Travels with Bennett

I’m sure many of our readers have experienced college tour trips with their teenage sons or daughters. I’ve been on the road with my 18-year-old son Bennett for the last week throughout the NW region including Canada. Five schools, five hotels, two ferries, 1100 driving miles and one missed plane. I write from the SeaTac airport. By far the most interesting part of the journey was the conversations we’ve had along the way, about life, about the way things are and maybe the way things should be. Listening to the next generation, hearing their concerns and passions, gives us a clue as to what’s next and the themes that will dominate our futures. There is a lot to learn here with ramifications for markets and economy in the years ahead. Q and A with Bennett follows with my own observations and anecdotes in Italics. I’ll finish with a Q2 Market Update.

Sam: What do you think is the most pressing issue of our time?

Bennett: Climate change obviously. “You all”, and the last couple generations have absolutely screwed all future generations. My generation feels pretty helpless, hopeless and without representation to do anything about it. We’re just starting our lives in a compromised world, maybe one that becomes uninhabitable in certain areas.

They see it, feel it, hear about it and are acutely aware of the not-so-subtle changes occurring in their environments from day to day. He and his peers are angry that others before them seemed to have sacrificed nearly everything for personal wealth. It’s really hard to find anyone under the age of 25 that doesn’t feel the same because “We’re the ones who will pay”.

Sam: But don’t you see positive change happening now, like electric vehicles becoming adopted in mass?

Bennett: Feels like too little too late. I could see our climate issues start to be addressed in my lifetime but we’re going to have to deal with a lot of serious stuff (climate change impacts) between now and then.

Indeed, adaptation to climate impacts is becoming a larger and more costly effort with each passing day. Those who can’t see it or admit it because their tribe won’t allow it, are still doubling up on their flood and wildfire insurance, or even moving to more climate friendly locales. Here in the west, municipal organizations with names like the County Office of Emergency Management are high bidding for potential employees who have experience in climate change mitigation. Private companies are hiring sustainability and resilience directors, joining the C-Suite as a new company position. None of this is circumstantial or without cause. Adaptation is in full swing… but we’re still not solving the problem.

Sam: What about politics and leadership. Do you have any confidence that they can make real change for good?

Bennett: Not really, at least not those who are currently in power. We’re going to need a whole new slate of politicians, probably those who are closer to my age now, who “get it” and have something to lose. They might not even be members of the two-party system. There is just so much crazy on both sides, and nothing will get done until that breaks. We need an entirely new type of politician to run for office.

I heard a lot of anger directed at old white men who seem to be working every day to protect and defend their decades long seats at the privilege, power, leadership, and entitlement tables. “If they would just get out the way, I think we’d have a chance”. Bennett is not alone. I’ve heard the same exact words regularly from my class of seniors in our local high school where I teach personal finance and markets. I had to remind him that one day, I will be an old white man. While my intentions are good, I am still guilty by association.

Sam: So, What Would You Do If You Ran the Zoo?

Bennett: I would take the whole country (the world if possible) to net zero emissions as aggressively as possible, he said. We don’t have time to screw around at the current pace of change.

Bennett would take a heavy hand, mandating, forcing change with a quick stick and not the slow carrot. Because anything short of radical reversal of our carbon footprint, will end badly, he thinks. Easier said than done of course.

The ramifications are pretty clear to me. Spending and investment in climate solutions will accelerate and could become THE investment of the next several decades. The success of Tesla is probably just the beginning as an early leader in this space. We are already seeing mass adoption of EVs among our auto manufacturers, globally. I suspect that we’ll see incumbent energy companies morph into renewable energy companies (or buy them outright) in the next several years. Today, I see big investment opportunity in this space as wind, solar, battery technologies, electric vehicles, green hydro, smart grid, and all supporting technologies have been knocked down in a stock market sell off that has punished growth investments of all types. Oddly enough, energy shortages stemming from the war in Ukraine are creating an urgent and obvious drive for all countries to become energy independent including adoption of non-fossil fuel-based energy technologies.

