February 22, 2024

I thought I would commemorate this moment with a look back to our popular blog post “40% Off” on October 16th, 2023 and provide a little update as to what has happened since. There are some great lessons for investors of all types in the last 5 months. Extremes can get even more extreme and our perceptions of how high or low something can go, are limited only by our imaginations.

My Good American Darn Tough Socks

Because I know you’re curious, my Darn Tough American socks have been under heavy wear now. They are still as good as new. No pilling, no holes, not even faded. Really an amazing product. I should have bought more when they were 40% off! Looking back to October 16th of last year, in our post, we talked about the many sectors, stocks and asset classes that were being thrown out for dead and placed on the 40% off rack (40% off from the highs in 2021). This was the list in October of 2023 with a cautionary note to not buy until these turned higher.

- Telecom companies like Verizon, 8.48% and AT&T , 7.34% dividends

- Dows stocks like 3M (MMM), Boeing (BA) and Disney (DIS)

- Mega theme sectors like clean energy (ICLN, TAN) and Biotech (XBI)

- Oversold banks (KRE, KBE, BAC and C)

- Mortgage and equity REITS paying 8-11% dividends.

- The retail sector (XRT)

- China and Chinese Technology (MCHI and KWEB)

- Silver Miners (SIL, SLVP)

- Long term US Treasury bonds

So, what’s happened to these oversold, forgotten, thrown out, gone for good, sectors since October of 2023. Well not surprisingly, most are up strongly.

Fact: Since October 24th of 2023:

Banks, retail, mortgage and equity REITs, Biotech and several oversold Dow stocks like Disney (DIS) are still outperforming the mighty S&P 500!

Others in the group are up but not quite as strong as the market.

And several sectors like Long Term bonds, Silver, Clean technology and Chinese Tech are still down.

Two Important Things Happened Yesterday

First, you may have heard of a company called Nvidia. It’s been on a tear in the last year, up over 400%, and is the poster child of the AI revolution. Last night, Nvidia reported earnings and they came in as expected but showed clearly that growth, sales and earnings were slowing dramatically compared to one year ago. Naturally, the stock is up 14% to a new all-time high as I write despite the fact that the stock trades at 41 times gross revenues. That means that if you are buying NVDA today, you are paying for 41 years’ worth of top line revenues and assuming the company has zero expenses, cost of goods or taxes to pay against those revenues. If you are buying NVDA today, you are paying a price for a company with the market capitalization (enterprise value) larger than the combined total of all Chinese internet stocks as well as the entire energy sector in the United states. Maybe Nvidia is that big? Maybe AI is going to replace humanity? Maybe one company can be bigger than everything else combined. As a lifetime contrarian, I have my doubts and it seems fairly obvious to me that given the valuation, frenzy and piling on effect in play, this would seem like an obvious time and place for NVDA stock to top out as fully valued. While companies like NVDA can defy gravity for longer than our imaginations can grasp, we must not forget that gravity still exists.

