Making the Turn

“Making the Turn” is our company name for any household typically falling in the age range of 61-70. It’s an important time in life as households are 3-5 years either side of retirement. This is a confusing and anxious transition along a lot of fronts.

Many questions come up.

Do you have enough to retire and not outlive your money?

What is a reasonable withdrawal rate against your savings and retirement accounts?

When is the right time to take social security and how do you sign up for Medicare?

While having to make all these decisions, our Making the Turn clients are also helping both elderly parents and adult children. Business succession, vacation properties, etc. and planning for the future are all on the radar—at the same time! We’re here to help.

This blog is for YOU!

The most important and popular question for those approaching retirement

As we approach retirement, there is really one dominant question on everyone’s mind—do I have enough to retire? It’s not an easy one to answer. Furthermore, life continues to change even after retirement—bobbing and weaving, sometimes quite erratically. Today, we highlight some of the issues, planning considerations, and current realities associated with this important question.

Do I have enough to retire?

While unpacking this primary and popular question, we must investigate the individual pieces of the puzzle first. The real concern from retirees is about outliving your financial resources forcing you into some unsavory situation like moving in with adult children, not being able to afford basic healthcare, or living well below your desired standard of living.

This is the stuff of night sweats.

Retirement has a strange fantasy to it. Many think that the event of retiring is like finishing a race. It marks the end of a period of “work” and the beginning of the golden years when we reap what we sow, harvest the fruits of our labor, and reach the promised land. For some that may be the case. For most, I would advise another philosophical stance.

Specifically, look at retirement as just another life transition where we need to make some decisions, make adjustments, measure results, and carry on. Life will continue moving forward with changes and surprises along the way. Financial planning software, like our new Advizr platform on Orion, is helpful for sure. We can use it to paint a picture of the future, even to our projected death, making many assumptions about rates of return, inflation, spending (withdrawal rates), etc. While we can view our net worth over time, nothing about life is static. Returns change, inflation changes, costs rise, emergencies happen, and/or our spending changes. Just to name a few.

Look at retirement as the time to spend more time—at least initially– measuring, planning, and projecting for your post-retirement years. Fail to plan, plan to fail, as they say.

Necessary planning occurs both before AND after retirement.

Let’s look at a few examples of how we determine an appropriate investment allocation against several different withdrawal rates. Again, our goal here is to make sure that our investment allocations are appropriate to meet our withdrawal needs and avoid eating cat food in retirement.

A big thanks to JP Morgan’s 2019 Guide to Retirement (which you can search and download for free) for providing several of the following graphics and data.

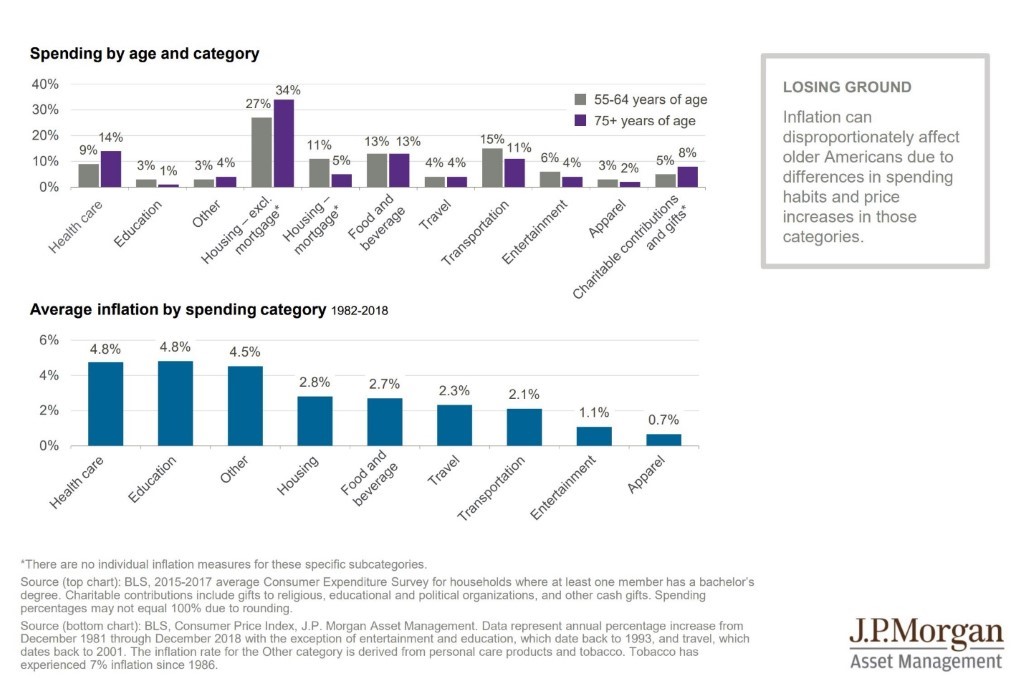

First, let’s look at some realities regarding spending patterns pre and post-retirement factoring in some important inflation figures by spending category.

