Client Driven Q and A (Continued)

Of course, any conversation these days with clients can’t finish without discussing the BIG question; What’s going to happen next year?

I’ll take a stab at it as my one and only 2018 Investment Forecast.

Reversion

Admittedly, market returns in 2017 came in about 5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} higher than even the upper end of our range of possibilities offered in January of last year. Things change during the year making forecasting generally a foolish, grandstanding venture. I don’t know why we even do it as we’re strictly trend followers by nature. Forecasting is inherently predictive, quite the opposite of trend following. Anyway, things are pretty stretched to say the least across multiple asset classes, which presents a clear moment for us to identify obvious risks and opportunities. When any of these plays out is anyone’s guess, but they will happen eventually. So this Investment Forecast will be a bit different. I’m not going to talk about S&P 500 price targets or timing of market peaks and troughs. Instead, I’m going to focus on a simple theme of reversion and let the markets work out the details of when all of this will happen. It might even happen in 2018!

When we speak of reversion in financial market terms, we’re generally talking about a thing moving in a reverse course back to some form of normal place from an extreme place. Now a thing can be a security like a stock, an asset class, an industry sector or even a country-specific index. A thing can also be a behavior, specifically among the market players. And finally a thing can be a policy stance from a central bank. Let’s open our minds and look for “Things” that are stretched far to one extreme and likely to revert back to a more normal level.

Bonds are Ready to Revert

I’ve said this many times in the last several years but the potential for wealth destruction in bonds of all sorts with only a few exceptions is likely to be larger than any other asset class. I am talking about a historic moment for the economic textbooks, which will look back at 2017 as perhaps the last chance to sell bonds before losses became real and almost unimaginable according to modern era standards. European bonds are the worst offering of them all and I cannot fathom how the ECB will get out of trouble gracefully. The ECB is the only buyer of European bonds left in the world. I’m going to say the odds of a sovereign credit market default in Europe are probably one the highest in history now. High yield Euro bonds were coming to market at negative yields a few weeks ago. Practically, that means that we investors should PAY an annual yield for the right to own a very low-grade bond issued by a company with zero principal protection and a high degree of default risk. Wow, write that down because it won’t ever happen again in your lifetime. Even after five rates hikes by the Federal Reserve here in the states, our bond market isn’t much more attractive. Bond interest rates bottomed in 2012 across all maturities and all bond grades. Prices have generally been falling now, although not precipitously, for almost five years.

Investors can handle mild losses over a long time. But they can’t handle large losses over any period of time. We have not seen the latter situation yet when selling begins to intensify, leading to more selling, and eventually panic. I am expecting bond prices to fall and accelerate into a long term down trend reversing nearly 30 years of rising prices. We should expect interest rates to continue rising also at an accelerating pace, driving inflation higher also for the first time in nearly two decades.

Shrewd investors with experience in these situations (none under the age of 50) know how and where to make money in these types of environments. I’ll provide a short list for you as I just turned 50 and qualify to speak to these things 🙂

Cash – with a reasonable amount of your investment portfolio

Banks – love higher lending rates

Hard assets – base metals, energy, select commodity groups

Inflation Protected Bonds – the only man alive in the bond pit

Domestic, small and mid cap stocks with attractive valuations

Emerging Market stocks held in local currencies

Commodities are Ready to Revert

As bonds are beginning to really break down on a longer basis, the All Season Investor (wink) will turn his gaze to commodities as the next asset class likely to run higher from a business cycle standpoint. That is where we are right now.

