As the last and final great opportunity, we’re going to give it some extra juice and make it a two for one. Who doesn’t like a BOGO? Actually, you’re spending nothing beyond your own time in reading this blog so BOGO isn’t really right, is it? On with the show.

The “Opportunity “ to Buy Low

First, we need to clarify one thing. The US stock market is in a bull mode as it has been since 2009. There have been periodic signs and warnings that the trend higher is weakening but all of these situations, have resolved to the upside including the most recent round of weakness in August of this year. “Buy the dips” mentality is still healthy reflecting the healthy economy and nearly perfect Goldilocks environment of not too hot and not too cold in terms of growth rates. There are currently no signs of imminent recession here or globally. So at the moment, all is well, we are nearly fully invested and making nice returns. But eventually, the economic system and financial markets break down as they have since the beginning of time. On average, bear markets drive the major market indices lower by -33{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} over an average time period of almost two years. Subjectively, we think this event is closer than many are expecting so it’s time to start making plans. That’s what this is all about; making a plan for the inevitable.

Understanding Where We Are Today – S&P at 2500

Let’s back into this opportunity with an observation of where the US stock and bond markets are today in terms of their valuations, risk structure, and upside/downside potential. I’ll state this as clearly as I can. I find almost nothing attractive about the US stock or US bond markets from a value perspective at these levels. Our 2017 upside target of 2460 on the S&P 500 has already been met. Perhaps we undershot the opportunity this year, but the year is not over yet. Yes, there are pockets of opportunity in oversold assets that we continue to watch but don’t seem to want to get up and run. I also see the great moves of the last several years from the likes of Facebook, Netflix, Amazon, Microsoft, Google, etc. These are all great companies, some would even call them consumer staples now. Will they continue higher? Unequivocally yes, with our 10-year goggles in place. But at some point in the shorter term, you’ll need to put up with standard 30-50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} declines in any of these names. I also see the broad US market indices, just this week, making all-time highs.

Sam, all time new highs in the major stock indices? How is this not attractive?

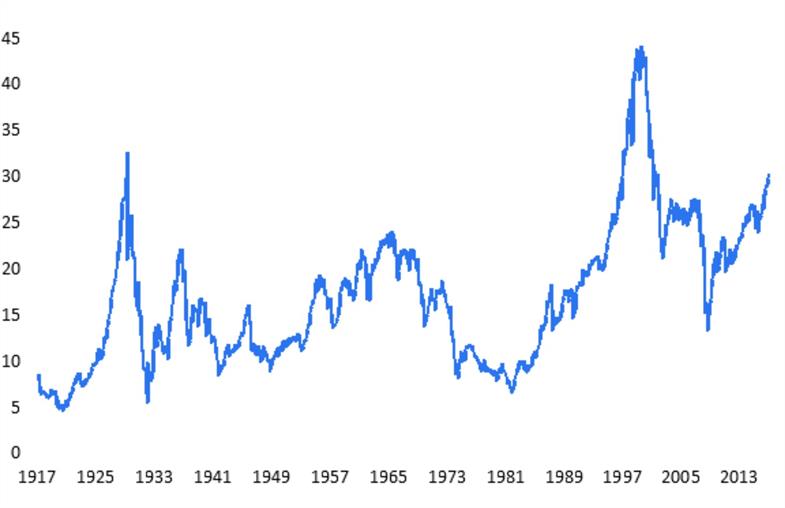

Forgive me, I don’t like to buy expensive things and this market is very expensive by almost any standard. I see valuations that are now statistically the third highest in the last century which tells me that prices are rising faster than earnings. The first was at the dot.com peak of 1999 ushering in a 14 year period of investor suffering. The second was the very market peak in the late 20’s, just before the Great Depression. And now, we are making history again. Here’s the classic chart of the Case/Shiller P/E ratio by month.

The Price to Earnings ratio is just one measure of valuation but the others (price to book, price to cash flow, dividend yield, etc) all tell the same story. Now markets don’t fall because they are overvalued. They fall for other reasons most of which surround lack of liquidity, credit crisis or economic recessions. These are not current risks to the market. But valuations matter very much in terms of the magnitude of downside potential when the turn happens. As I said earlier, average bear market losses are about -33{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} so I’m going to make a conservative forecast and assume that the next bear market is going to yield a larger loss than 33{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} given the current lofty state of valuations. That’s unattractive.

The Price to Earnings ratio is just one measure of valuation but the others (price to book, price to cash flow, dividend yield, etc) all tell the same story. Now markets don’t fall because they are overvalued. They fall for other reasons most of which surround lack of liquidity, credit crisis or economic recessions. These are not current risks to the market. But valuations matter very much in terms of the magnitude of downside potential when the turn happens. As I said earlier, average bear market losses are about -33{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} so I’m going to make a conservative forecast and assume that the next bear market is going to yield a larger loss than 33{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} given the current lofty state of valuations. That’s unattractive.

Unfortunately, US Treasury Bonds are also unattractive and will be an unproductive asset class for many many years. In February of 2015, I made a similar statement. Since then, the total return on the 10 year US Treasury bond to date is up… 2.2{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} or 0.83{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}/annualized. The total return on the longer-dated 20 year Treasury bond is a negative -2.08{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}. This is dead money at best and probably the source of some rather serious wealth destruction looking forward. Not attractive, check.

Where is the Opportunity?

I believe in the benefits of investing in stocks in terms of wealth accumulation. I wouldn’t be doing this for the last 24 years if I didn’t firmly know that truth. I also believe firmly that success is a function of timing and deliberate Net Exposure to the markets at different times. Our industry likes to call this Asset Allocation. I call it common sense. If stocks are in a bear market, don’t own stocks. When stocks are rising in a bull market, own stocks (as we do today). Sounds easy, doesn’t it?

