Change of Seasons – Why New Power Will Run When You Might Least Expect It.

The New Power Fund (www.newpowerfund.com) is our very unique, separate account investment strategy that could be described several ways. It is a pure green, clean energy strategy that incorporates supporting emerging technologies. It is a game changer’s strategy investing in companies that challenge the status quo leading to a more efficient, cost effective, and informed way of life. It is a portfolio of pure plays with plenty of risk and plenty of reward, driving capital toward companies that make positive change (Impact Investing!). I personally love it despite the inherent volatility of the program. It’s been a while since we did a strategy profile on our New Power investment strategy. Some think that in a Trumpian ecosystem, companies that provide real solutions to climate change and carbon emissions, would be suffering. As we are now crossing into the second half of 2019, I urge you to consider what is really happening in this space.

Solar is As Bright as The Sun

Let me do a little show and tell first.

Here’s a chart of the Guggenheim Solar ETF (TAN) from early 2014 to today.

The casual chart observer will notice a few things.

- The entire solar sector is still off its recent highs set in 2015 by about 80{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}. But these were only the recent highs. Back in 2007, this ETF was trading at $307/ share. Today, it’s trading at $28.98. Those are some shocking numbers and illustrates exactly how much the solar industry has been hurting in the last decade while our broad stock market has almost tripled in the same time period.

- We also see a very long-term base in the price of this ETF dating back almost three years. Big bases, spanning many months are solid. This one spans years!

- In 2019, we have seen the TAN ETF rise in price very strong and just recently took at the highs of 2018 by almost 8{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} (shown by the white circle above). I know there has a been a ton of press covering the ALL TIME NEW HIGHS IN THE US MARKET. Let’s me just say for a moment how completely unremarkable these new highs have been in reality. In January of 2018, the S&P 500 hit a high of 2940. Today, 19 months later, the S&P 500 is looking to close at… wait for it…. 2959. That is a difference of 19 S&P 500 points over 19 months, less than 1{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} total return. How totally unremarkable.

- You will also see the words, BLUE SKY, written in the vast space above the current price of TAN. That’s a lot of blue sky with no obvious resistance levels anywhere. If TAN wants to run, it can go much higher without any technical trouble ahead.

The Real Case for Solar Now

Back to the theme. You might assume that in age and time when carbon-based energy has the full unbridled support of the White house as well as new solar tariffs on imported panels, that the future of solar, and all forms of clean energy, would be questionable. Here are five reasons why clean energy is getting a boost despite the unpleasant “climate”.

- Mayors across the country are making their own local commitments to solar energy regardless of our national or Federal stance. This is the complete list of mayors by state who have “resolved to make solar energy a key element of their communities’ energy plans”. Of course, this is not binding and a subjective pledge, but the local intentions are clear and happening. https://environmentamerica.org/sites/environment/files/resources/Mayors{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}20for{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}20Solar{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}20letter{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}20{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}28pdf{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}20for{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}20web{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}29{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}20{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}281{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}29.pdf

- 182 corporations are setting their own goals and executing on them regardless of what the White House says and does. Here’s the list. Hint these are not small companies and they are making some very large investments.

- The US investment tax credit for solar energy installations is slated to decline from the current maximum level of 30{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} to 26{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} in 2020 and then by 5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} each year down to 15{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} in year 4. Effectively, solar installation projects are being pulled forward into 2019 to capitalize on the tax break, thus boosting solar company financial performance. Of course, we could be robbing demand from the future, but the tax credits still provide healthy incentives for the next several years.

- Solar plus Battery solutions are now impressively cost effective. The combination of solar with large utility scale battery storage now offers a compelling option for power generators. In fact, Green Tech Media did a recent podcast covering an Arizona power plant that committed to a solar plus battery solution over a natural gas peak plant. Imagine, solar is now winning the bidding wars against Natural Gas! Coal is of course not competitive with either anymore. In fact, more coal fired power plants have been closed and retired in the last two years than any other time in US history. Politics and promises will not stop the tide of closures.

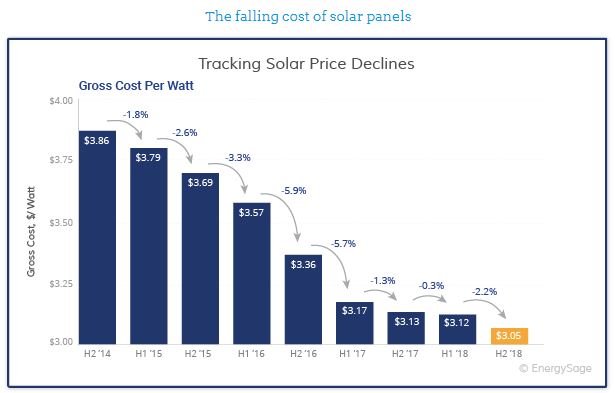

- Finally, we see that the cost of installed solar, and other clean energy options, continues to fall over time again making them more competitive and viable. Economics and financials are now the drivers of installations rather than philosophy or ideology. If you are a utility operator and feel compelled to pay more for your energy by building another coal fired power plant, have at it, but know that you’ll be hearing from your users as costs to rise over time.

The New Power strategy at All Season Financial Advisors owns solar stocks and the TAN solar ETF as its largest allocation in the portfolio. There have been very few times in the last decade when I could make that statement. Clean energy stocks represent 50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of the investment strategy. The other half is allocated to emerging and innovative technologies. Similar to the clean energy side of the portfolio, we hold the high standard of “do no harm” to our technology investments. Facebook will not be part of New Power for instance. New Power is, and has always been, an Impact Investors strategy as it has been since before Impact investing became popular. These are the sectors we find attractive now.

Digital/Mobile payment systems

Home energy efficiency systems

Smart grid solutions and software

Cyber security

5G wireless technologies and networks

Electrification of transportation

Good stuff!

Who is an Appropriate Investor in New Power?

We’re excited about the prospects for New Power regardless of the political landscape. We see a lot of opportunity here and it appears to be accelerating. Investors in New Power are encouraged to invest a smaller portion (up to 15{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}) of their total liquid investments given the inherent volatility of this program which is not risk managed like our other core strategies. It is however suitable for all ages, especially those who care about the health and welfare of future generations. The strategy is open to accounts of $50,000 or more. We cannot publicly publish our results but would be happy to provide them upon request.

Go New Power, Go!

Sincerely,

Sam Jones

New Power Fund – Senior Portfolio Manager