocks that are trading at historically low valuations where this comparison wouldn’t be the same. These are the deep value names and themes we’ve discussed, and I can’t say enough or with enough conviction that investors should stick with value and avoid any type of security that is overvalued or has an “earnings yield” below 5%. We have populated our stock portfolios with value plays, first and last.

- In a stagflationary environment, we can still own stocks of companies who offer “must have” products or services and therefore have pricing power. Companies like Microsoft and Apple will do fine because they can charge whatever they want, and we’ll still use them. Grocery and restaurant? Yes, we’ll pay for both. Energy? Yes, at any price, Healthcare and Utilities of course. Consumer discretionary is…. Discretionary and has almost no pricing power (avoid). Financials, banks and brokerage can all do well as higher interest rates can be good for business. What you see is a lot of sectors that will continue to push higher in this environment, but we must be selective about what we own with each. Stock pickers have a great chance of making solid returns here.

- The market in aggregate is trading at a significant discount to the highs of late 2021. I personally don’t believe the discount is enough to call this a screaming buy, but a discount is a discount.

- The markets do tend to rise and have a positive return bias over time. That is simply fact when looking at any time period beyond 3-4 years. Owning a low-cost S&P 500 index ETF for the last 10 years would have generated almost 10% annualized returns including three bear market losses since 2018! If we are highly risk tolerant and can get ourselves to buy the big dips, the returns are there.

- There are also a lot of options beyond owning common stocks found in the S&P 500. We can own REITS, high yield corporate bonds, preferred securities, convertible securities, dividend paying stocks, and internationals, all of which are generating returns or have yields higher than inflation and cash.

I believe in my heart that a well-constructed and selective portfolio of securities with a value and income bias, will outperform both inflation and cash from here. Cash might feel good now as a safe haven and a means to avoid potential risk of loss in stocks. But as Keith Fitz-Gerald of KFG Research said in an interview I heard this week,

Missing opportunities is always more expensive than trying to avoid risks you can’t control.

Cash Versus Real Estate

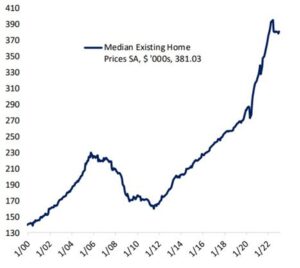

Here’s the situation with real estate that everyone knows. Most homeowners today purchased their properties when rates and affordability were far more attractive (pre – 2020). The last great moment to buy real estate was in 2010 with the option to refi your mortgage rate to below 3% somewhere around 2019. Cheap real estate prices in 2010 and historically low borrowing rates have both been a huge boon to household wealth at least on paper. Gains since 2010 have been ridiculous and unsustainable, especially since 2020. Here’s a picture of current pricing again from our friends at Bespoke.

Affordability by any metric is really just the inverse of this chart if you can imagine that. Now, the market is frozen as buyers and sellers are at a standoff. Sellers won’t sell and give up their sweet mortgage rate and buyers can’t afford to buy at todays prices, unless they are paying cash or are economically insensitive. So, sales are falling off a cliff. This also from Bespoke.

The ONLY way for this situation to reconcile is for prices to fall to a point where affordability becomes more reasonable. Rates can even fall from here, but it is unlikely to affect sales really until prices come back to earth. Today it takes 80 hours of monthly earnings on average to cover the mortgage on a house for today’s median prices. That’s a level not seen since the late 70’s.

Back to the Discussion on Cash

Should you use cash to buy real estate? Well, now that cash is earning 4-5%, we must have remarkably high conviction that real estate prices are going to go up at least 5%/ year for the foreseeable future. I don’t see that happening any time before 2026. We also have to consider carrying costs with real estate. In May, property owners will be shocked to see their new tax bills associated with the newly assessed values in their properties. Expect to see 25-30% increases in your property taxes conservatively. Utilities are up 11% year over year and maintenance costs are up about 10% year over year. Homeowners insurance is up 7% year over year. It’s getting expensive to carry a home to be quite frank. So, all told, using cash earning 5% to buy an expensive piece of property that is likely to depreciate in value and is already seeing strongly rising carrying costs makes zero sense to me. Every situation is different and real estate is one of those emotional things so I’m sure I’ll get blasted for saying this, but these are the facts today as I see them. What a wonderful time to rent!

I’ll leave it at that. Please feel free to reach out to us to discuss your individual situation or any decisions you might be considering. We want to be your first call when you need help!

Spring is coming!

Sincerely,

Sam Jones