Our third mega opportunity for investors is the opportunity to buy stocks at much lower levels than they are today when the upside potential is real, long lasting and can yield incredible life changing wealth. But for us to capture this opportunity we need to do a few things first. We need to secure and maintain our emotional and financial capital through the next bear market.life changing wealth. But for us to capture this opportunity we need to do a few things first. We need to secure and maintain our emotional and financial capital through the next bear market.long lasting and can yield incredible life changing wealth. But for us to capture this opportunity we need to do a few things first. We need to secure and maintain our emotional and financial capital through the next bear market.

What is Emotional Capital?

It is something that is earned when we don’t lose a great deal of our wealth to things like bear markets. When we have the discipline to recognize an overvalued market and execute a well-defined risk management system that gets us out of harms way when the time comes, we build emotional capital. We stay in the driver’s seat with our money and we give ourselves the emotional strength to buy near the lows when everyone else is giving up. As soon as you have lost more than your emotional comfort will allow, you have lost your emotional capital and there are no second chances. Of course, your financial capital is also lost. For most, we’re really talking about understanding your risk capacity, not to be confused with your attitude toward risk taking. The most common error I see among investors, especially younger investors, is a self-diagnosed risk loving attitude without the necessary risk capacity (total assets, incomes, savings rates, controlled spending habits and ability to withstand a significant loss) to support the attitude. When prices fall, attitudes change. Emotions quickly shift into survival mode with honest statements like “I can’t afford these types of losses” ending in frustration with a “sell all” type decision at or near the lows. Frankly, this is why “Buy and Hold” as a strategy isn’t practical for many investors over time, as attitudes toward risk very often do not match up with actual risk capacity.

Picking Up Nickels

Back to today’s market. Jared Dillon of “The 10th Man” newsletter said it well a few weeks ago. If you’re reaching for returns now, it’s like picking up nickels in the street in front of a steamroller. Funny but I think about that statement a lot these days. The markets can go higher and probably will, but how much risk are you taking to get those last nickels?

I will advise any and all investors. If you do not have a plan to keep your emotional and financial capital intact when the markets turn lower, you need to make one right now. If you do not have a system or any criteria or experience with such things, find someone who does and pay them to do it for you. Make a commitment to do it before you are raking leaves.

When prices are back to normal and valuations for both US stocks and bonds become attractive again or even discounted significantly again, you can gleefully take advantage of this opportunity.

BOGO

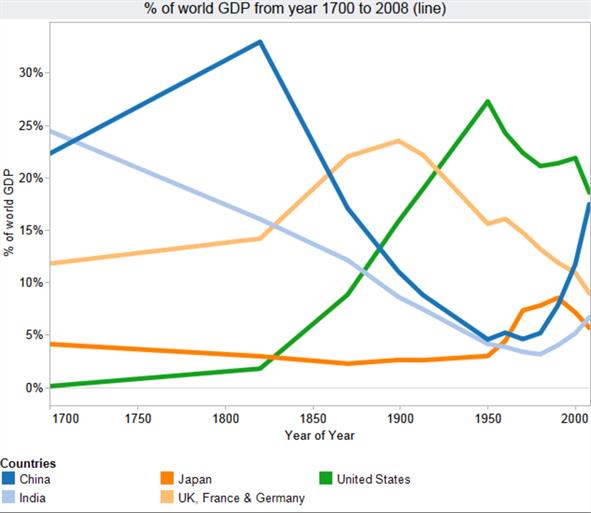

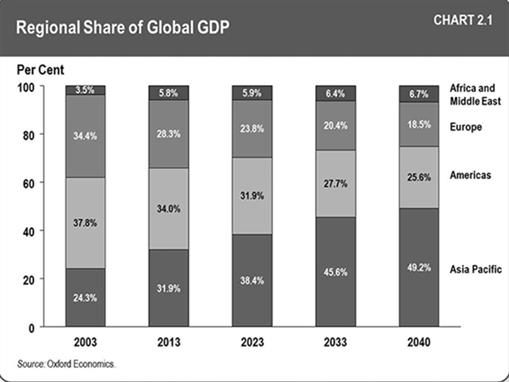

As we’ve spoken of many times in the last year, we believe that international investing, outside of the US, is far more attractive and probably will be for quite a few years. This is especially the case with China, India and other developing countries. Price trends relative to the US are very strong for the first time in the last eight years. Currency differences are supportive, valuations are far more attractive outside of the US and political risk is much lower. But most importantly, we now have solid price patterns that reflect the mega shift in the percent of World GDP from developed countries to developing countries. This has been going on largely since the 50’s but the trends are now accelerating. The US is not the global superpower that it used to be.

Here’s the past

and here’s the projected future

Practically, we want to be conscious of a few things with our International Investment theme. First, currency trends do matter and a strongly rising US dollar will make for tough sledding with dollar-denominated foreign securities. So far, the US dollar is not rising so that’s good. Second, we can’t assume that international securities will rise in the event of a global financial crisis. They got crushed along with the US market in the last cycle. It seems reasonable that they might lose less than their US counterparts in the next round, but I wouldn’t bank on that. Finally, there is a distinct lack of transparency with foreign investments, specifically individual stocks, creating some extra risks for investors. Stock pickers beware. We are leaning on foreign indices and ETFs for our exposure rather than trying to own the right international stocks. With that said, we feel that investors need to get comfortable owning a much larger percentage of their portfolios in foreign funds than we have historically seen in the past.

This ends our three-part series on great investment opportunities in the future. They are all in various stages of development but should offer investors some guidance on where to look – or when to look.

Cheers

Sam Jones