As you can see, retirees spend more on healthcare, “other” (which is code word for eating out and trips), housing, and charitable giving than those in pre-retirement. Now, look at the inflation rates in the lower table. Inflation is disproportionately affecting older Americans based on their spending behavior!

This is a planning moment. For instance, as retirees, we need to plan to spend more on healthcare and expect that cost to rise at nearly 5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} annually. The real number is closer to 10{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} but who’s counting.

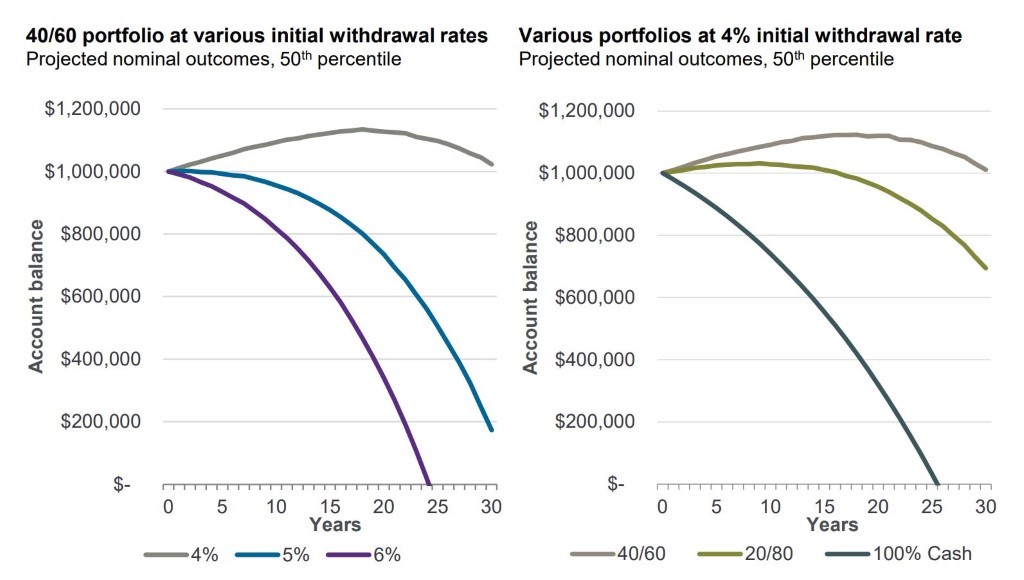

Now let’s shift gears to withdrawal rates against a few theoretical portfolio allocation mixes of stocks and bonds.

This illustration shows a theoretical net worth line of a household starting at $1M.

On the left side, we see that a portfolio of 40{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} stocks and 60{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} bonds against a 4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} withdrawal rate will generally hold its value over a 30–year period (assumptions are made in this math). The same portfolio with a 5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} annual withdrawal rate will almost deplete after 30 years and a 6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} rate goes to zero in year 25 (cat food at age 90 – yuck). Looking at the right side, if we can successfully keep our withdrawals to 4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} annually but never invest (100{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} cash) we can also run out of money too early.

But there are some amazing assumptions built in here that I must call out. This analysis assumes that a 40{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} (stock)/60{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} (bond) portfolio will produce 6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} average annual returns for the next 30 years in a virtuous straight line. With high confidence, I will tell you that assumption is unlikely to happen.

Based on the current setup, bonds will not likely produce more than 2{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} annually and stocks are unlikely to generate more than 4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} annually from here until we experience a severe bear market.

Any combination of US stocks and US bonds is likely to fall in the range of 2-4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} average annual returns. 6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} is no longer available from here given valuations and the current interest rate environment if you are only looking at stocks and bonds.