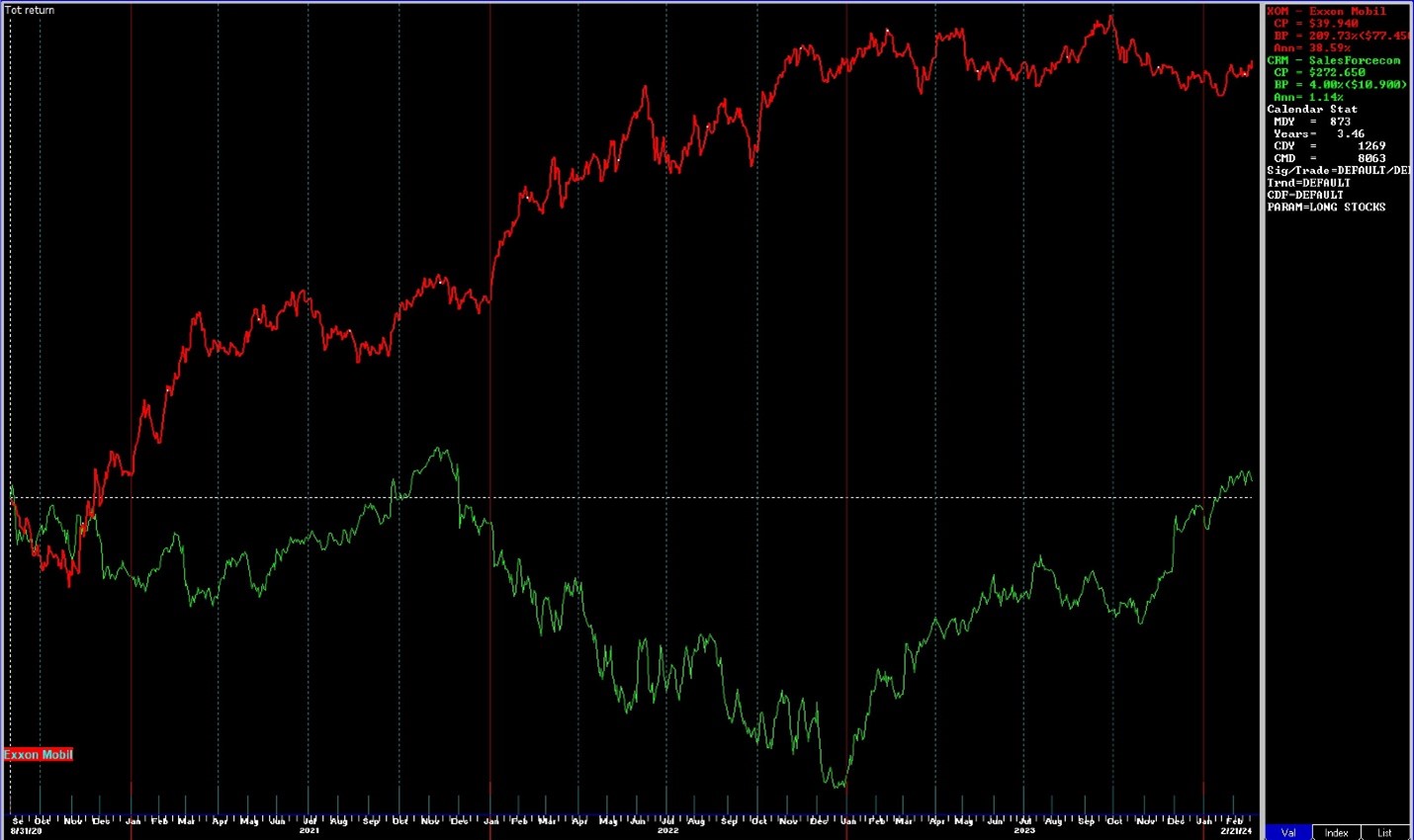

Second, Walgreens (WBA) was replaced with Amazon (AMZN) in the Dow Jones Industrial Average yesterday. This feels like another bell ringing moment on a lot of fronts. The good folks at Dow Jones are quite literally the worst ever in their timing of changes to the index. Their last big change occurred on August 31st of 2020 when they replaced Exxon Mobil (XOM) with Salesforce (CRM). Here’s what has happened to both stocks since August 31st, of 2020. Sorry for the quick screen scrape.

XOM is in Red, up + 209% and CRM is in green up only 4% after moving straight down -52%.

Read all about it here:

Walgreens has seen some tough sledding since it’s last major peak in 2015, down -69% but in the process, we have seen its dividend push up to a whopping 8.61% annually. I couldn’t say what might be the catalyst for Walgreens stock to rise from the ashes with 100’s of store closures pending. Perhaps it’s a game of survivor since Rite Aid just declared bankruptcy leaving only two players in the retail pharmacy world – CVS and Walgreens? But that dividend!

Meanwhile, Amazon is being added to the Dow and it seems logical that Amazon will continue to eat the lunch of all small business and suck the air out of all competition. Could Amazon march higher? Of course. Amazon certainly represents the US economy more than Walgreens but maybe they will run into antitrust issues, or continue to see their revenue growth shrink, or maybe Amazon’s best days are behind it (fact)? The good folks at Dow Jones are clearly pursuing the path of least embarrassment with this change. If only their track record of timing was better.

For what it’s worth, Pfizer (PFE) and Raytheon (RTX) were also removed from the Dow in August of 2020. Put them on your watch list?

Opportunities Everywhere

I am reminded of 1999 and I know the situation today is far different. But what is not different between now and then is the clear piling on effect and concentration of investor wealth in just a few names. Some would argue that the best and strongest companies like Nvidia, Amazon, Apple and Microsoft, etc. are the most resilient to a flagging economy given their size and scale. True, true and the companies themselves will be just fine even if we slip into recession. But when the stocks of these companies rise to a point where it just doesn’t make any sense to buy at current prices, we have to start looking around for where else we might deploy our capital. We don’t need to sell out of our winners completely yet, but we certainly don’t need to add to them; might I suggest taking some profits? The sentiment bells are ringing loudly now as the expectation of higher forever reaches a fever pitch in mega cap tech. Historically, these types of moments don’t bode well for the future. Meanwhile, there are deeply discounted opportunities everywhere that bottomed in October of 2023 and still rising strongly!

Our clients know that we make these tough decisions in our managed strategies, and we are not stock pickers as much as asset allocators using low cost ETFs. Already we are sliding into oversold value, internationals, emerging markets, small caps, pharma, banks, basic materials, oversold industrials, insurance, financials and looking at the deep discount sectors. We are not chasing anything, just buying slowly and methodically at low-risk entry points. The point I want to make today is that investors at large need to be aware of the condition of the markets; specifically, the imbalances we see today with extreme concentrations of wealth in the most expensive sector of the most expensive stock exchange in the world. Why not follow our lead and explore the rest of the market where opportunity lies ahead?

Just like my socks…

I think we’ll all look back on this time and wish we had bought more from the 40% off rack!

Sincerely,

Sam Jones