Let me give you a few stats

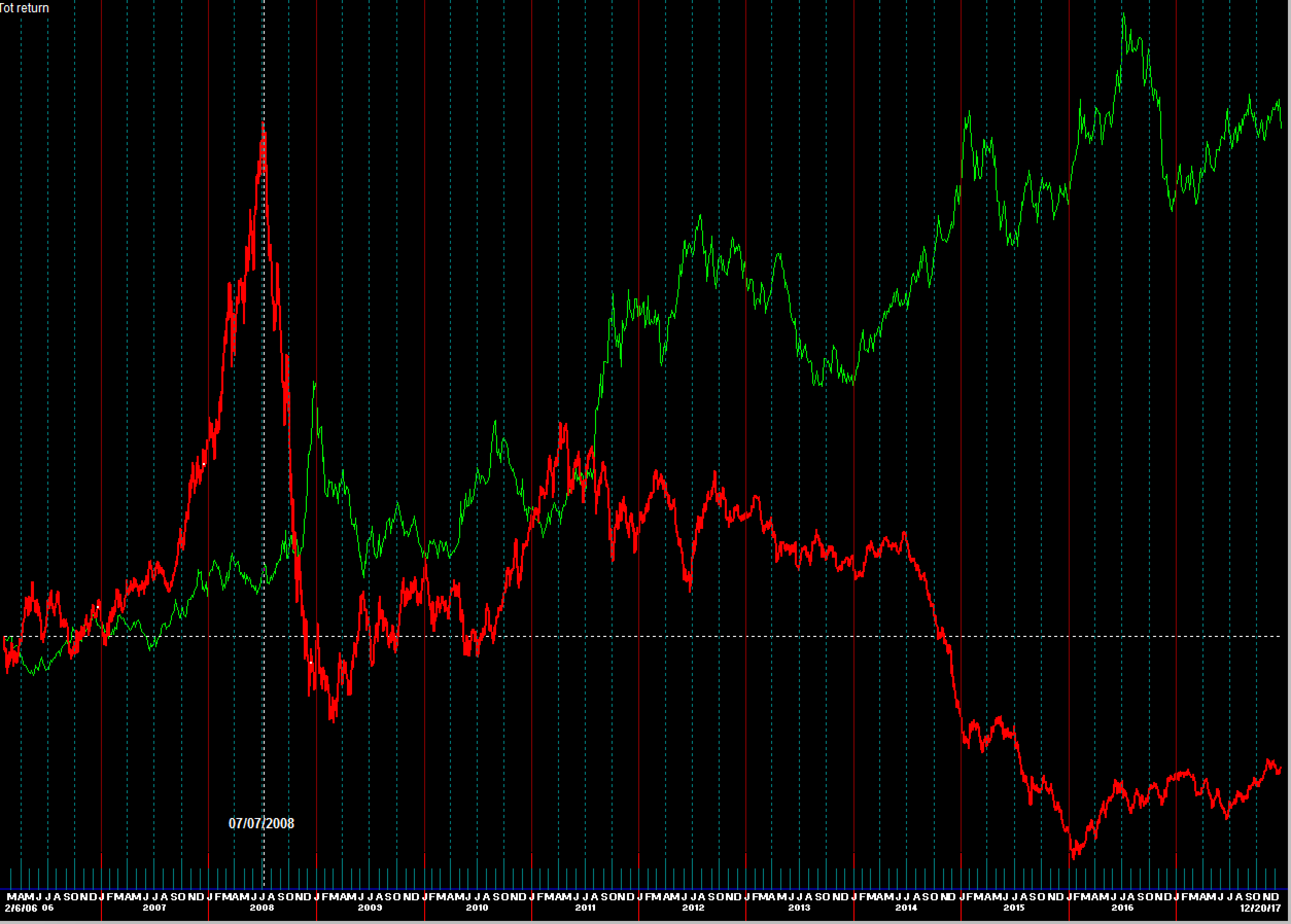

If we drop a measuring pole on July 7th of 2008, we see the following results in the three major food groups

The S&P 500 + 113.94{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

30 year Treasury Bonds + 80.47{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

Commodities Tracking Index – 64.22 {1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}

Ok now, if we are smart investors we try to buy low and sell high. I would buy commodities, slowly deliberately and consistently while selling bonds aggressively and without hesitation expecting both asset classes to revert back simultaneously to less stretched positions in the coming years. Today, we continue to accumulate positions in energy, some metals, and even a few commodity index funds. We own almost no bonds. Clients can follow along if you care to as we make this dynamic change in our (your) holdings. In the chart below, the Green line is the 30 year US Treasury bond and the Red line is the basic Commodity Tracking Index. The gap between these two will close, somehow, in the years to come but again timing is everything. If the economy slips into recession, the gap will widen. Today, there are virtually no signs of recession on the horizon.