The ramifications are pretty clear to me. Spending and investment in climate solutions will accelerate and could become THE investment of the next several decades. The success of Tesla is probably just the beginning as an early leader in this space. We are already seeing mass adoption of EVs among our auto manufacturers, globally. I suspect that we’ll see incumbent energy companies morph into renewable energy companies (or buy them outright) in the next several years. Today, I see big investment opportunity in this space as wind, solar, battery technologies, electric vehicles, green hydro, smart grid, and all supporting technologies have been knocked down in a stock market sell off that has punished growth investments of all types. Oddly enough, energy shortages stemming from the war in Ukraine are creating an urgent and obvious drive for all countries to become energy independent including adoption of non-fossil fuel-based energy technologies.

We may be quickly approaching a time and place to back up the truck and buy aggressively into the clean energy and clean technology sectors again. This could be one of the greatest investment opportunities of our lifetimes in the context of absolute need for clean energy solutions combined with developing leadership from the next generation.

Our New Power investment strategy, which focuses on disruptors and game changers in clean tech and clean energy, is down almost 8%+ YTD. The strategy has been consolidating some very strong gains made in the last couple years in a constructive way. I have little doubt New Power will continue to provide one of our strongest returns over time for investors with the patience and risk tolerance to stick with it. The set up today with prices trading at 5-6 year lows, is nearly perfect.

As we drove across the plains of eastern Washington from Spokane to Oregon, we saw miles and miles of ridge line dotted with huge wind turbines, spinning slowly. A long string of trucks, each carrying a single 120’ wind prop, moved down the highway like leaf cutter ants carrying an absurd load. Bennett smiled when I told him we were investing in Wind companies for our clients. I could see hope.

Sam: What else seems like an issue to you?

Bennett: I feel like I’ll never be able to afford anything, like a house or a car. Everything costs so much; I don’t how we can ever own anything? Am I going to have to rent my whole life? It’s kind of like the climate thing. You all have run up the price of everything during your lifetimes leaving us with a ton of debt and a life that is unaffordable except for the very rich.

Heavy sigh…

Bennett is talking about inflation of course, not just the recent spike, but the very long term increases in the prices of things like real estate, cars, and college tuitions. He buys his own gas and feels real inflation at the pump. He’s not wrong. In every economic slowdown, recession, or world event like COVID, since the days of Greenspan, we have seen the Federal Reserve pump endless money into the US economy. Why? Because our country is not very good at accepting economic pain of any sort. In every period of economic contraction for the last 40 years, they (The Fed) have dropped interest rates to zero and kept them there for extended periods. They have infused $Trillions of stimulus into the system and now openly buying financial assets to prop up prices in our debt and credit markets. I have no doubt, they will ultimately follow the Chinese and start buying stocks on the next cycle down. It’s become so engrained that market people call it “The Fed Put” (meaning a permanent hedge against any form of lasting price damage).

Now we discover two unintended consequences of “The Fed Put”, that will not be easily undone. The first and most obvious today, is runaway inflation – yes runaway (not transitory, not stabilizing, not going away any time soon type inflation). No surprise to me as you know. The second is wealth inequality. I’ll save that topic for another update.

Bennett asked how anyone in his generation will ever be able to afford a home of their own? I didn’t have a good answer.

Real estate may not be something that the next generation owns as much as uses unless parents get involved and heavily subsidize the whole thing. It feels like something is going to break here but I couldn’t say how, when, or why. On March 16th, the Federal Reserve raised the Federal Fund rate by .25%; The first of 7 or 8 or 10 such rate hikes. 30-year mortgages are very suddenly approaching 5% and we’ve only just begun the process of increasing the cost of borrowing. Who needs a mortgage these days? You guessed it, first time home buyers and those who don’t have the huge assets necessary to pay cash for a property. In my short time on earth, I’ve never seen so many real estate deals happen with cash, no mortgage. In my small town, nearly 75% of all home purchases are done with no mortgage. The wealthy in our country have plenty of cash and accumulated equity to get these deals done. Meanwhile those less fortunate and younger people are seeing their costs of borrowing go vertically higher. If you have owned property since 2010, you are sitting pretty. If you’re a young, first-time homebuyer, you’re locked out.

