Welcome to the 4th quarter of 2019! If you think the last 22 months have been exciting, just wait for the next 12 months. One year from now, we’ll be so sick of Federal election junk, we’ll all want to go back to tribal rule with lords and fiefdoms. Already there? October is one of those turning months. We have seen a larger than average number of significant bottoms in markets as well as the beginning of crashes and devastating bear markets begin in the month of October. This is the edgy time when smart investors will focus keenly on the scales of bullish or bearish readings to plan their next course of action. Let’s take a peek under the hood of the markets to help us find the edge.

Still No (Good) Leadership

As we’ve mentioned many times over the last 14 months, we are still seeing the recession sectors lead the market. Lead means, losing less on the down moves and making more on the up moves. Specifically, these investment themes revolve around consumer staples, utilities, and real estate. Healthcare is suspiciously lagging behind its own recession team and I suspect Elizabeth Warren’s rising prospects, has something to do with it. Personal opinion – the chance of free healthcare for all in the US is zero, ever. Healthcare and the many subsectors, are simply too much of a profit center for “it” to ever give in to a socialist type agenda. Capitalism in the US would have to end first and then healthcare would be the least of our problems. But I digress. Today the US stock market is still range-bound as you can see below.

We’re approaching the bottom of the current range which I marked with a red line because that may be a fine place to look for a solid buying opportunity. But there is also a larger trading range in play marked by the lows in December of 2018- white line. If the approaching lows are going to hold and serve as the springboard for our next move higher, we’ll need to see the growth/ cyclical sectors take over leadership very soon. Those are financials, industrials, technology, energy, and consumer discretionary. So far nothing. If the short-term bottom does not hold, the odds increase substantially that prices will work toward the deeper discount (-20{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}). The blue line in the middle is one that I inserted as a reference to mark the high of January 2018, 22 months ago. As we close today, the S&P 500 has gained a total of 0.50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} since then. I know, this all makes your eyes and your head hurt.

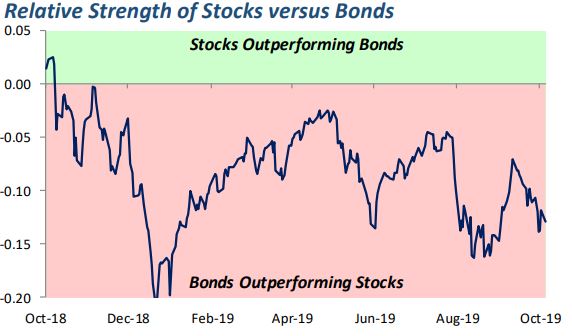

Bonds Still Outperforming Stocks

This is really the only chart anyone needs to follow.

Honestly, what’s the big mystery? Own bonds, lots of them, when they are outperforming stocks. If and when the relationship changes, we can shift back to owning stocks in bulk. But really, we have no reason to do so yet. In fact, with the nasty close in stocks today, municipal and mortgage-backed bonds, just went back on a buy signal for us. We bought more of both today. We continue to own core positions in intermediate and short-term treasuries.

Recession Risk Still on the Rise

Why are bonds outperforming stocks? Because recession risk is on the rise and investors want to own safe income-producing things like bonds before and during recessions. However, there is a timing issue that is critically important to know. When RECESSION is finally labeled in the US, it is often the time to sell bonds and begin looking to buy stocks. Remember that the financial markets are just a basket of prices moving around with expectations about the future. You’ve already heard about recent ISM surveys coming in very weak. You’ve heard the stories about high-end real estate markets already falling in price by double digits year over year. You’ve heard about the export numbers making new lows while manufacturing has all but stopped. GM workers on strike, etc, etc, And now, our nervous employment numbers are starting to show more signs of weakness last week. The yield curve went negative in May as you also know. There is a lot of empirical evidence pointing to recessions being recognized 10-12 months after a yield curve inversion. So, if our trajectory doesn’t change and we do the math against a calendar, we should expect formal recession headlines in June 2020 and a final top in stocks in the early spring of 2020. Trump will do everything in his power to keep the wheels on until elections including forcing the Fed to drop rates aggressively and that could be the short-term catalyst for temporary higher highs in the months to come (year-end rally?). But we have already seen that more rate cuts from where we are now, are not going to keep prices rising sustainably all by themselves

If we put everything on the table, we begin to recognize that the stock market is reflecting what we see on the fundamental and economic cards. Stock prices have gone nowhere in over 22 months reflecting an economy that has been gradually getting weaker for as long, very gradually. Conditions can and will change frequently, but for now, our investment portfolios should simply follow the leadership (pre-recessionary stuff).

In our world of dynamic asset allocation, we don’t need to make a big bold bet on the future. We simply follow trends in asset classes, sectors, internationals, and so forth. We do not need to defend a position on the markets or the economy because we do not stake ourselves to any specific outcome. Forecasting is for those who need a lot of attention. Now that owning index ETFs and trading them is free (Thank you Schwab!), dynamically adjusting your index holdings toward leading stuff makes sense, right? That’s what we do and have done for the last twenty-five years.

Just a quick check-up on conditions as they stand today as we move into the edgy zone of the year.

Have a great week

Sam Jones