Who is a Builder?

“The Builder” is our company name for any household that typically falls in the age range of 40-60. Typically, these households are in their highest earning years and are focused on building assets as they approach retirement, helping to pay for educational costs, early support for aging parents, and accumulating wealth. Tax efficiency is important to this group of high-income earners as well as adequate insurance and early structuring of estate plans. The Builder is on a plan and working hard to stick to it. The Builder likes the idea of vacation homes, personal health, wellness, and enjoying experiences with growing family. They might also be considering a second career. There is a growth orientation to Builder investments but an equal interest in capital protection understanding they have a lot more to lose now and many who depend on them financially.

This blog is for YOU!

The Real Reasons Most Households Don’t Have Enough Saved for Retirement

For any who browse financial media regularly, it’s hard to go a day without seeing one of those scary stats about how little Americans have saved for Retirement. We all get a little nauseous either thinking about the future societal implications of under-saving generations or even admitting that we are part of that statistic. But rarely do the financial media actually address the source of the problem or offer effective solutions for those who are still at an age where they can transform and alter their own end game. Let’s dive in.

The Problem

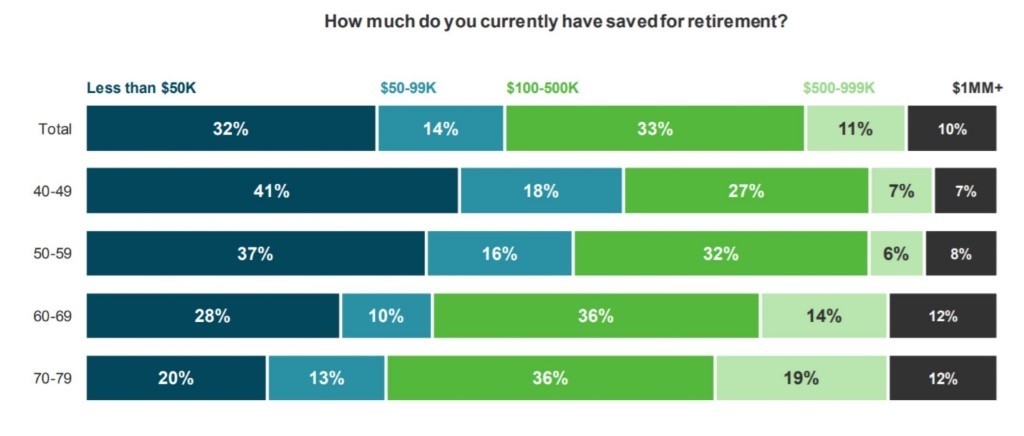

I’ll structure this blog post as a Source and a Solution, effectively identifying the real causes and solutions to not having saved enough for retirement. First, let’s look at some ugly data. I say ugly because we know several things. We know that people live a long time now, like well into your late 80’s and 90’s. Many many people in our country are going to outlive their current net worth. Looking at the chart below, I am most concerned about the 50-59 age group. 86{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of this age group has less than $500k in total assets saved. For some living on very little, that might be fine. It all depends on your lifestyle. But a full 53{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} have less than $100k saved. That is not enough by a long shot. This is the group that is fast approaching retirement. Those in retirement age 60-69 are not much better off if you look at the numbers. We also know that living costs in retirement are not really that much different than the few years prior to retirement. Finally, we know that the cost of living is going up (I don’t care what the Fed tells us about No inflation). So this is a problem. If Niall Ferguson is right in his book “The Ascent of Money”, our aging country may be entering the final phase of empire in which the general population becomes highly dependent on its own government for its livelihood and basic survival. Warren, Sanders, Universal Basic Income, free healthcare, free education? Maybe we shouldn’t be surprised at the popularity of these folks and ideas.

Realities of current savings by age group.

Ok, here we go…

Source of the Problem: Not Saving Enough

Ha, of course, that’s the source of the problem of not having enough saved. We don’t save enough! But let’s dig deeper into that and identify WHY we don’t save enough. The real answer is that we’re human beings with precious egos and we tend to protect ourselves by providing excuses. Let me give you a few examples.

- I don’t make enough money to save

- I’ll don’t have time to save now, I’ll do it later because I’m only (x years old).

- Everything costs too much and I don’t have anything left over … to save for my future.

Indeed, these are real emotions that we either verbalize to others or say to ourselves. Our egos want to blame external situations or conditions for our own shortcomings. Saving is hard, saving a lot is even harder but I will tell you that the hardest thing ever is to save when you have no income (aka retired).

Solution: Engage with planning, measuring, budgeting, controlling costs, controlling spending, and creating some discipline in your financial life. Do it while you’re young!

I will say this flatly with a 100{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} guarantee. Everyone can save. Everyone. I would also argue that to various degrees, Income and personal expenses are also under your control. The first steps are really about planning. If you want to control something, start by measuring it first. In this case, we measure all sources of current and potential income. We also measure and categorize all expenses into fixed and variable types. Soon, you will find the reason why saving seems so difficult. Most households need to add a huge dose of discipline in their spending habits. This is true for low- and high-income earners. Inherent to this is all the not so fun realities of deferring self–indulgence, saying no, maintaining something before buying new, buying used, and all the stuff that falls into the box of self–sacrifice. It’s hard, especially when you don’t have much income but even that much more necessary. I will also say that the whole project is much easier if you have someone in your corner (planner, spouse, friend) who is holding you accountable or better yet doing it with you. I hired a personal weight trainer way back when I lived in the city. I wanted to get strong. I fired him 30 days later because he was too easy (on me). I wasn’t going to get stronger anytime soon. Our in-house financial planner, Lauren Sigman CFP is tough, but in a nice way. I’ve seen her put households onto healthy and sustainable financial tracks with spending, debt, asset restructuring changes, and help solve very complex financial issues. Engaging with a good financial planner is a great step.