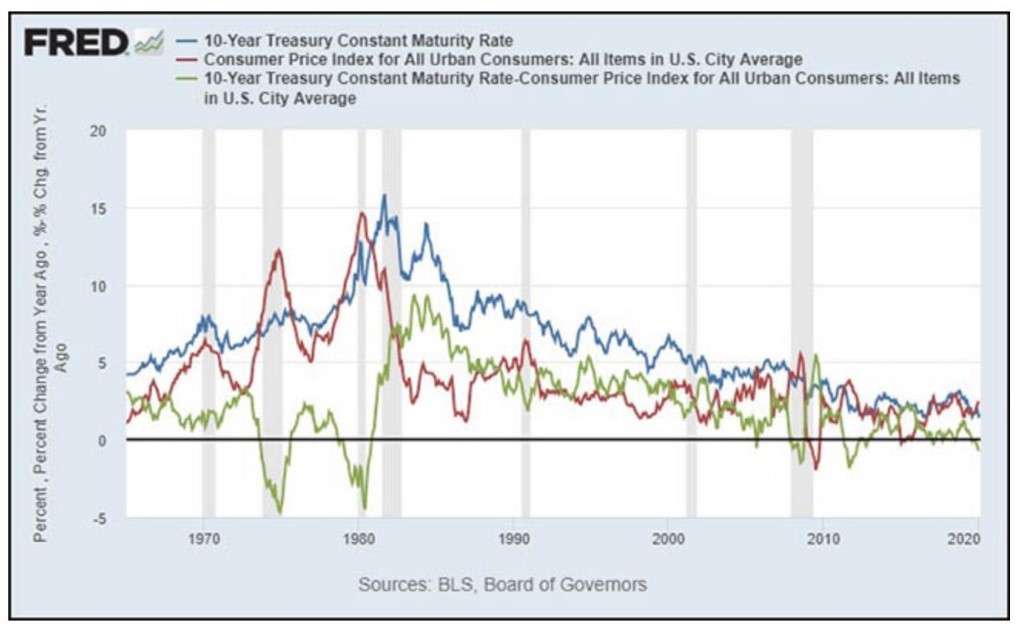

I’ll pick on the US Treasury bond market for a minute to make a point.

As of this week, the 10 year US Treasury bond is now offering negative interest net of inflation shown as the green line above. This condition has happened in the past but only during periods of very high inflation or in the case of 2008 when the Fed dropped rates to zero following the real estate and stock market bust.

Today, we have negative rates because, because, …. Ummmm because the economy is so strong? Just kidding. The economy is not strong, and inflation (red line) has been rising gradually since 2015 generating a negative net yield on Treasury bonds.

Back to our analysis. As a retiree, you might think of putting most of your net worth into the safety of US Treasury bonds as many do. However, US bonds will produce nothing more than the current yield (1.51{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} and falling) while inflation and your cost of living are rising above 2{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} annually (that number is artificially low). Remember, the analysis requires that we make 6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} on all assets in order to afford a 4-6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} withdrawal rate to cover our living expenses. Like cash, a portfolio that is heavy in US bonds will not work. Some are migrating more to US stocks in order to adapt to the current interest rate environment.

That looks like a risky maneuver at this stage.

US stocks are now in the 2nd most overvalued position in modern history. Expected returns for US stocks are likely to fall to less than 4{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} annualized for the next 5-7 years (or until we see our next bear market). Again, literally any blend of US stocks and US bonds is not going to generate an adequate return.

So, what is a retiree supposed to do? I’m glad you asked.

Introducing the Unconventional Portfolio

There are many ways to continue making 6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} + average annual returns on your money but you’ll have to do things differently. This is our forte as a firm. This is that time and place when an experienced manager of your assets knows where to look to find growth in a marketplace that seemingly has no opportunity left.

Here are a few examples:

- International stocks specifically emerging markets and China (after the virus crisis)

- Gold and silver – now

- Hard asset investments like real estate – now

- Oversold value sectors and value stocks – not yet in full swing but developing

- Emerging market bonds – now

- Trading strategies and alternatives – now

- Hybrid options like preferred securities, mortgage REITS and convertible securities – now

Our flagship All Season strategy, which has been in existence with real returns since the mid ’90s, has six investment sleeves. All sleeves are currently filled, and we remain fully invested. One of them is US stocks. Another is US bonds. But, there are four more that offer compelling growth opportunities with non-conventional drivers of returns. These various sleeves of investments have been engaged since early 2016. Over the last four years to date, the All Season Strategy has generated…. 6.03{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} net of all fees with a fraction of the market’s risk! (please see our composite performance disclosures). Clearly, the stock market has done better in absolute terms over this same time period. But the real test will come in the next couple of years. Our bet is that we’ll continue to generate consistent returns of this nature with an unconventional portfolio while the US stock market does not.

Retirees are going to have to build and maintain an unconventional investment portfolio looking forward if they want to— or need to— generate returns that will enable a financially secure retirement.

US stock/ bond blends are not going to cut it.

Retirees obviously have other concerns and questions beyond – Do I Have Enough to Retire? It’s a complicated and confusing time to be sure. Hopefully, some of these ideas will help you dive into the issue with your eyes wide open. We’ll cover other issues facing our Making the Turn client profile in future updates to help navigate these waters.

We’re here to help.

Cheers

The All Season Financial Wealth Management Team