US Stocks Will Revert

I do see some sort of reversion in the primary benchmark stock indices, especially in the US. Any way you turn it from a timing perspective, or valuations, or the sudden appearance of bubbles in things like Crypto currencies, or sentiment, or percent ownership of US stocks, or historically low cash levels in portfolios, we are getting close to a tougher cycle for stocks.

As of today, consensus investor expectations for 2018 are for a relatively smooth 10-11{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} gain in any of the US benchmark stock indices. From a statistical valuation basis, we might see a 4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} gain if conditions remain stable but with a downside risk of 25-37{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} . The sharp analyst will recognize that the current risk to reward ratio is no longer favorable. That doesn’t mean you can’t make money or are doomed to lose but rather, the odds of another big year of double-digit gains are just pretty darn small. Right now, investors are only looking up, earnings are healthy, price gains have been even stronger, and we just got the long awaited tax reform. That’s a lot of perceived good stuff that is now in the rear view mirror. Focus on what’s next and be open to a different outcome than what is being suggested.

Investor Attitudes Will Revert

Today and for much of the last five years, investors have done well. As time has moved on with ever higher prices, the perception out there is that passive indexing with zero cost ETFs if about as good as it gets in terms of costs and returns year over year. The DIY investor is feeling empowered by their success, many of whom are not old enough to have even seen or experienced an actual multi-month decline in stocks of any magnitude. Some investing veterans have even forgotten what it feels like and are sitting on portfolios of 80-90{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} concentrated stock indexes. Our own conservative community foundation where I sit on the board, feels “very comfortable” with a 75{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} allocation to stock index funds. All of this makes me very uncomfortable.

Meanwhile, risk managers are grinding through this cycle of understanding and accepting the situation for what it is. We work hard to capture as much of the market’s upside as we can without compromising the standards and process behind our risk management systems. As a group, if we can make 70{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of the gains generated by the benchmark stock indices in these cycles, that’s a huge victory. Risk managers never draw a lot of attention when perceptions of easy returns with passive indexes are so dominant. The seas are calm and sailing is easy. But as any sailors knows, conditions change and we will enter a period of high seas with some destructive capacity. There are cycles to everything.

During these times, our client money will follow our Net Exposure model which mandates moving us largely to safety, early in the downtrend. Meanwhile, attitudes among the masses, gradually shift from greed to doubt to concern and ultimately to many sleepless nights as values continue to fall lower and lower without much cause. In our experience, investors avoid admitting error or really start selling in earnest until they are down 15{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} from any recent highs, usually more. Selling begets more selling and attitudes turn deeply negative on stocks and the future. This whole process takes nearly two years on average. It’s brutal.

The Lighthouse Project

With that said, we are going to finish 2017 by initiating the “Lighthouse Project”. This project involves any of our Red Sky Report readers and our clients who have friends or family that you care about.

Here’s the project

If you know of someone who is an investor in indexes and leaning on things like diversification to mitigate risk, please make them aware that we are now turning on the light in the Lighthouse. When conditions become less productive and clear sailing gives way to darkness with no land in site, we want to be your Lighthouse, bringing you safely to harbor and out of harms way. Diversification does very little to limit losses in a bear market. When it goes, everything goes and this time bonds may be leading the way down. Besides, most investor portfolios aren’t even diversified. I see them every day.

There is no obligation to do business with us but let us provide you with a free stress test of your portfolio, against rising rates, against a falling stock market or rising inflation. All of these things will happen and few have any concept of how this might impact their portfolios. We can plug your holdings into our Hidden Levers software and run many different scenarios based on actual price action in the past to determine future outcomes. Let us shine some light on the unknown risks in your passive portfolio.

Pass this offer on to someone who can use the help and get it done before objectivity leaves the scene. Going into 2018 with no risk management system in place is just reckless in my opinion.

Click – The light is now ON!

I hope everyone has a fantastic holiday with friends and family. Enjoy it all!

Cheers

Sam Jones