Source of the Problem: Carrying too much cash over time

We see this a lot. Saving is happening, but most of these savings go directly into a bank, CD, or money market of some sort. We have our own cash proxy strategy called Holding Tank for those who are in transition, need money in the short term, or waiting for a good buying opportunity in one of our investment strategies. We use T-bills here paying a little over 1.5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} but I’ll say that’s about the highest interest rate you’ll find in the risk-free, liquid cash market these days. Saving to any cash instrument offers a risk-free return but also eliminates any opportunity to make a return that beats real inflation (2-4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}) or gets you where you want to be financially. No risk, no return, check. There are many emotional reasons why investors save to bank accounts instead of saving to an investment account. Here are a few:

- I want to have cash in case something happens

- I don’t have much confidence in… the markets, politics, economy, etc.

- I don’t know what to invest in

- I usually add money to my investments at the worst possible times

The reasoning here is largely fear-based.

Solution: You need a system to identify when to add money to productive investments AND a system to manage downside risk through all market conditions.

Unlike, most in our industry, we have a dual mandate – Create AND protect wealth. This is a system and a process that allocates investment capital to markets based on trends, leadership, and our Net Exposure model. When conditions are not favorable, we reduce our exposure to the stock market and increase our exposure to the bond market for instance. Our system inherently gives our investors confidence to save to their investments, rather than a bank, because we handle the timing, confusion, and fear–based arguments. Even if you added money to your investments at exactly the wrong time, a well-executed system would limit any losses to something tolerable. But when you add money at a great time, your “system” will have you fully invested, and you’ll see those savings yield a very healthy return. So, timing matters, but it’s almost more important to have an investment system that adjusts your exposure and follows trends appropriately. Fear is a natural part of putting your money to work but a solid process behind your investment strategy should make that problem go away.

Source of the Problem: Piling on to a Non-Diversified Portfolio of investments

Again, we’re talking about reasons why investors ultimately do not have enough saved or accumulated for retirement. The real problem here is that investor portfolios experience a bias and strong lean toward the asset classes that perform best and lose critical diversification in the process. It’s very natural and tends to be most extreme at the long bull markets in stocks. Today, the stock market is 11 years off the 2009 bear market lows. That’s a long time and investors have long forgotten that bear markets happen (40-50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} declines), or that stocks can go down for more than a few days or weeks. During these long bull markets, investor portfolios gravitate toward a massive overweight position in stocks (in this example) while their exposure to the diversified assets classes like bonds, commodities, or real estate investments almost dries up. These are the reasons why portfolios get badly out of balance.

- Investors find reasons to add only to their stock holdings based on past performance

- Investors rarely rebalance their portfolios from stocks to bonds or other asset classes

- Investors experience some risk tolerance shifting convincing themselves that they can handle more risk than they should. When real sustained risk doesn’t seem possible (in stocks), it’s easy to justify.

In the end, as we are seeing in full-color today, investors have way too much stock in their portfolios, are not allocated properly to bonds or non-correlated holdings, and will very likely sell only after they feel the pain of not being properly diversified. Savers find that they make a lot of money on the way up and then lose more than they expect on the way down. Returns through a full cycle can be negative over a long period of time. We saw this happen in the early 2000’s when the dot com bubble burst or again in 2007 when the real estate bubble burst. Not having enough saved for retirement is often a function of being wildly imbalanced in your investment portfolio including hard assets like real estate at the wrong times.

Solution: Need a System or Process to maintain a balanced and diversified portfolio or regularly adjust your portfolio according to market trends.

A system or process to keep your portfolio structured properly is again critically important. If you are a passive investor, hoping to own a set diversified mix of investments across multiple asset classes (stocks, bonds, international, commodities, etc.), you must rebalance your mix at a minimum of once per year. There are challenges beyond just rebalancing your portfolio. You will need to accept the realities that returns for some of your diversified holdings can be very poor for a very long time. Commodities for instance have generated a negative annualized loss of -13{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} since July of 2008. That’s a very long time of negative returns for some portion of your “diversified” portfolio. It’s hard to own commodities after such abysmal performance but a passive diversified portfolio would need to carry this position over time, even adding to it. The same would hold true for international investments, especially emerging markets in the last seven years.

Alternatively, you might choose, as we do, to underweight and overweight your asset classes based on current strength and weakness, you must remain diligent in your daily assessments and make changes as needed on a very timely basis. This is called dynamic asset allocation. For instance, commodities have not been part of our dynamic asset allocation mix for years because the trends are down. When the trend turns up, we will be ready to allocate assets there. A dynamic approach gives an investor the latitude to overweight productive investments but it’s a lot of work and generally not a good idea for the armchair investor.

Meet Regularly with Your Financial Professional and Avoid Fear

As always, a regular check-up with your financial advisor is a great way to keep tabs on your situation, make sure you are following a well-defined process, make sure you are saving enough to your investments (not just a bank) and regularly measure your mix of assets and exposures to the market. We work closely with our clients to make sure they have the right mix of our investment strategies but also to measure their cash flow, debt, income, savings, expenses, liabilities, etc. These are the important sessions that help you avoid the risk of outliving your money. Managing your investments and your net worth should not be an exercise in fear. Personally, when I see the current numbers behind retirement savings across most age groups, I fear that many have not done the regular work to get where they need to be financially.

Sam Jones

President, All Season Financial Advisors, Inc.