Well it’s that time again. Time to flex. This week, both of our High-Income strategies moved out to all time new highs net of all fees. What else is trading at all time new highs you might ask? Nothing. We’re obviously doing something right here. Settle in to read about why this program continues to generate results over time, recent history of changes in our holdings and when our clients find this strategy attractive.

Unconventional Income Strategies

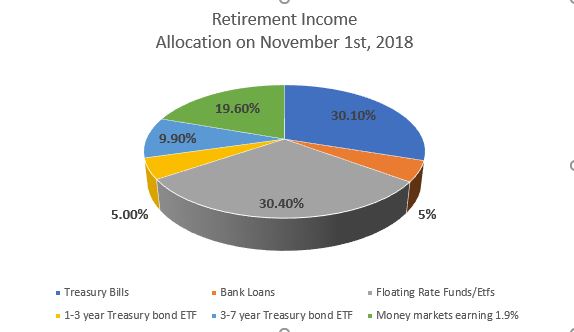

For the uninitiated, we have two varieties of Income strategies. The first is called Retirement High Income designed for those with tax deferred registrations. The other is called Freeway (the opposite of the Toll way) High Income which is designed to be more tax efficient for clients with taxable account registrations.The strategies are largely the same in terms of their orientation and timing of buys and sell. One is just more tax efficient than the other based on our use of High Yield municipal bonds versus an extra helping of Corporate bonds. Both strategies are unconventional in two ways. The first is that we dynamically move client assets in and among the various food groups of the income security world. For instance, in one cycle, we might lean heavily on traditional Treasury bonds, floating rate funds and bank loan type securities while owning virtually no corporate bonds. In fact, this was exactly the situation when the stock market was cratering in the 4th quarter of last year. This was our exact allocation in the Retirement Income strategy on November 1st, the very center of the stock market hurricane.

In aggregate, the ASFA income strategies gained ground slightly during the 4th quarter during a period when Treasury bonds were up slightly, Corporate bonds were down over 4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} and stocks lost over 19{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}. So that’s good and we set ourselves up for success in building wealth by avoiding losing in the first place. Now the trick is to make money, not just avoid losing money so let’s talk about that. At the end of the 2018, it became painfully obvious that stocks, and corporate bonds were wildly oversold and Treasury bonds were equally overbought. We sent out a notice to that effect on 12/26.Time to move!

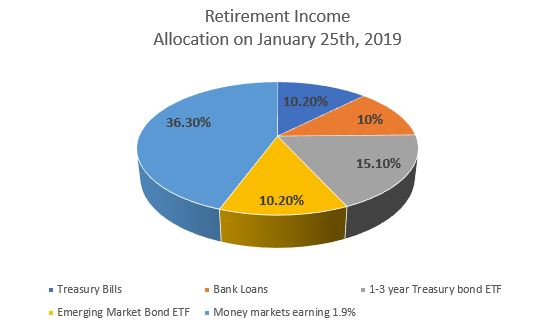

We sold a bunch of our Treasury bonds, sold Floating rate funds and began buying into Emerging market debt with both hands including one that trades in “local currency” (EMLC). We also bought Preferred securities Income ETF (PFF) and doubled up on our Senior Bank Loan ETF (BKLN). We still own zero Corporate bonds because we continue to find this segment of the income world completely unattractive and destined for a dirt nap in the words of the venerable Jared Dillan of the Daily Dirt Nap. In the end, as of today, this is our current allocation inside the Retirement Income strategy.

Without doing the math, the point should be clear. We made a significant change to our holdings at a unique moment in time when opportunities and risks inverted. This is unconventional stuff in the big world of Income investing and allocations. Since making these changes, the Retirement Income strategy has moved out to all time new highs and is currently annualizing over 6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}.

Putting it all together, here’s a picture of the Retirement Income strategy results based on our composite performance (please, please, please read our composite performance disclosure doc in this email), net of all fees. The Red line is our strategy and the green line is the Core US Aggregate Bond ETF (AGG), our primary benchmark. Both are shown on a total return basis. Obviously the AGG fund is close to breaking out to a new high as well but this is also the level where it has failed to move forward in the last three years. We shall see.

Good Stuff

Why Does This Strategy Work?

The design of the income strategies is the most-simple of trend following systems. We monitor the prices of various income options daily against an intermediate term moving average, put a few proprietary filters on the signal set and voila’ we have green light/ red light indicators telling us when to move in and out of the different types of income bearing securities. Some of our criteria for ownership is based on valuations, spreads and ranges of overbought or oversold as well, so it’s not entirely technical in nature. Mostly the strategy works because we’ve been running it with real client assets for over 15 years and we’re pretty darn good at it.

When Do Clients Find the Income Strategies Attractive?

Obviously, when other asset classes like stocks and commodities are having a rough time and showing huge volatility, clients often love their Income strategy allocations as these are the sides of their portfolios that continue to make all time new highs. But there are other situations. We have several clients who use our income strategies for their corporate accounts including foundations, endowments, non-profit and HOA reserve accounts.These are situations where a client (entity) is hoping to earn more than a typical yield on a bank account or a money market fund for a pot of money that needs to stay liquid, available but cannot be at risk with things like stocks. Other situations might be when a household knows that they are going to need money, say for a house or a college tuition in 2-3 years. This is a very short time horizon but still long enough that they don’t want to just keep the money in a bank earning zip. Finally, we also have several clients who have accumulated enough in net worth that they simply don’t need or want stock market risk in their lives. They want a steady 5-6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} return on their assets which are substantial in order to make a reasonable return and stay ahead of inflation net of any fees.That’s what we’re doing here, exactly.

But It’s So Boring

I won’t bore you with the math of compounding returns, but every investor should know that making a reasonable return year over year, with very few periods of loss either in duration or magnitude, is one of the fastest ways to accumulate wealth over time. Compounding interest and returns is a very powerful math principle, but it only works if you strip away volatility and let your returns on previous returns compound. I continue to be amazed when I see the mass of investors chasing the BIG return with this or that stock, only to find it evaporate before their eyes. They look back over periods of years and discover they have simply gone through a repeat cycle of loss and recovery, over and over, gaining no ground. The need for instant gratification is a disease in our business and we truly wish more people would understand the benefits of slow money. Income strategies are so boring and yet they just continue to make money year after year after year. We should all love “boring” with a lot of our net worth as far as I’m concerned.

I apologize for the shameless flex in this update. I won’t do it again, until we make another all-time new high with no one else around us.It’s lonely on top.

Sincerely,

Sam Jones