Bennett: I want to understand more about investing. Seems like a lot of my friends are getting into Crypto and stuff like that.

Sam: I’m sorry I haven’t spent enough time with you talking about investing and how it all works (Bad Dad!). But Crypto isn’t really the best place to start.

As we drove, we listened to a bunch of podcasts. One caught Bennett’s attention – Animal Spirits, a podcast with hosts Ben Carlson and Michael Batnick of Ritholtz Wealth Management. These guys are all bullied up on Crypto currencies, NFTs and catered commentary to smaller DIY investors. Don’t get me wrong, I loved the financial literacy effort with their listener Mailbag sessions; I’m all about it. But there was also a ton of content surrounding get rich quick investing strategies aimed at the younger generation. “Going to the moon” was heard often enough for me to mentally sign off. As regular readers know, I’ve been harping on the investor gambling problem of the last couple years. In fact, after a little probing, I discovered that some of my high school finance class students are making regular sports bets via Draftkings and haven’t made the distinction that this is NOT investing. I feel like I have seriously failed as an instructor. Those without a lot of wealth are trying unsuccessfully to build wealth quickly with a lot of investing gambling type behavior – they don’t know any better or maybe they don’t have the patience to do it right? Meanwhile, the wealthy are focusing their efforts on long term growth, capital protection and tax abatement. I know which group will be better off in the next 1-100 years.

If I were a billionaire philanthropist, I would focus the vast majority of my giving on financial literacy in our high schools and higher education. We cannot expect the next generation to drive their own stake in the ground without knowing the basic rules of personal finance, investing and markets. We can all make smarter financial choices regardless of your place in the world. Knowledge is critical.

Those were the highlights of our conversations. I was proud of him for his insights and passion. And I was sad to hear a sense of despair at the hand he and his generation have been dealt. We can all do a lot better at setting up the next generation for success.

Quarter End Market Update

This is a slippery market and one that still needs to prove itself if it is to go higher sustainably from here. We’ve seen a tremendous amount of wealth destruction in the growth side of the market through the middle of March. This didn’t just happen. It’s been slowly grinding lower since February of 2021. Thankfully, value is returning to the US stock market but we’re still a long way from anything I would consider attractive from a valuation perspective. A move down to 3600 on the S&P 500 would get us there. Today the S&P is trading around 4600. You can do the math. At the same time, we have witnessed a washout of companies that have no business in the public markets. These are members of the Unicorn class of stocks, many of whom have gone public in the last 2-4 years. Investors seems to be excited about the prospects of buying these companies now that they are trading down 70-90% from their highs and well below their IPO prices. I’d be very careful. There is a lot of roadkill out there. Vulturing mega cap companies might choose to buy the assets of a few for pennies on the dollar if there is anything worth salvaging but that could be their only good option. Some will survive and thrive, but today we’re just sifting through the wreckage looking for something “valuable”. Growth investing styles will continue to struggle while inflation rages and recession risk rises. We’re sticking with Value companies with high cash flow, healthy balance sheets and dividends, as well as inflation trades. We remain fully invested as there are so many great options in this space.

As we approach the end of the quarter, I’m pleased to report that over 60% of our total client assets under management are showing solid positive returns YTD, net of all fees, while the broad US stock market is still down between 4-8% and Treasury bonds are down 7-12% (as of March 29th). At the beginning of the year, I suggested a high likelihood that our risk management investment strategies could generate positive returns in this environment. So far, so good. We’re having a great year and proud of our results.

The first quarter of 2022 has ushered in our first real correction and a few formal bear markets at the sector and country level, since the last pandemic bear market in February and March of 2020. All things considered, the range of possible outcomes for the remainder of 2022, is far wider now than any time in the last decade. We could see an end to the conflict in the Ukraine that brings in a short and sharp rally for stocks. We could also see Inflation and aggressive Fed Rate hikes push us over the edge into recession leaving Bonds (the most hated of asset classes) as the only reasonable place to seek returns. A new round of earnings will be coming soon but comps to Q1 of 2021 are going to be tough to beat. Inflation, the Fed, and Putin will govern the airwaves through the summer leading us right into the feud of midterm congressional elections and our first round of voter fraud claims by both parties in November. Uggg.

Is Recession on the Horizon?

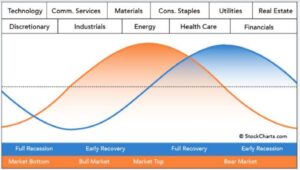

In a word, yes. The pattern of events today is not unlike any other market and economic cycle. Yesterday, the “yield curve” inverted in the bond market which has long been an early warning of recession by 6-18 months. That means we have almost no risk of recession happening now but 2023 is still an obvious time and place to expect that outcome. It is what it is, this time is not different. The signs of a cycle high are all falling into place including a sharp rise in energy prices (always the bell ringer at the top of nearly every bull market), lagging performance from cyclical sectors like communications, technology, and consumer discretionary. On the theoretical chart below, you can see how Energy is typically the strongest sector at the top of the Market cycle shown in Orange. Energy is up 40% YTD while nearly everything else is down.

The Fed is raising rates now (check), industrial production is in decline (check), consumer expectations are falling (check), etc, etc. But we must remember that recession is just another market condition to be managed. As we move closer to the end of the year and as evidence confirms, our dynamic asset allocation approach will shift gradually out of stocks and commodities and into bonds as we have done in the past. There are times to Create Wealth and times to Defend It, as our tag line says. Also remember that stocks often sell off into recessions and find a lasting low just as recession formally arrives in the economy. As we have seen already, 2022 is not going to be easy, but 2023/24 should be very attractive years for investors who understand market cycles and are looking for long term entry points to deploy cash.

Supply of Homes for Sale Rising Sharply

This caught my eye recently. There seems to be a drum beat of consensus opinion surrounding the shortage of homes for sale and the assumption that prices will therefore continue higher and higher. That dynamic is changing quickly now that mortgage rates are pushing strongly higher. The monthly supply of homes for sale is now rising sharply nationwide and fast approaching the top of the historic range of the last 10 years. I also found it interesting that the current supply of homes is already above the level we saw at the beginning of the Great Financial Crisis in 2007.

Between 2004 and 2007, the Federal Reserve raised rates (14 times?) and effectively ended the real estate bull market of the time. Look what it did to the supply of homes during that time in the chart above – and we know what subsequently happened to prices. Today, the Fed has again begun to raise interest rates and will likely continue on this path until they see prices stabilize or we slip into recession again. I’m not forecasting a real estate disaster like 2008 but keep your eye on the supply of homes as real estate represents a great deal of wealth in our country. The table is set for a bit of a surprise here.

What Should Investors Do Now?

Investors would be wise to be patient and add investment capital to their positions AFTER steep declines (always, right?). Investors would also be wise to hold on to inflation hedges for dear life as the only remaining source of portfolio diversification. I see no evidence that the commodity bull market is over yet. For as much as we might want to hide on the sidelines, carrying a big cash position during very high inflation is tough as life costs a lot more each day. Dividends, especially high dividends, are still your friend in the new environment while low yielding Treasury bonds should be held to a minimum. Of course, we manage all of this for our clients but offer these suggestions to any outside of our firm. Remember that markets rise and fall. There is no opportunity for investment in a market that is trading nosebleed levels but there are enormous opportunities for wealth creation when valuations reset. 2023-24 is going to be a great opportunity zone for investors who have their emotional and physical capital intact. Reflecting on my conversations with Bennett, perhaps the best thing we can offer the next generation is real and lasting opportunity. An opportunity to invest in something that offers value and an opportunity at affordable living in a healthy environment.

As always, we are always thankful and appreciative to our clients for your continued trust and confidence in our firm. We’re here to help you with any and all things financial, as usual. We hope to be your first call when you have questions.

Thanks for reading!

Sam Jones